Artificial Intelligence — A BUBBLE Ready to Explode?

Between Technological Revolution and Speculative Bubble

Dear Investors,

With specialized indices jumping 30 to 60% in 2023 and hundreds of billions of dollars in annual revenues expected over the next five years, the AI sector now dominates investors’ visions.

They’re not hesitating to go into debt to profit from it or to focus all their money on it.

But as prices rise rapidly and sharply, the same question always comes back: Is this reasonable?

In finance, this kind of phenomenon has a name: a bubble.

We’re familiar with its mechanics, and it doesn’t bode well.

On one hand, there are those who believe that we’re indeed in a bubble created by irrational behavior, betting on the sector’s general decline, like Michael Burry.

On the other, there are those who want their share of Nvidia, AMD, or Palantir Technologies to join the dance of the 5th industrial revolution.

To determine who’s right, let’s quickly review what a stock market bubble is and compare its characteristics to the current situation.

So, what exactly is a bubble?

A speculative market bubble appears when the market anticipates the growth of a value a bit too optimistically.

It can be a stock, a raw material like gold, real estate, or any other tradable asset class.

It starts with strong fundamentals — healthy accounting ratios, big contracts being signed, good growth prospects, or announcement of results exceeding expectations, which increase the value of a stock.

But there comes a point when hype attracts more and more investors who don’t want to miss out on potential profits — a phenomenon known as FOMO (Fear of Missing Out).

They invest en masse, and under pressure and without other justification, the price of the stock begins to climb and eventually detaches from real economic performance.

The risk then becomes significant, and the correction, when it comes, will be as violent as the prices have risen high.

When the bubble bursts, prices collapse, billions vanish in smoke, indebted investors can’t meet their commitments, and a chain reaction ensues, which can affect the entire economy, leading to bankruptcies and unemployment.

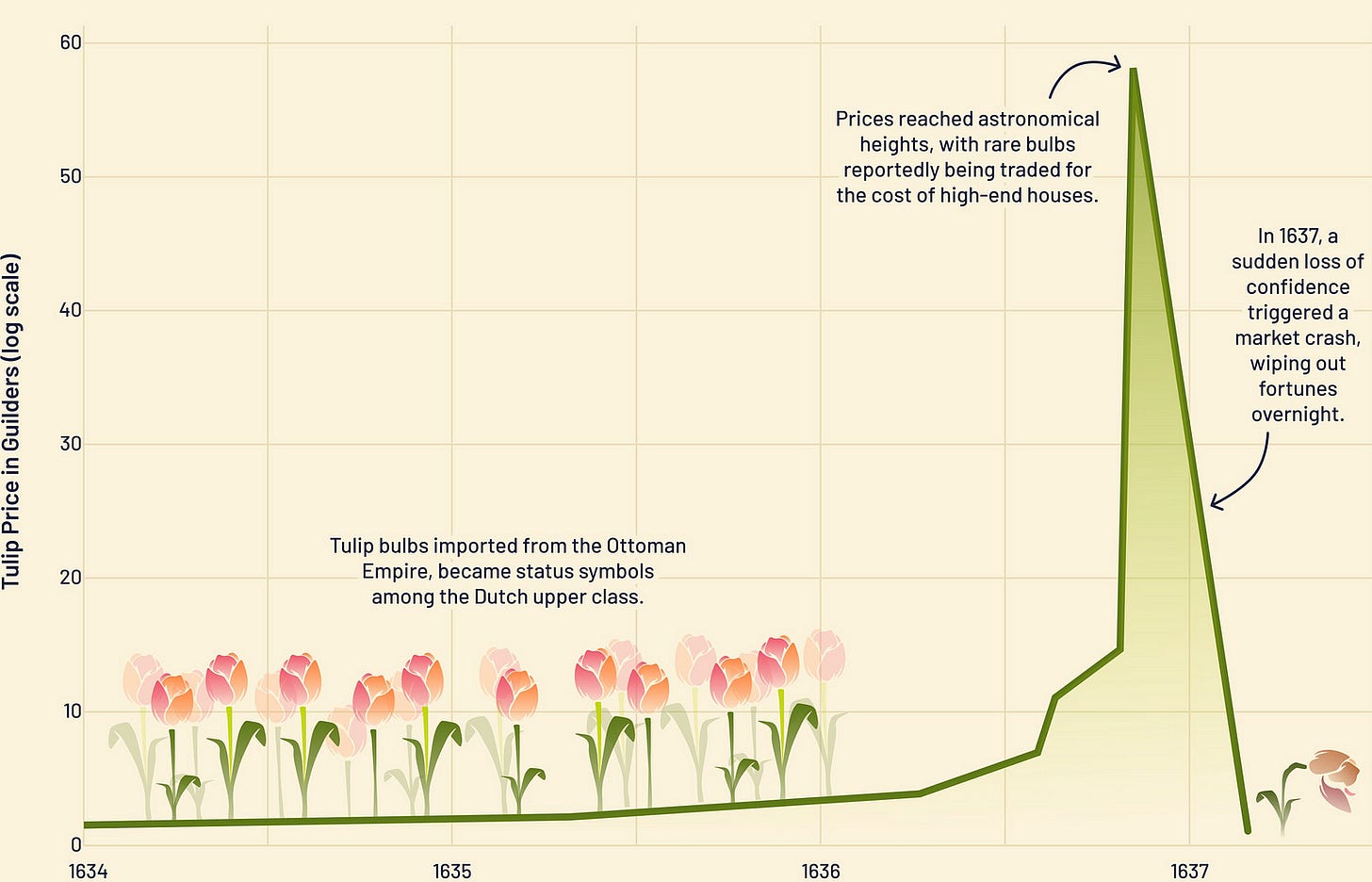

The most original bubble in history is the Tulip Mania in the Netherlands around 1635.

Tulips were considered exotic and rare, imported in small quantities from the Ottoman Empire, and they became a status symbol.

Speculators bought tulip bulbs in the hope of reselling them at exorbitant prices, using the futures market to secure future harvests and setting increasingly insane prices.

But when the price of a single bulb reached the cost of a house, the whole market collapsed.

More recently, the Dotcom bubble of the early 2000s became a textbook case.

Stimulated by the development of home computing and the emergence of the Internet, tech companies attracted a lot of money throughout the 90s.

The young Nasdaq index, which includes all the growth values of the time, multiplied its value by 5 between 1996 and 2001.

But when investors realized many of these companies were not profitable and could not keep their promises, panic set in.

In March 2002, the bubble burst, and the Nasdaq plummeted 78%, with billions lost and many companies like WorldCom, Lycos, and Boo.com going bankrupt.

It took until 2010 for the tech sector to recover and 2017 to return to pre-crisis levels. Then it set off on a course intimately linked to progress.

Around the same time, the race towards artificial intelligence began with the advent of the first voice assistants, image recognition algorithms, and publicly accessible autonomous vehicles.

In research, deep learning, convolutional neural networks, language models, and robotics became areas of intensive work, and the progress opened unprecedented prospects, akin to the greatest science fiction novels.

With hundreds of thousands of applications across all fields, AI is gradually integrating into our society, and we’re just at the beginning.

In the next five years, the current capacities of data centers are expected to double.

In 2024, the AI sector comprises four major sub-sectors, in order of importance: software and IT services led by Microsoft, electronic devices including computers and smartphones led by Apple, semiconductors and derivatives led by NVIDIA or AMD (showing the strongest growth), and communications and networks led by Cisco Systems.

Several stock indices are benchmarks in the AI and robotic technology sectors.

In the US, the first one is the Nasdaq AI and Robotics, launched in 2018, encompassing about 85 of the world’s largest companies working in these sectors.

The index has risen 46.67% since its inception, including 33% last year.

Other indices to watch include the MSCI Imi Robotics and AI, which jumped 102% since its creation in February 2019, and 28% in one year, compared to last year’s S&P 500 which also rose about 28%.

Now, the question is: are we in a speculative bubble with AI and semiconductors?

The risk factors include the international situation, like the tension over Taiwan and the potential impact on American technology manufacturing, and the looming possibility of a US recession.

At the beginning of last year, Michael Bury, the “Big Short” man of Wall Street, warned of an impending crisis, predicting inflation would return with reduced interest rates and government economic stimulation.

His advice was to sell, and he bet $47 million against the semiconductor industry.

While he was wrong in the short term, his prediction might still be valid in the long term.

The optimism in the AI sector may be exaggerated.

With increasing defaults on student, real estate, and car loans, a soft landing is anticipated, but a sudden economic downturn later this year can’t be ruled out, potentially causing a 30% average market downturn.

In this rapid ascent, the semiconductor and AI industry is among the most profitable yet riskiest in the world.

For those interested in the AI sector’s performance, exploring indices and trackers is worthwhile.

Despite exceptional bullish movements, remember that past performance does not guarantee future results.

Be selective and invest with long-term goals in mind.

The sector remains volatile and risky.

If you’re tantalized by the P/E ratio and capitalization-to-revenue indices and want to learn other methods to accurately assess if a company is correctly valued by the market, dive into “Security Analysis,” the investment bible written by economist Ben Graham, the father of value investing.

This method made Warren Buffett billions.

The AI industry, particularly the semiconductor sector, is characterized by rapid innovation and growth, but it’s also fraught with volatility and speculation.

The astronomical valuations of companies like NVIDIA, riding on the back of their cutting-edge technologies, reflect the market’s optimism about the future of AI.

However, such optimism can sometimes detach from economic realities, leading to inflated asset prices.

In this context, understanding market fundamentals is key.

Analyzing P/E ratios and comparing them across similar companies can provide insights into market expectations and whether a stock is overvalued or undervalued.

NVIDIA’s exceptional rise in valuation, while reflective of its technological advancements, also raises questions about market overexuberance.

It’s a clear indication of the market betting heavily on the future potential of AI and related technologies.

The risks associated with investing in such a rapidly evolving sector cannot be overstated.

Geopolitical tensions, economic downturns, and shifts in market sentiment can all lead to significant corrections.

The history of financial markets shows that periods of rapid growth and high valuations are often followed by adjustments and corrections.

As such, investors need to be cautious and not get carried away by the current euphoria around AI and related technologies.

The AI sector offers exciting opportunities for growth and innovation, it’s important to approach it with a balanced perspective.

Understanding market dynamics, analyzing company fundamentals, and maintaining a long-term investment approach are essential.

Remember, the most successful investments are those that are well-researched and aligned with your financial goals and risk tolerance.

I hope this has provided valuable insights and will assist you in making informed decisions for your investment portfolio.

Sincerely,

The Pareto Investor