Dear Investors,

I’ve been around the investing block for a solid 15 years now, and let me tell you, it’s been one heck of a ride.

I’ve made my fair share of mistakes, but hey, I’ve learned a thing or two along the way.

So, for all you fresh-faced investors out there, here are some hard-earned nuggets of wisdom straight from the school of hard knocks:

1. Avoid Leverage

It’s wise to steer clear of using borrowed money like margin or options, as they can amplify losses significantly, especially when the market takes a downturn.

“The difference between successful people and really successful people is that really successful people say no to almost everything.”

— Warren Buffett

2. Longevity Over Upside

Prioritize longevity over chasing high returns.

Compound interest works wonders over time, but it’s only effective if you survive long enough to benefit from it.

Focus on sustainable strategies rather than risky ventures.

“It’s not whether you’re right or wrong that’s important, but how much money you make when you’re right and how much you lose when you’re wrong.”

— George Soros

3. High Conviction ≠ Accuracy

While it’s essential to have confidence in your investments, being sure doesn’t guarantee success.

Even with strong convictions, stocks can perform unexpectedly, leading to significant losses.

Stay vigilant and open-minded, acknowledging that being wrong is part of the investment journey.

“Rule №1: Never lose money. Rule №2: Never forget rule №1.”

— Warren Buffett

4. Short-term vs. Long-term Correlation

Understand that short-term fluctuations in stock prices don’t always reflect the underlying performance of the business.

While it’s tempting to react to immediate market movements, focusing on the long-term trajectory of the company is crucial for making informed investment decisions.

“The stock market is filled with individuals who know the price of everything, but the value of nothing.”

— Philip Fisher

5. Have a System

Utilize tools like checklists, journals, and watchlists to organize your investment approach.

Relying solely on memory or intuition can lead to oversights and mistakes.

A systematic approach helps you stay disciplined and methodical in your investment strategy.

“An investment in knowledge pays the best interest.”

— Benjamin Franklin

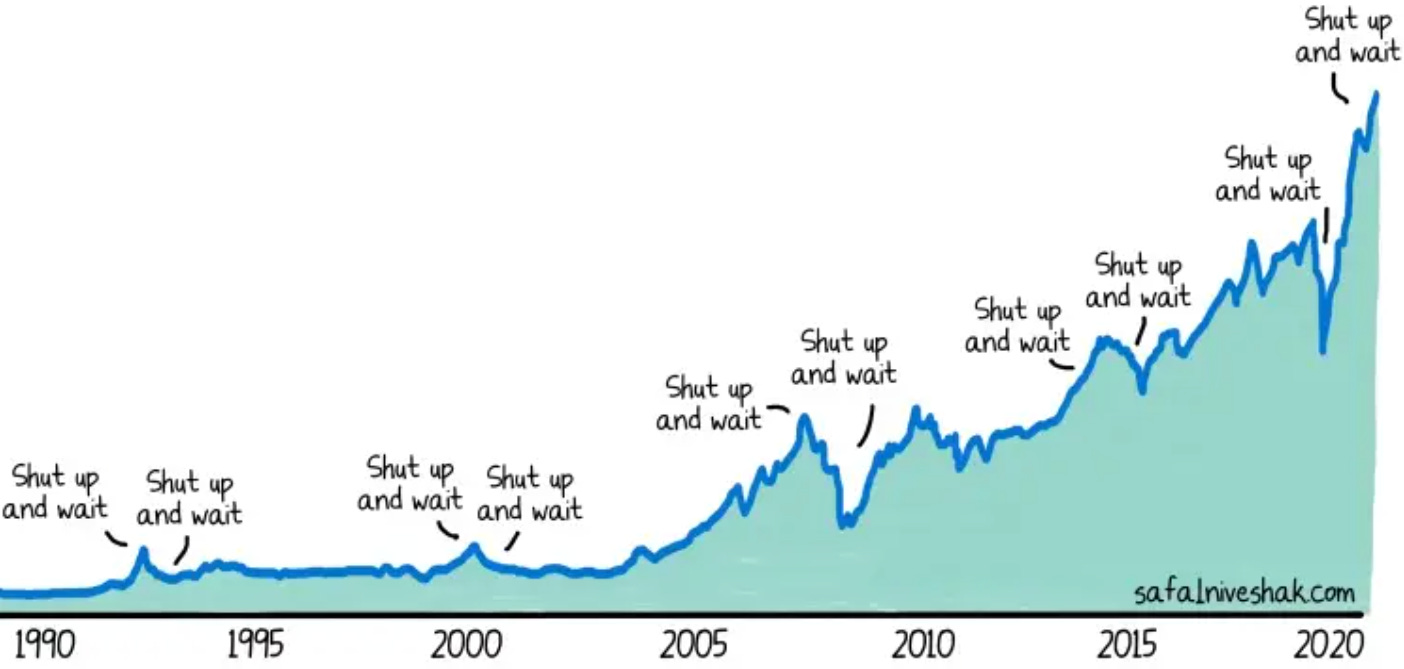

6. Avoid Panic Buying and Selling

Emotional responses can cloud judgment, leading to impulsive buying or selling decisions.

Stay calm and rational, especially during market volatility.

Stick to your investment strategy and avoid making decisions based on fear or excitement.

“The stock market is designed to transfer money from the Active to the Patient.”

— Warren Buffett

7. Learn from History

Study historical market cycles and human behavior to gain insights into market dynamics.

Recognize that market patterns often repeat themselves, and understanding historical trends can help you navigate current market conditions more effectively.

“History doesn’t repeat itself, but it often rhymes.”

— Mark Twain

8. Focus on What You Can Control

Accept that you can’t predict or control macroeconomic factors or market movements.

Instead, focus on factors within your control, such as your investment strategy, risk management, and financial discipline.

By concentrating on actionable elements, you can mitigate unnecessary stress and uncertainty.

“The investor’s chief problem — and even his worst enemy — is likely to be himself.”

— Benjamin Graham

9. Be Willing to Change Your Mind

Embrace flexibility in your investment approach and be open to admitting when you’re wrong.

Acknowledge that making mistakes is inevitable in investing, but learning from them and adjusting your strategy accordingly is essential for long-term success.

“In the short run, the market is a voting machine, but in the long run, it is a weighing machine.”

— Benjamin Graham

10. Embrace Your Mistakes

Understand that being wrong is a natural part of investing.

Rather than dwelling on past errors, use them as valuable learning opportunities to refine your approach and make better decisions in the future.

“The four most dangerous words in investing are: ‘This time it’s different.’”

— Sir John Templeton

11. Confidence vs. Accuracy

While confidence in your investment decisions is important, it’s crucial to recognize that certainty doesn’t always equate to accuracy.

Stay humble and open-minded, continually evaluating and adjusting your strategies based on new information and market developments.

“The greatest enemy of knowledge is not ignorance, it is the illusion of knowledge.”

— Daniel J. Boorstin

12. The Gut Punch of Losses

Experience the emotional impact of financial losses firsthand, realizing that the pain of losing money far outweighs the satisfaction of making it.

Avoid leveraging investments with borrowed funds, as it can magnify losses and lead to financial ruin.

“The stock market is a device for transferring money from the impatient to the patient.”

— Warren Buffett

13. Humans Aren’t Perfect

Acknowledge the inherent cognitive biases and emotional tendencies that can cloud judgment and lead to suboptimal investment decisions.

Recognize that human psychology often conflicts with rational investing behavior, requiring conscious effort to overcome.

“You only have to do a very few things right in your life so long as you don’t do too many things wrong.”

— Warren Buffett