Maximize Your Portfolio Returns with the 80/20 Rule!

A Simple and Effective Way to Beat the Market!

Dear Investors,

Today, I share with you my Pareto Investment Methodology to master the market with the 80/20 rule, the most simple and effective way to maximize your portfolio returns!

In other words, identifying the vital few stocks that lead to massive returns.

This approach challenges the conventional wisdom of broad diversification with indexes but offers a path to greater financial efficiency and success!

“Everything popular is false.”

— Oscar Wilde

Introduction

In the world of investment, the quest for a strategy that consistently outperforms the market can often seem elusive.

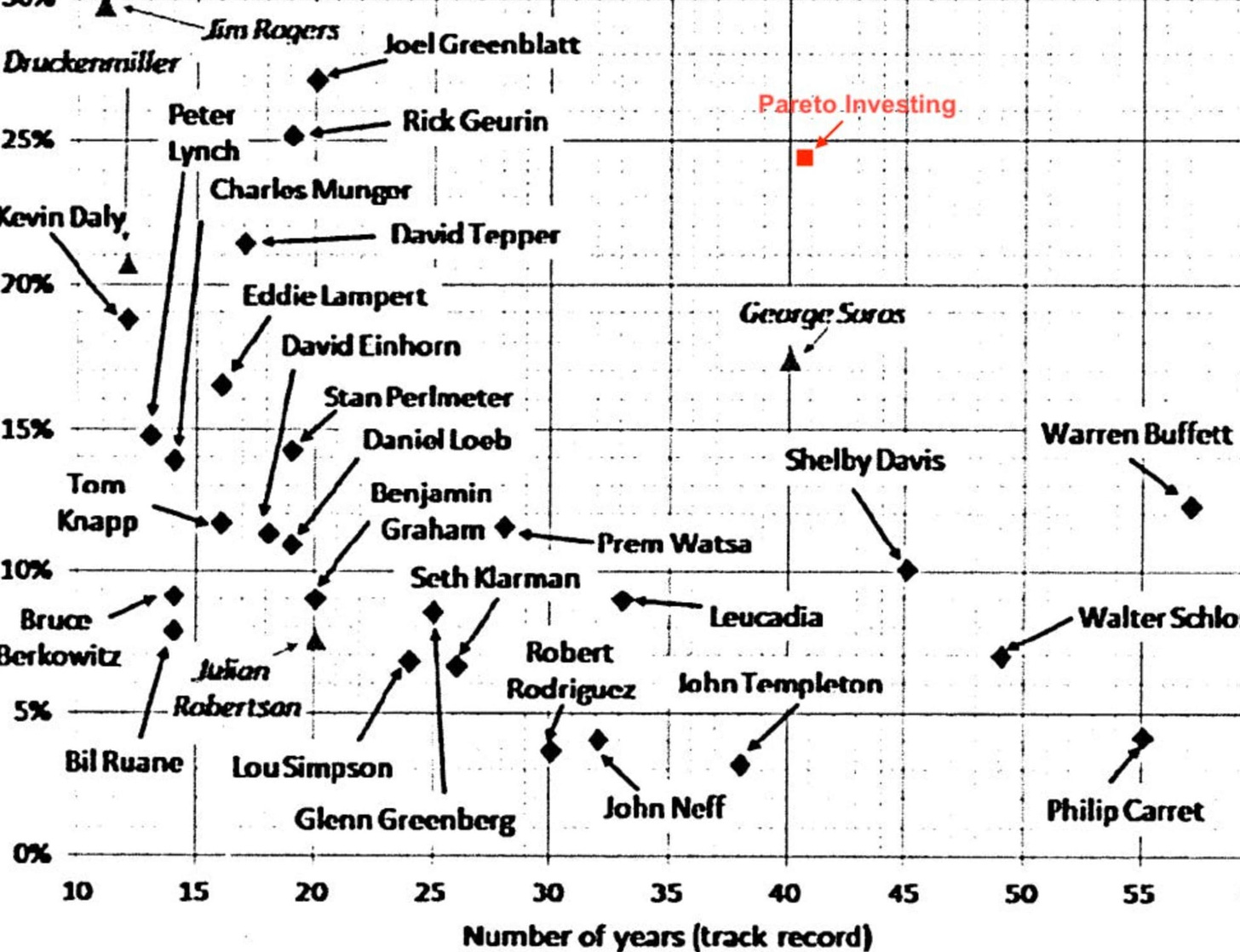

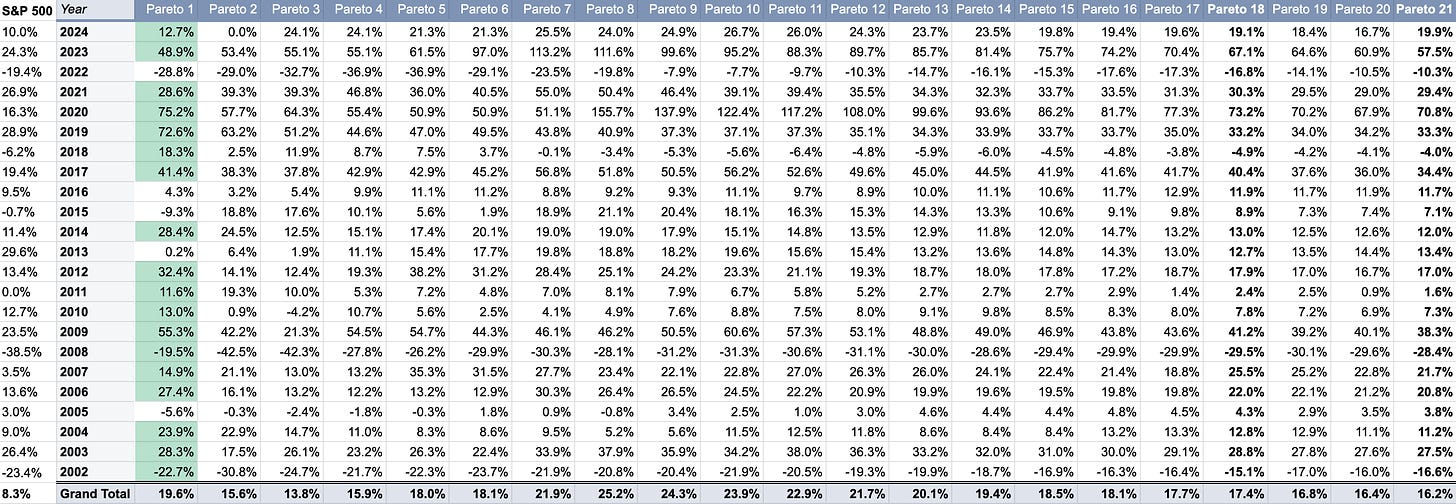

But I, The Pareto Investor, has pioneered a compelling approach to investing that leverages the Pareto Principle—commonly referred to as the 80/20 rule.

Initially observed by economist Vilfredo Pareto, who noted that 80% of Italy’s wealth was owned by 20% of the population, this principle has profound implications across countless disciplines—from business, management to personal life and productivity.

The Pareto Principle suggests that in many areas of life, a majority of consequences come from a minority of causes.

Applied to investing, this principle posits that a small selection of stocks typically drives the majority of market returns.

This insight is not just academic; it has practical, lucrative applications for investors at all levels.

By identifying and focusing on these high-impact stocks, investors can streamline their portfolios to capitalize on the most profitable opportunities, outperforming more traditional, diversified approaches.

“My biggest prediction for the future is that people are going to start looking after individual investors.”

—John C. Bogle, father of index funds

Here's an in-depth look at how my Pareto Investment Methodology can transform your investing strategy, offering a more focused, efficient path to financial success.

Part I: Foundations of the Pareto Investment Methodology

1. Epiphany Through Socrates

My investment philosophy was profoundly shaped by the ancient wisdom of Socrates, who famously claimed,

“All I know is that I know nothing.”

This humble approach underpins the Pareto Investment Method, where acknowledging one’s limitations in predicting market movements becomes a strategic advantage.

By adopting a mindset geared towards adaptability, investors can better navigate stock market complexities.

2. Historical Insights and Shocking Stats

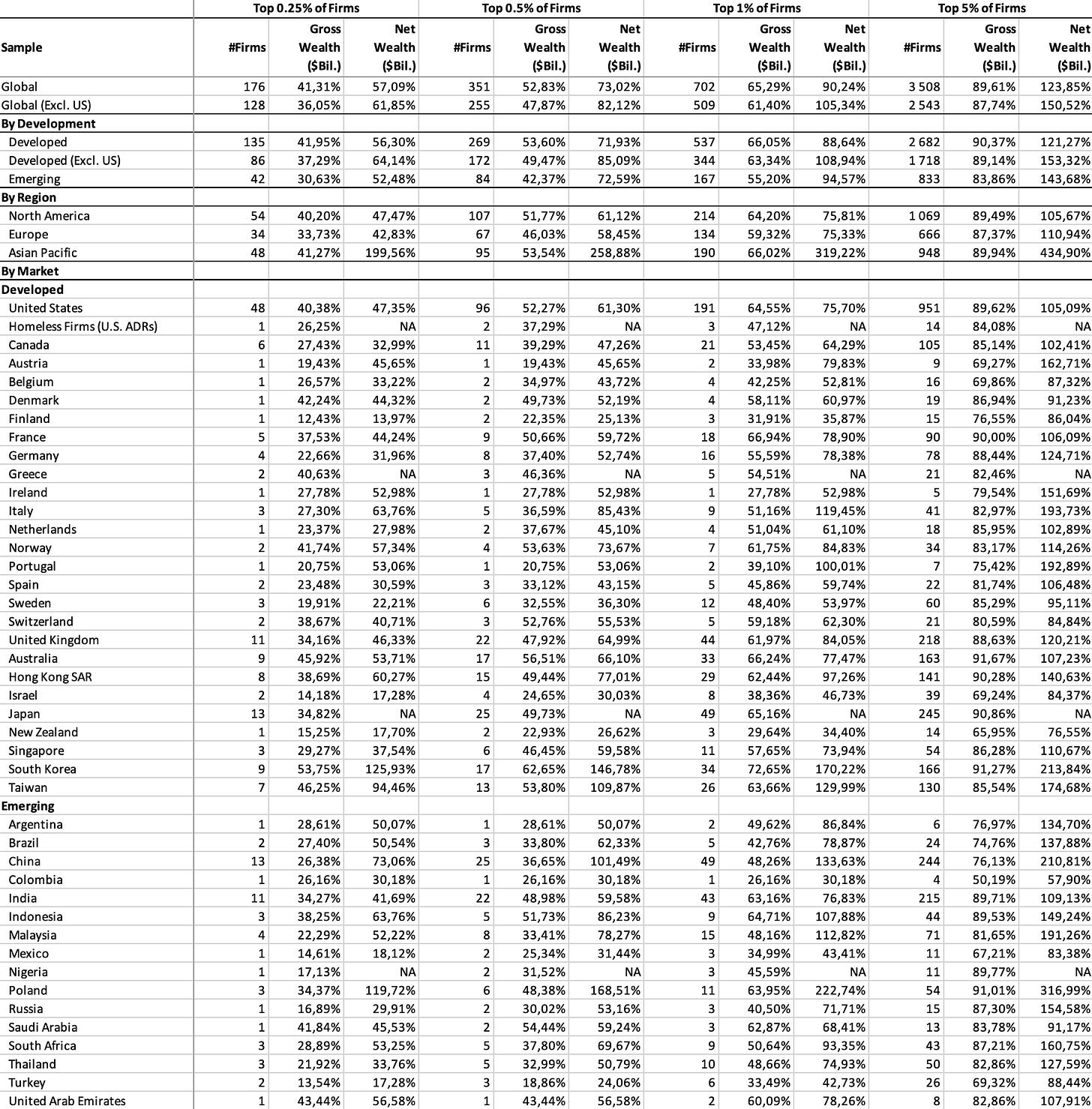

In the stock market, the Pareto Principle illuminates a fascinating and often overlooked pattern: a small number of companies often contribute disproportionately to overall market returns.

This phenomenon is supported by substantial research, including studies by prominent financial analysts who have found that, historically, a mere 1% of stocks are responsible for the lion's share of market growth over time.

“Less is more.”

—William Shakespeare

Supporting the 80/20 investment strategy, researcher like Hendrik Bessembinder reveals that, from 1926 to 2019, only a small percentage of stocks were responsible for the majority of market gains.

Research link: do-stocks-outperform-treasury-bills

This statistical skew suggests that pinpointing and investing in these key stocks could significantly enhance an investor's portfolio performance.

This empirical evidence is a cornerstone of my Pareto Investment Method, which advocates for a concentrated portfolio of high-performing stocks, eschewing the traditional diversified approaches that lead to average returns.

3. Against Averages and Indexes

While index funds provide a passive, broad-market exposure, they inherently limit investors to average returns.

My Pareto Investment Method challenges this status quo by focusing on the outlier stocks that are statistically likely to outperform.

This selectivity aims to capture the extraordinary gains that indexes, by their very nature, miss.

Part II: Executing the Pareto Investment Methodology

4. Identifying Pareto Stocks

My method is straightforward, as outlined earlier: pinpoint the top 1%.

This approach entails employing a few key criteria to select stocks, emphasizing robust fundamentals, growth potential, and leadership in their respective markets.

These 'Pareto Stocks' are likely to continue outperforming due to their inherent advantages and market position.

Keep reading with a 7-day free trial

Subscribe to The Pareto Investor to keep reading this post and get 7 days of free access to the full post archives.