2x Your Investments with Monte Carlo Method!

How Advanced Simulation Technique Can Skyrocket Your Portfolio Growth.

Dear Investors,

There are two major ways to invest in the stock market.

The first is the passive approach.

Buy the whole market through an ETF tracking the S&P 500 or All-World, and trust that historical returns of 8-10% will continue.

It's a strategy built on diversification to minimize the risk of picking a losing company.

The other path is active stock picking.

Active investors aim to identify specific companies with the potential to outperform the market, accepting the higher risk that comes with being wrong.

A path, I embrace, as it offers greater rewards in the end. #Pareto

This is what I've been able to do, so far, beating the S&P500.

Yet, I’m not infallible.

Consistently outperforming the index, each year, is nearly impossible—many have tried and failed.

Choosing a specific company carries substantial risk, as it requires thoroughly analyzing the company’s financial health.

Whenever, I must evaluate the company profit margins, reflecting efficiency and profitability.

I also need to assess the management’s confidence through their statements and track record.

Additionally, I should confirm the company allocates its capital effectively, delivering solid returns on investments.

By synthesizing these insights, I can form sound judgments.

If any company in my portfolio displays weakness—such as declining margins, uncertain leadership, or inefficient capital use—I’ll replace it with a superior alternative to maintain an elite portfolio.

But what if there were a more robust method to test investment ideas?

A method to quantify the sentiment that, for instance, Mastercard may continue to outperform Visa?

We might think that Mastercard will continue to perform better than Visa, but do we have a method to test it, to rely on something more solid?

The good news is that in the age of artificial intelligence (with ChatGPT), some powerful computational tool, once the exclusive domain of high-end investment firms, are now accessible to all investors.

Among these tools is one called Monte Carlo simulation.

I would like to explain what it is, why it's interesting, and how you can use it.

What is a Monte Carlo Simulation?

Named after the famous casino in Monaco known for its games of chance, the Monte Carlo simulation is a statistical technique that models the probability of different outcomes in a process where random variables are present.

This method lets you model uncertainty and turn randomness into more informed choices.

Instead of relying on a single average or a best-guess forecast, it runs thousands, or even millions, of random simulations to generate a full spectrum of possible results and their likelihoods.

In finance, it's used to tackle uncertainty head-on.

The Monte Carlo method is used in finance to model the probability of different outcomes in a process that cannot be easily predicted due to the interference of random variables.

Applications range from pricing complex stock options and analyzing corporate project profitability and, most importantly for many here, managing investment portfolios—an area we'll explore today.

In investing, it helps quantify the potential risks and returns of a particular stock, index, or portfolio by running thousands of potential future scenarios.

This method, once primarily used by professionals, is now accessible to individual investors through modern tools.

So, because I don’t do things halfway, I had ChatGPT create a Python script for me to get all available historical data for any stock, starting from its inception.

Now, I can input any ticker I want and get results in seconds.

If you want to try this out, I've included a Python script later in this article.

It's all set up to run a Monte Carlo simulation using Yahoo Finance data, and it works right out of the box in Google Colab (easy way).

But before we get to the exciting part, let's lay a little more groundwork.

How the Monte Carlo Simulation Works?

To understand how a Monte Carlo simulation works in practice, let's walk through a specific investment question:

"What are the chances that my investment in ExxonMobil will double in the next 5 years?".

1. Formulating the Hypotheses

First, we need to establish a model with key variables and assumptions, which are based on historical data. For our XOM example, these would be:

Average Annual Return: The expected average gain from the stock, including both capital growth and dividends.

Annual Volatility: This measures fluctuation around the average return.

Time Horizon: The investment period you want to test, 5 years in our case.

2. Running Thousands of Scenarios

With the assumptions set, the simulation begins.

It generates a random return for each of the 5 years,

One 10-year scenario might start with a +5% return in year one, a -12% return in year two, and a +25% return in year three.

The computer then repeats this process 10,000 times.

Each run is a unique, randomly generated 5-year future for the stock.

Think of it as playing out the same half-decade 10,000 times, each with a different roll of the dice.

3. Analyzing the Results

After completing all 10,000 simulations, the results are aggregated into a probability distribution.

By counting how many of these scenarios resulted in the initial investment doubling, we can calculate a percentage chance.

For ExxonMobil, the simulation reveals there is a 40% probability of the investment doubling in value within 5 years.

The magic happens because after running enough simulations, we get a clear picture of what's likely to happen versus what's just wishful thinking.

This is where Monte Carlo really shines.

Want to know if a stock has a good chance of doubling in 5 years?

Monte Carlo can tell you.

You input factors like historical returns, volatility, and market conditions, then run thousands of scenarios to see what percentage of the time your investment actually doubles.

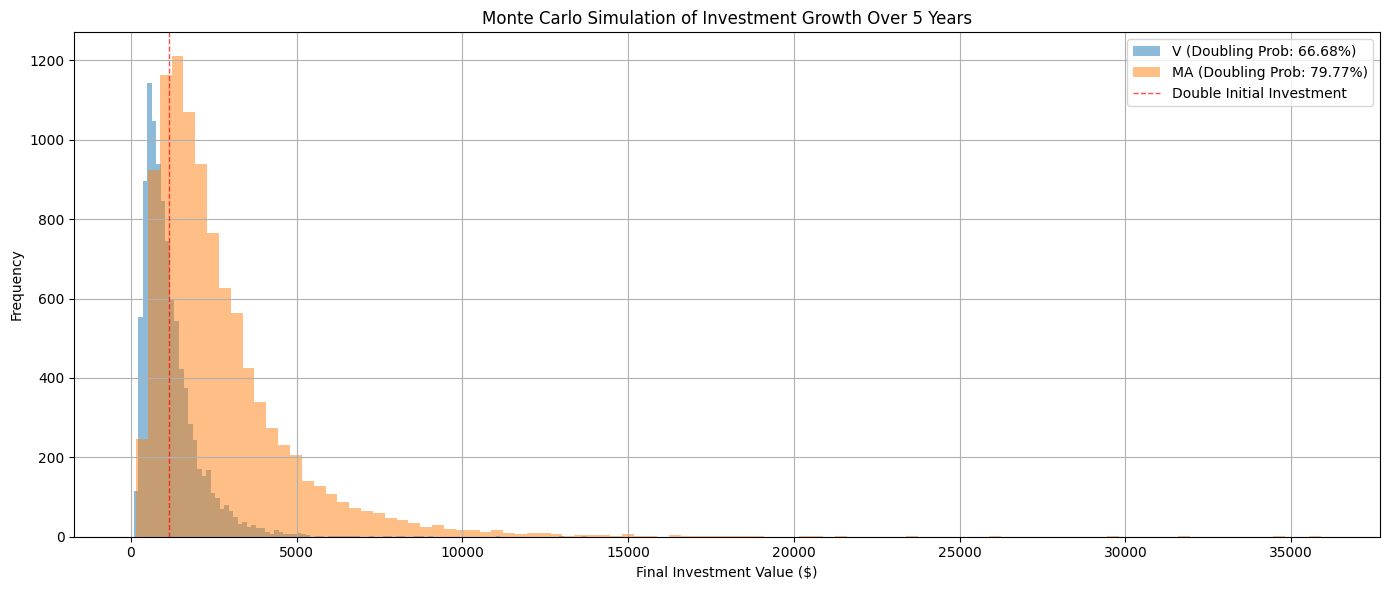

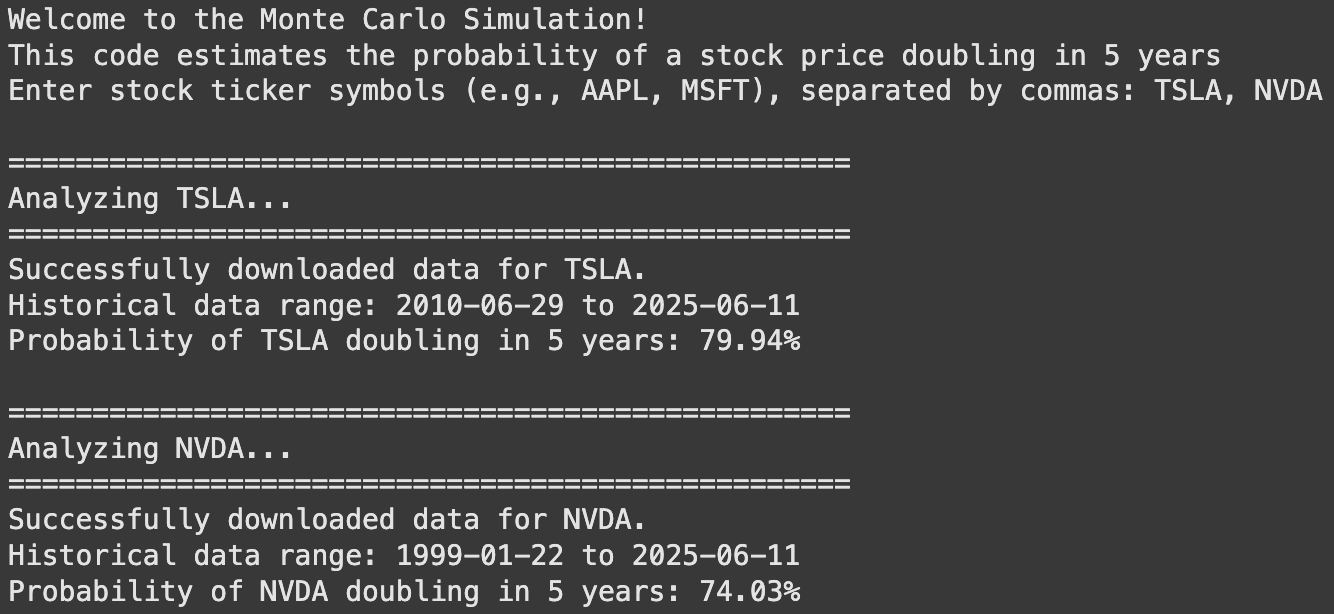

Simulation with TESLA & NVIDIA

The simulation used each company's complete historical trading data through, running 10,000 Monte Carlo simulations over a 5-year period (2,520 trading days) to generate these probabilistic forecasts.

Tesla (TSLA) shows the highest probability of doubling at 80%, indicating that based on historical volatility patterns, there's approximately an 8 in 10 chance the stock could reach $617+ within the next 5 years.

NVIDIA (NVDA) demonstrates a strong 74% probability of doubling, suggesting roughly same chance of reaching $285+ over the same timeframe.

Both stocks show significantly higher doubling probabilities compared to the previous XOM (40%).

That's the kind of insight that can seriously improve your investment decisions.

Now we have the principle, we can have fun, and run more simulations.

How to Use the Monte Carlo Simulation?

The real power of the Monte Carlo method comes from comparing different assets to inform your portfolio construction.

The Monte Carlo method can be applied to compare the potential performance of individual stocks, indices, and entire portfolios.

Simulations run on various assets over a 5-year horizon revealed different probabilities of doubling your initial investment.

Given this, we can ask ourselves:

'By constructing a portfolio comprised exclusively of stocks that each have a greater than 70% probability of doubling, do we increase the likelihood that the portfolio as a whole will more than double in value?'

Absolutely!

Even if it doesn't add up exactly, if we have 10 stocks in our portfolio, and each of these positions represents 10% of our portfolio and has more than a two in three chance of doubling, then the likelihood of doubling our investment increases to something like 65-70%.

For example, if each position represents 10% of your portfolio and has a greater than 70% chance of doubling, the portfolio's overall probability of doubling could rise to approximately 65-70%.

So let’s try constructing such a portfolio.

Top Assets for the Next 5 Years

Based on multiple simulation results, assets such as Bitcoin, AI companies, and US technology companies show the highest probability of doubling in value over the next five years.

By focusing on these asset classes, which each have an individual probability of over 70% of doubling, we can construct a portfolio where the overall probability of the entire portfolio doubling increases significantly, potentially to between 65% and 70%.

Bitcoin has a massive 96% of chance of doubling, making it the strongest contenders.

Palantir have an impressive 90% chance of doubling, making it second of the strongest contenders.

Broadcom is also very promising with an 88% chance of doubling.

Mastercard is quite solid too, with a 79% chance of doubling.

Tesla’s not far behind with a 78% chance, which looks appealing for growth investors.

Microsoft also has a very good chance of doubling with a 72% chance.

Amazon is a bit less clear but still strong with a 69% chance.

META is not bad at all with a 68% chance.

On the other hand, Gold & SPY seems to be a bad investment for the next 5 years, with roughly 30% chance of doubling, making it far less attractive than these individual stocks.

By running the same 5-year simulation on a variety of stocks and ETFs, a clear picture emerges about their relative potential.

And this is more or less what I’ll try to do with my portfolio as of now.

I try to project the performance of this portfolio is to ensure that each of the stocks, if taken individually, has a good chance of doubling in the next 5 years, even if, of course, this is only quantitative and I have many other criteria for making investment decisions.

That's why it might be worth starting to devote some of your time to developing your investor skills.

That's why I have created all this content on Substack!

That's why I do FAQs where I answer all your questions, and I also show you types of investments that are outside the box.

Even if you select good quality companies well, with a Monte Carlo Simulation, you have a chance of doing something even better.

As usual, I remind you that if you want to start investing, the link below will help you to start on solid tracks.

I hope this kind of content helps you.

I hope this kind of content interests you because once again, we are here to build skills, and the best thing I can do on this earth is to allow as many people as possible to become more skilled in managing their finances.

Now, It's Your Turn!

As promised, I've included the Python script for you to run Monte Carlo simulations in any environment that supports Python (ex. Google Colab).

However, given its significant value, this is exclusively available to contributors.