Dear Investors,

As the Pareto Investor, my approach is deeply rooted in the principle that a small number of actions lead to the most results, famously conceptualized by Vilfredo Pareto.

Adapted to finance, this principle is not just an investment strategy; it's a holistic way of looking at financial markets that leads to success. This approach, I have designed over the years, empowers both seasoned and novice investors alike to navigate the complex world of investing with confidence and clarity.

Today, I'm offering you a deeper insight into my core investing tenets, blending ancient wisdom with modern economics, embracing patience, and focusing on market leaders to build a portfolio that not only endures but thrives in any financial landscape:

Embrace humility and continuous learning:

Acknowledge that the world is complex and ever-changing.

Continuous learning and being open to new information is crucial.

Avoid arrogance and stay humble, knowing that there is always something new to learn.Learn from past, invest in the present, and prepare for future:

Analyze your past investment decisions to understand what worked and what didn’t.

Use this knowledge to make informed decisions in the present while keeping an eye on future trends and opportunities.Combine ancient wisdom with modern economics for investment success:

Blend timeless financial principles, such as the value of compounding and risk management, with modern economic theories and market analysis.

This holistic approach can provide a deeper understanding of the market.Nobody can predict the future:

Accept that the stock market is inherently unpredictable.

Instead of trying to predict market movements, focus on sound investment principles and strategies that can withstand market volatility.Learn from experts who have achieved what you want to achieve:

Seek advice from successful investors and financial experts.

Analyze their strategies and adapt their insights to your investment style while being aware of differing market conditions.Adopt a holistic view of investing:

Understand that investing involves cycles of ups and downs.

Develop a resilient mindset and a diversified portfolio to navigate through different market conditions confidently.Success in investing requires discipline, focus, and a clear strategy:

Establish a disciplined investment approach, maintain focus on long-term goals, and stick to a clear strategy.

Avoid impulsive decisions based on short-term market fluctuations.Investing is about picking the right stocks, not just any stocks:

Quality over quantity is key in stock selection.

Conduct thorough research to identify companies with strong fundamentals, growth potential, and a competitive edge.Embrace the philosophy of doing less but achieving more:

Avoid overtrading and excessive portfolio changes.

Sometimes, the best action is inaction, especially when it allows your investments to compound over time.Recognize the value of patience and long-term thinking:

Long-term investing often yields better results compared to short-term speculation.

Be patient and allow your investments the time they need to grow.Follow the dominant consensus and let the market guide your choices:

While it's important to do your own research, also pay attention to market trends and consensus.

However, be wary of herd mentality and always validate with your own analysis.Index funds track the market, not beat it; aim for more than average returns:

While index funds are an effective way to match market returns, strive to outperform the market through well-researched, individual stock selections or other investment vehicles.Learn from success story and invest in innovation and market leadership:

Study companies like Apple and Microsoft that have demonstrated consistent innovation and market leadership.

Investing in such companies offers significant returns as they continue to dominate their sectors.Learn from the rise, fall of market leaders, and avoid spreading yourself thin:

Study the history of market leaders, their rise, and potential fall.

This helps in understanding market cycles and avoiding investments in declining sectors or companies.Capital flows to where it's treated best (Smith’s Invisible Hand):

Understand Adam Smith's concept of the 'Invisible Hand', which suggests that money naturally flows to where it earns the best returns.

Align your investments accordingly.Vilfredo Pareto’s work is underrated, especially in investing:

Recognize the significance of Pareto’s Principle (80/20 rule) in investing, where a small number of investments/stocks yield most returns.Shakespeare was right, less is more, including with investing:

Embrace the concept, a smaller number of high-quality investments can be more effective than a large portfolio of average ones.Diversify wisely but avoid the trap of over-diversification:

Diversification is key to managing risk, but over-diversification can dilute potential returns.

Strive for a balanced portfolio that is diversified but still focused.Avoid over-diversification and trust in Pareto’s Principle for top stock selection:

Focus on identifying the top-performing stocks that could potentially contribute to most of your portfolio’s returns, instead of over-diversifying.Only a few stocks drive most market returns; quality over quantity leads to superior performance:

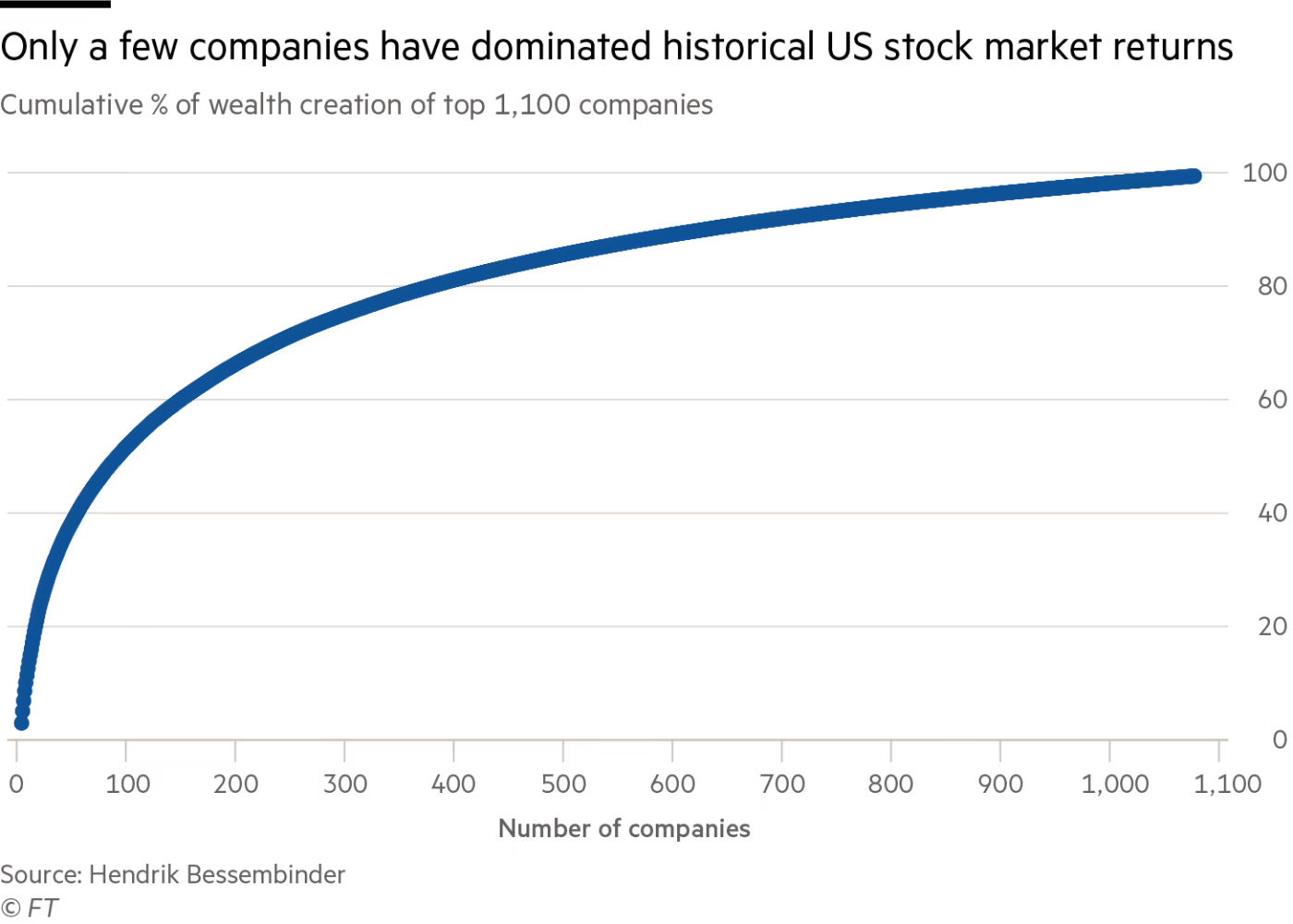

Understand that in the market, a small number of stocks drive most gains as Hendrik Bessembinder demonstrated years ago.

Focus on identifying and investing in these high-quality stocks.Pareto’s Principle in the stock market is undeniable; evidence shows that 80% of returns come from 20% of stocks:

Acknowledge and apply Pareto’s Principle in your investment strategy.

Recognizing that a significant portion of returns comes from a relatively small subset of stocks.The secret to outperforming the market is not hard work, but smart work with a handful of top-performing stocks:

Realize that hard work in research combined with smart decision-making focusing on a few top-performing stocks can lead to market outperformance.Aim high with your money and use Pareto’s Principle to provide a strategic edge in the stock market:

Set ambitious financial goals and use the 80/20 rule as a guiding principle to make strategic investment decisions that could provide a competitive edge.Understand the importance of market leadership in selecting investment stocks:

Focus on companies that are leaders in their sectors, as they are more likely to sustain growth and profitability, leading to better investment returns.Learn how to identify opportunities from a long track record of success:

Study companies and sectors with a history of success to identify enduring investment opportunities, while being aware of potential changes in market dynamics.Investing is an art and science, and Pareto’s Principle guides both:

Acknowledge that investing involves both analytical skills (science) and intuitive judgment (art) and use the 80/20 rule as a framework to guide both aspects.Building a successful portfolio requires a blend of wisdom and strategy:

Develop a successful investment portfolio by combining practical wisdom gained from experience with strategic planning and analysis.High-quality concentrated investments lead to exceptional returns:

Concentrate on a few high-quality investments rather than spreading resources too thin.

This approach can lead to exceptional returns if these investments are chosen wisely.Understand the cyclical nature of the market and adapt to changing conditions for optimal results:

Recognize that markets are cyclical and adjust your investment strategy accordingly to take advantage of different market phases.Pareto’s Principle is a key to financial success in investing:

Pareto’s Principle teaches us that a minority of investments often yields most returns.This underscores the importance of focus.

It means putting all your capital into a few assets; it’s about identifying and keeping eyes on high performers.

Here six additional tenets, in conjunction with the existing 30, solidify my Pareto Investing Philosophy and How to Get Rich with Investing (without Getting Lucky):