Dear Investors,

I’m thrilled to share with you an extraordinary investment opportunity that I believe is a game-changer.

As an investor in privately-held companies, particularly in the tech sector, I’ve always been drawn to fast-growing firms with strong leadership.

My belief is that generational wealth is built in the early stages of a company, often long before an IPO.

Fred Wilson of Union Square Ventures sums it up well:

“Venture capital is all about capturing the value between the startup phase and the public company phase.”

However, a significant challenge has been the inaccessibility of these investment opportunities to everyday investors.

Traditionally, only after venture capitalists and founders have reaped the benefits are retail investors given a chance to invest, usually at the IPO stage.

This system is primarily due to regulations intended to protect from risky investments but also limits the potential for significant returns to a small, accredited investor population.

In 2016, only 13% of the U.S. population qualified as accredited investors, able to invest in large privately-held companies.

This discrepancy in investment opportunities creates a gap between the wealthy and retail investors.

Enter Destiny (D/XYZ) — DXYZ

To bridge this gap, Sohail Prasad and Samvit Ramadurgam, founders of Forge Global, introduced Destiny, a platform aimed at democratizing access to private company investments.

According to Destiny, best-in-class companies.

“The Destiny Tech100 is designed to be an exchange-listed portfolio of the top 100 high-growth tech companies — providing everyday investors access to these private market leaders for the first time.

To be eligible for inclusion in the Destiny Tech100, companies must have been vetted by top US institutional investors and meet key health metrics.

Further, the companies in the portfolio will generally have reached a level of maturity and stability expected of a late-stage venture-backed company.”

Destiny’s mission is to provide liquidity, access, transparency, and efficiency in the private markets.

The platform allows accredited investors to invest in private companies like SpaceX, Stripe, and Reddit.

The Problem

Despite the opportunities presented by platforms like Forge Global, the average investor still faces significant barriers, such as accreditation requirements, high investment minimums, and limited access to high-potential companies.

The Solution: Destiny Tech100 ETF

Destiny addresses these challenges through its Tech100 ETF (DXYZ), modeled after popular ETFs like SPY and QQQ.

This ETF enables anyone, regardless of accreditation, to invest in a portfolio of the top 100 venture-backed private technology companies.

It’s designed to include companies that have received substantial institutional investment, have a healthy capital structure, minimal debt, and strong corporate culture.

Portfolio Details:

Name: Destiny Tech100

Ticker: DXYZ

Listing Venue: NYSE

Annual Management Fee: 2%

Target Portfolio: 100 companies

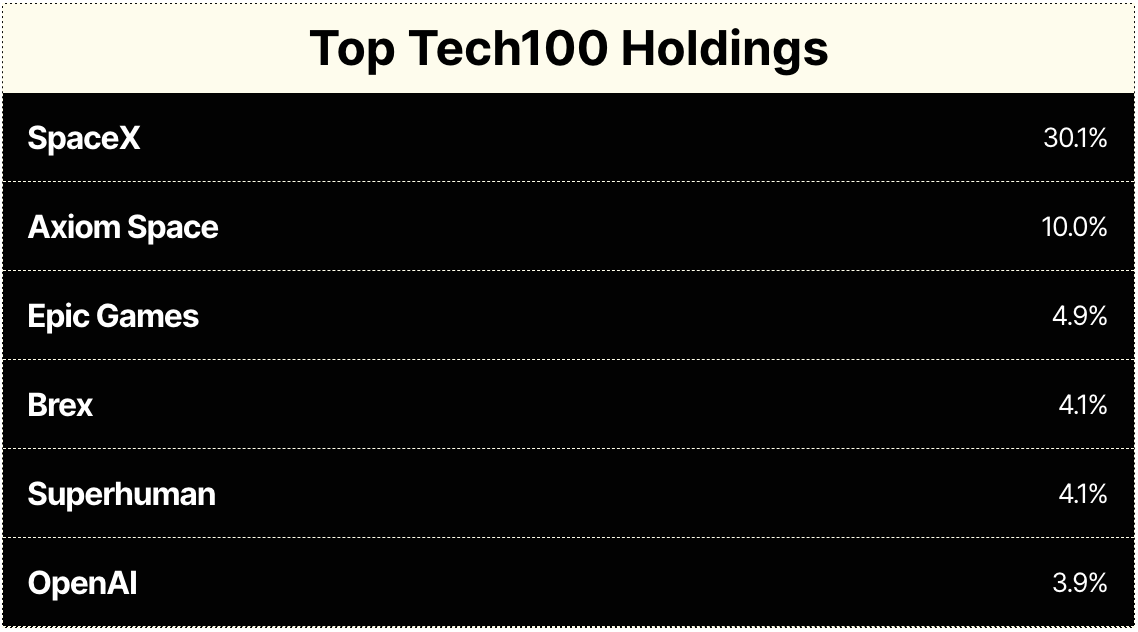

Top Holdings:

SpaceX: 30.1%

Axiom Space: 10.0%

Epic Games: 4.9%

Brex: 4.1%

Superhuman: 4.1%

OpenAI: 3.9%

Upside Opportunity Metrics:

Large total addressable markets

High revenue growth rates

Asset-light models

Economies of scale

Destiny’s team consists of experienced private market experts.

Early backers include founders from Dropbox and Coinbase, and partners from Sequoia Capital, Greylock Partners, and Y-Combinator.

Advisors span across industries, from tech giants like Google and Apple to legal firms and entertainment figures.

Destiny Tech100 ETF — A Massive Opportunity

The introduction of Destiny and its Tech100 ETF represents a shift in the investment landscape, making high-growth tech investments accessible to a broader audience.

That were once reserved for a select few. However, today, with Destiny and its Tech100 ETF, that future is now more accessible than ever.

By participating in the Destiny Tech100 ETF, investors have the potential to be part of the growth journey of companies like SpaceX and OpenAI, something that was nearly impossible for the average investor previously.

This development not only opens the door for new investors but also signifies a shift in the investment paradigm, where the barriers between private and public investment opportunities are increasingly blurred.

For those interested in seizing this opportunity, the process is straightforward.

By investing in the Destiny Tech100 ETF, you’re not just investing in a single company, but a curated portfolio of the top private tech companies.

This approach mitigates risk while offering the potential for significant returns.

Sincerely,

The Pareto Investor

How do the mechanics work? Like, if someone buys into a mutual fund or ETF, the manager buys the proportional weights in the open market. If I buy a share of this, presumably they can’t call up some SpaceX employees and get them to sign a forward agreement.

Imagine this is close end?

This is only available to US-residents/Citizens.