I’ve Analyzed Best Investments Since 1800!

Here’s What I've Found by Analyzing Investments Over the Last 220 Years Reveals a Clear Trend!

Dear Investors,

Analyzing investment strategies dating back to the 1800s provides crucial insights into how various asset classes have responded to historical, economic, and political upheavals.

A comprehensive review of global economic history reveals striking patterns in asset performance under diverse conditions.

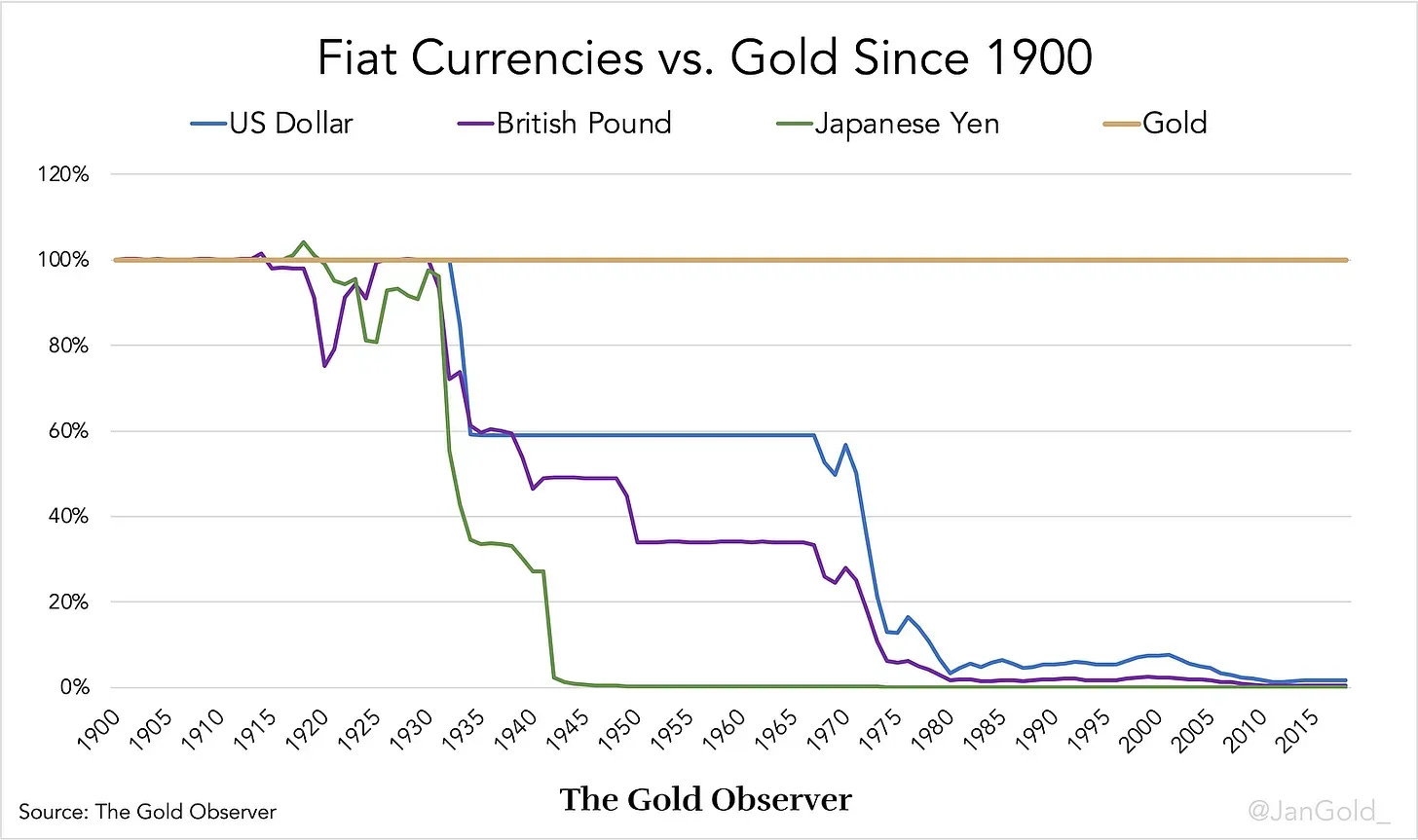

During the 19th century, countries adhering to the gold standard experienced notable monetary stability.

With currencies pegged to gold, the value of money remained consistent despite significant social and political turmoil.

While gold served as a stable monetary foundation, it yielded limited investment returns, reflecting the low inflation and price stability of that era.

Equities and real estate have consistently proven to be the most effective drivers of long-term capital growth.

Despite facing periodic crises, these assets have generally outperformed government bonds and cash over extended periods.

Real estate, in particular, has thrived during economic recovery phases, exemplified by the post-World War II boom in Europe.

However, global conflicts and economic downturns have tested investors severely.

Equities and real estate experienced significant declines in real value during these times.

In contrast, gold emerged as a resilient safe haven, appreciating when other asset classes faltered, underscoring its role as a critical asset during inflationary and unstable monetary conditions.

The advent of the digital age and access to comprehensive databases has transformed investment strategies.

Investors can now perform in-depth analyses and simulate various scenarios before making decisions.

This capability to empirically test investment strategies marks a significant advancement over previous generations.

Historical investment analysis underscores the importance of diversification.

Real estate remains a strong long-term investment, particularly in stable economic regions.

Gold continues to be an essential component of diversified portfolios, especially in times of crisis when monetary stability is at risk.

Meanwhile, equities offer substantial growth potential, albeit with short-term volatility.

A $100 investment in the S&P 500 (including dividends) in 1970 would have surged to an impressive $22,419 by 2023, making U.S. stocks the top-performing asset class.

In comparison, a $100 investment in corporate bonds would have grown to $7,775—65% less than the S&P 500.

Gold, another key asset, would have appreciated to $5,545 by 2023, particularly thriving during periods of inflation and a declining U.S. dollar.

In contrast, real estate has grown at an average annual rate of 5.5% since 1970, with significant gains observed in the decade leading up to 2020.

It’s important to note that this growth is based purely on price changes, and actual homeowner returns may vary due to factors like leverage and expenses.

Given the unique nature of real estate, a $100 investment would have appreciated to approximately $1,542 by 2023, as slower price growth in the 1980s and 2000s impacted overall gains.

Notably, the housing market has faced challenges, with significant recovery time following downturns such as the Global Financial Crisis, which delayed price recovery for a decade.

In recent years, the global financial landscape has been undergoing profound changes.

Traditional markets like bonds and equities are facing significant challenges, and many investors are turning to alternative assets such as gold and cryptocurrencies in response to mounting economic uncertainties.

At the heart of these challenges are concerns about inflation, unsustainable levels of national debt, and shifting global power dynamics.

The U.S., historically a global economic leader, is increasingly under financial strain, raising important questions about the future of the global economy and the role of central banks in maintaining stability.

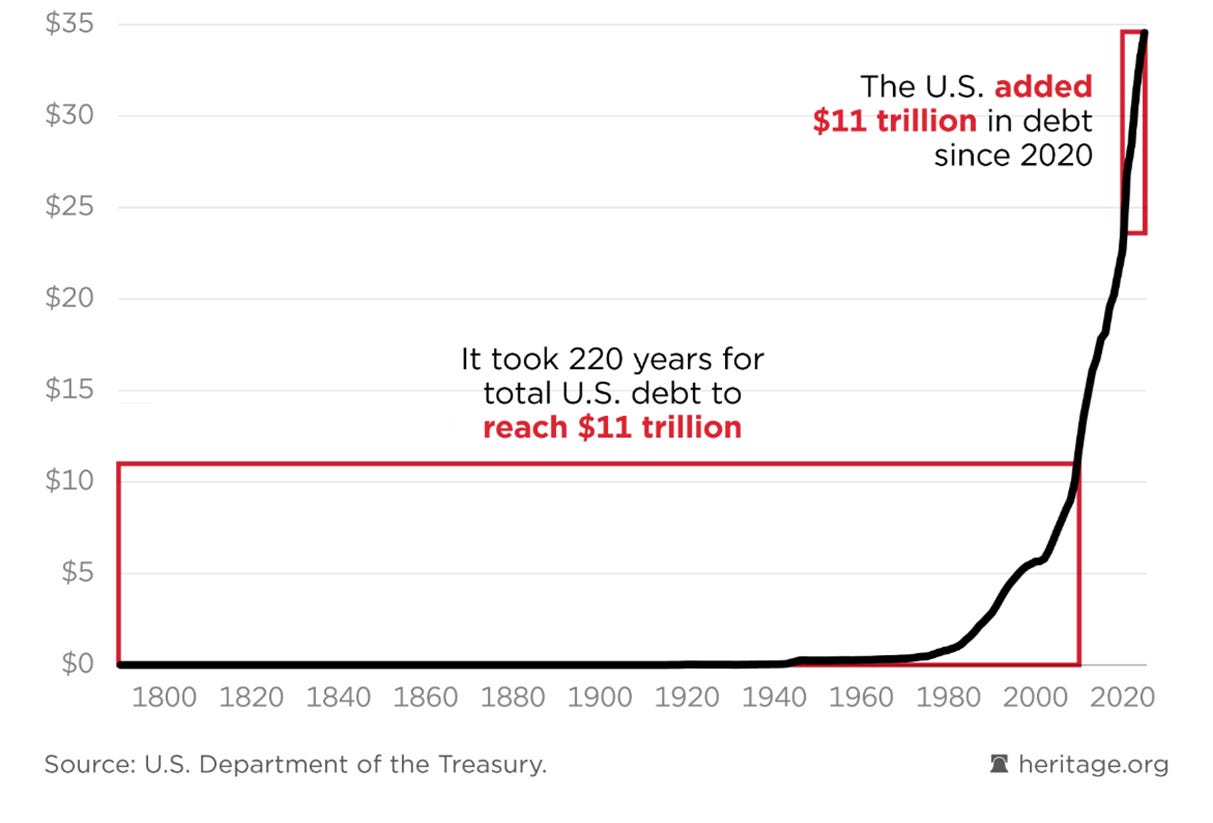

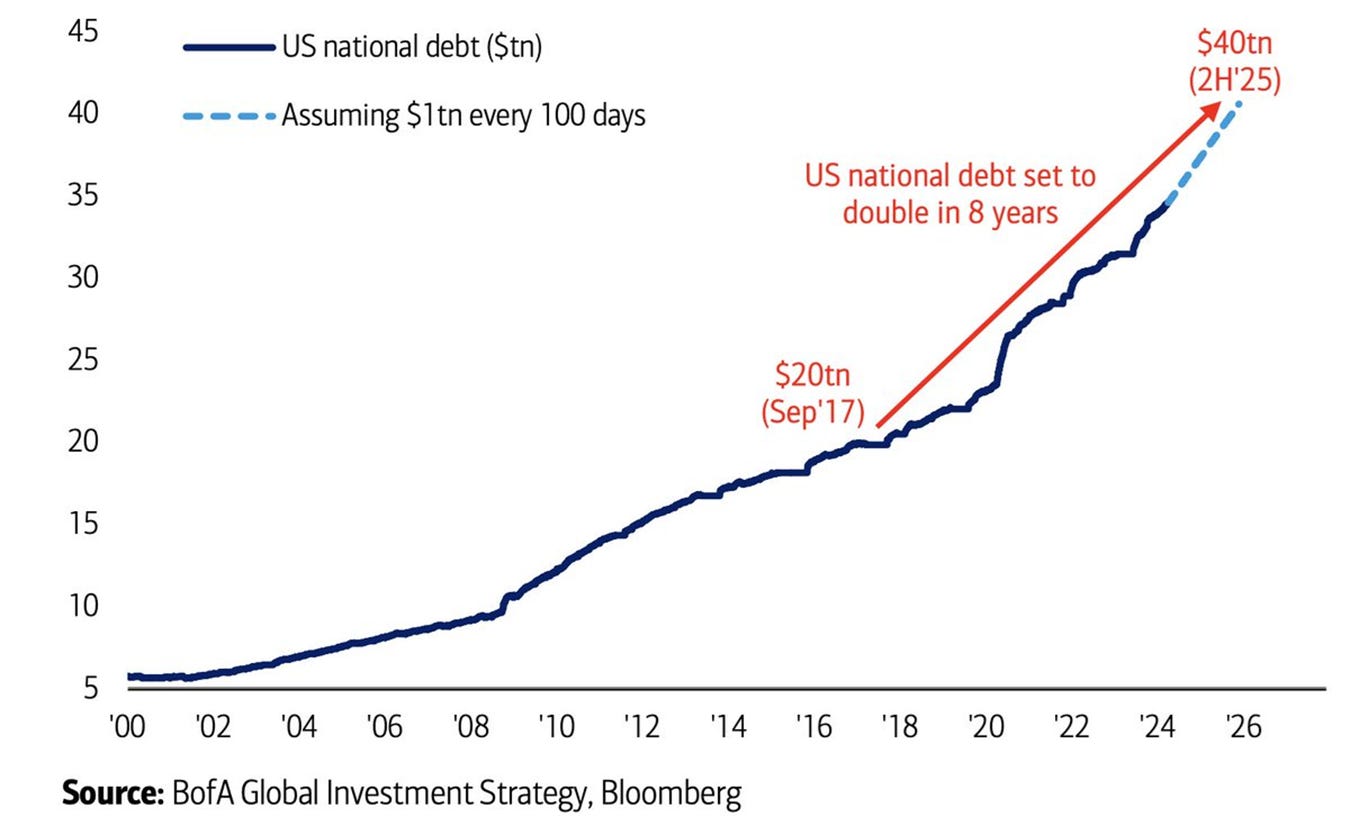

One of the most pressing issues facing the U.S. economy is the unsustainable level of national debt, now at a staggering $35 trillion.

This debt is growing at an alarming rate of $10 billion per day, raising concerns that even the U.S. might not be able to keep up with its financial obligations.

Historically, the U.S. has maintained its global economic dominance through a combination of military power and its control over the world’s reserve currency, the U.S. dollar.

However, the costs of servicing the national debt are now exceeding the country’s defense budget, a worrying sign for an empire that has long relied on its military might to project power.

Economists have warned that the collapse of every major empire throughout history has been preceded by crippling debt.

As interest rates rise, so too do the costs of servicing the debt.

A single percentage point increase in interest rates results in an additional $2.25 trillion in debt payments over the next decade.

This means that the U.S. faces a scenario in which over half of its national debt must be financed in the short term—a highly precarious position.

Another challenge the global economy faces is the resurgence of inflation.

Central banks worldwide, including the Federal Reserve in the U.S., have attempted to curb inflation by manipulating interest rates.

However, inflationary pressures continue to mount, and government bonds, which were once considered safe investments, are now seen as increasingly risky.

Investors are wary of purchasing government debt when the prospect of repayment becomes less certain, particularly as inflation erodes the real value of returns.

Historically, inflation has had devastating effects on bondholders.

For example, during periods of high inflation, such as in France during the 20th century, government bonds lost up to 97% of their real value.

As inflation expectations rise, bond markets become increasingly unstable, making long-term debt less attractive to investors.

In response to these risks, many investors are turning to gold as a hedge against inflation and currency devaluation.

Gold has historically served as a store of value during periods of economic instability, and its price has surged as concerns about fiat currencies grow.

Central banks in emerging markets, such as China, have increased their gold reserves, signaling a potential shift away from reliance on the U.S. dollar as the global reserve currency.

Moreover, digital currencies like Bitcoin have also gained traction, particularly among younger generations who are skeptical of traditional financial institutions.

Bitcoin’s decentralized nature and limited supply make it an attractive alternative to fiat currencies, which can be printed in unlimited quantities by governments.

As concerns about inflation and currency debasement grow, cryptocurrencies are being increasingly viewed as “digital gold,” offering a store of value in a world where traditional monetary systems are under pressure.

Another important trend shaping the global economy is the rise of China as an economic powerhouse.

China has rapidly expanded its industrial base and has become the world’s leading exporter of goods, including automobiles.

Chinese companies are increasingly capturing market share in emerging markets with affordable, high-quality products, a trend that threatens the dominance of Western companies in these regions.

At the same time, China’s bond market is emerging as a stable alternative to U.S. Treasuries.

With the Chinese government maintaining a more conservative approach to debt, investors are increasingly looking to Chinese bonds as a safer investment than their American counterparts.

This shift could have profound implications for the future of the global financial system, as more countries and investors reduce their reliance on the U.S. dollar and seek alternatives in Chinese assets.

The actions of central banks have come under increasing scrutiny as global economic challenges mount.

In the U.S., the Federal Reserve has been criticized for its handling of interest rates and inflation.

Some argue that the central bank’s policies have contributed to a misallocation of resources and an unhealthy dependence on short-term debt.

Additionally, the Fed’s attempts to manage inflation through monetary policy are seen as insufficient in the face of structural challenges like rising national debt and global supply chain disruptions.

As investors lose faith in fiat currencies, there is a growing shift toward decentralized assets like gold and cryptocurrencies.

This trend highlights the limitations of central banks in maintaining control over the economy, especially as new financial technologies emerge that bypass traditional monetary systems.

The Best Investments Since 1800

Over the last two centuries, investment landscapes have undergone dramatic changes shaped by economic, political, and technological transformations.

Through an in-depth analysis of investment performance since 1800, we can glean valuable insights into which asset classes have truly stood the test of time.