Dear Investors,

Today, I’ll share insights about the transformative power of Bitcoin and why I believe it represents not just an investment but the foundation of a new economic paradigm.

I’ll touch on three key ideas:

The structural challenges with traditional asset classes.

Why Bitcoin is uniquely positioned to solve these challenges.

How MicroStrategy’s strategy exemplifies the power of Bitcoin-backed leverage.

The Problem with Traditional Assets

Most asset classes cannot keep pace with monetary inflation.

“Every year, trillions of dollars are eroded by inflation, mismanagement, and entropy.

Bonds, the backbone of corporate treasuries, have lost 5% annually over the past four years.

Even the most innovative companies can struggle to generate the returns required to beat the cost of capital.”

— Micheal Saylor

Traditional strategies like stock buybacks or dividends fail to address the core issue: preserving wealth in an inflationary world.

Bitcoin solves the fundamental problem of capital preservation.

It’s the first asset in history that’s immune to physical and financial entropy.

Here’s why Bitcoin stands out:

Unparalleled Performance:

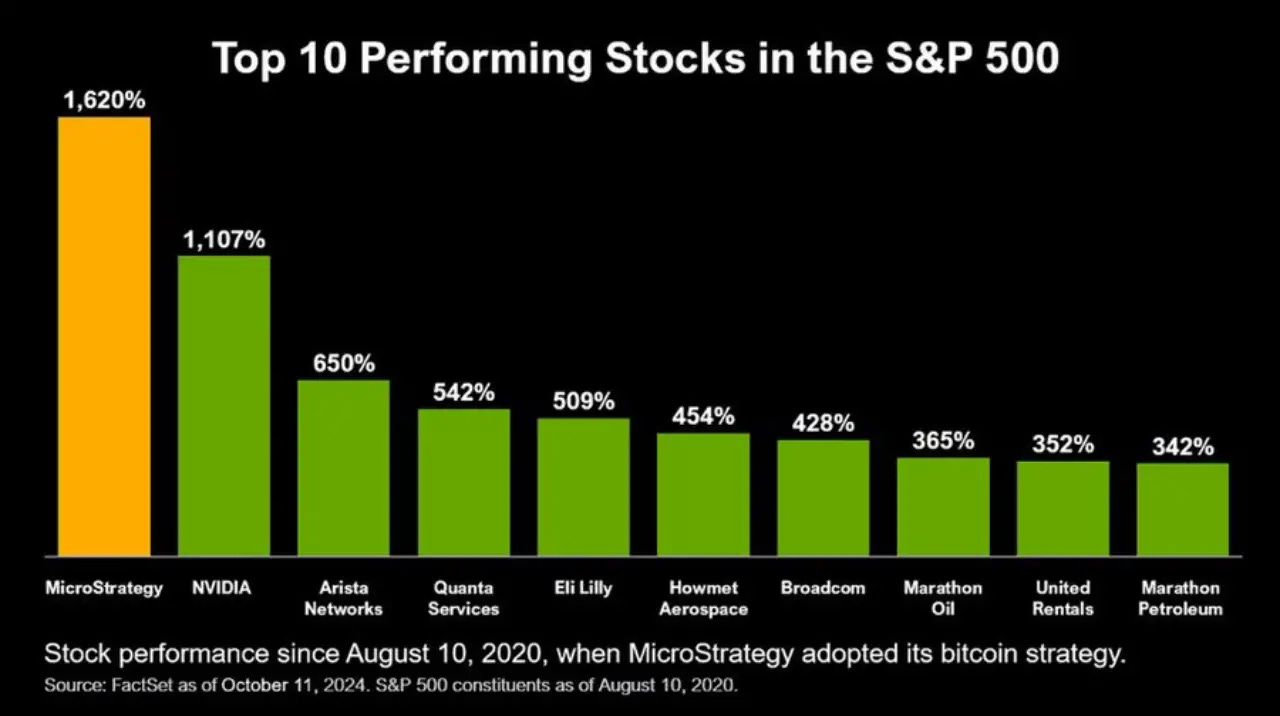

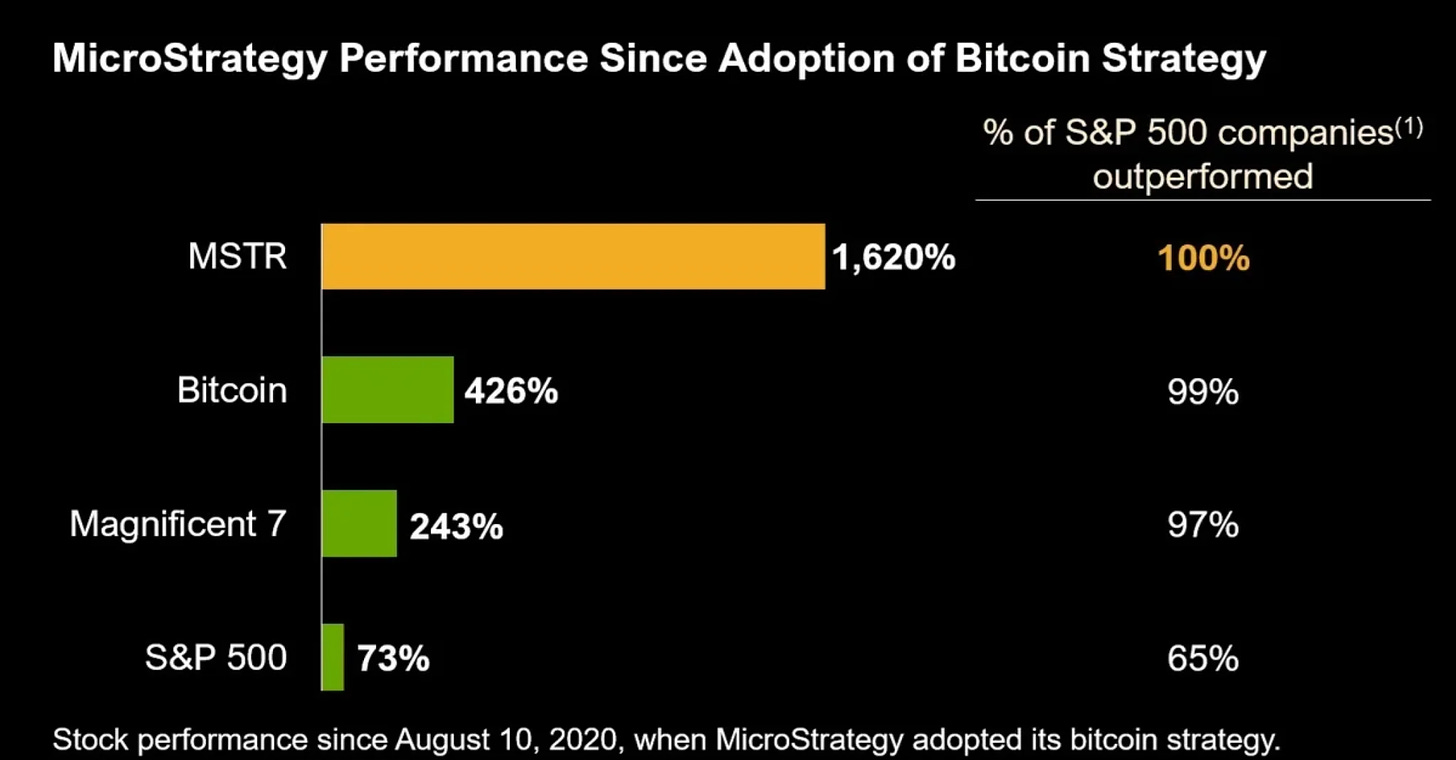

Over the last four years, Bitcoin has outpaced every major asset class, delivering an average return of 60% annually—doubling the performance of top equities like Nvidia and Apple.Uncorrelated Alpha:

Bitcoin’s low correlation with traditional markets makes it an ideal hedge for portfolios seeking diversification and superior returns.Digital Capital:

Unlike real estate or bonds, Bitcoin is free from risks like property damage, taxation, or geopolitical instability. It’s an indestructible, immortal, and globally transportable form of capital.

MicroStrategy: An Intelligent Leverage

I’ve always been a buy-and-hold investor.

For years, I stuck to index funds and Bitcoin.

But as I learned about options, I started exploring leverage strategies.

Bitcoin itself doesn’t have great options products, so I turned to MicroStrategy, which essentially acts as a leveraged bet on Bitcoin.

Why MicroStrategy?

MicroStrategy, led by its Bitcoin evangelist CEO Michael Saylor, has turned its corporate strategy into a bold bet on Bitcoin.

The company has acquired over 150,000 BTC, financed partially through debt, making it one of the largest institutional holders of Bitcoin.

The MicroStrategy Approach: Intelligent Leverage in Action

Leverage Without Liquidation Risks:

Unlike traditional margin trading, where sudden market downturns can trigger liquidations, MicroStrategy’s leverage is embedded in its equity structure.

This approach mitigates liquidation risks, making it a safer way to gain leveraged exposure to Bitcoin.Performance Amplification:

Through strategic leverage, MicroStrategy’s stock has consistently outperformed even Bitcoin’s impressive returns, demonstrating the power of its bold and focused strategy. When Bitcoin rallies, MicroStrategy often outpaces it due to its leveraged exposure. With a 3x net asset value (NAV) expansion as a realistic target during bullish markets, the potential for amplified returns is significant.

Options Trading Opportunities:

MicroStrategy’s equity is highly liquid in the options market, providing a versatile platform for investors to capitalize on Bitcoin’s volatility without directly holding the cryptocurrency.

Bitcoin-Backed Bonds:

By issuing innovative bonds, MicroStrategy has created a financial product that delivers returns surpassing Bitcoin itself, benefiting both bondholders and equity investors.

Consistent Accumulation:

Michael Saylor’s philosophy is simple yet powerful: “We buy Bitcoin during highs, lows, and everything in between. The key is persistence.” This disciplined approach ensures a robust and growing Bitcoin treasury.

MicroStrategy’s revolutionary treasury strategy combines innovation, discipline, and intelligent leverage, positioning it as a standout investment for those seeking amplified exposure to Bitcoin’s potential.

2045: Bitcoin as the Global Reserve

Volatility is not the enemy; it’s the price we pay for vitality and opportunity.

Wealth is built on assets with massive upside, and Bitcoin’s volatility is the engine driving its unmatched returns.

The Red Wave shifts favoring Bitcoin adoption, dubbing it the Crypto Renaissance.

With institutions and governments increasingly warming to Bitcoin, I see three milestones on the horizon:

Widespread ETF Adoption:

Spot Bitcoin ETFs are expected to bring billions of dollars into the market.Tokenized Equity:

Companies like Apple and Tesla could tokenize their shares, trading them 24/7 on blockchain networks.Strategic Bitcoin Reserves:

Governments, led by the U.S., could adopt Bitcoin as a reserve asset, further legitimizing it as the foundation of the 21st-century economy.

I’m incredibly bullish on Bitcoin and, MicroStrategy is the ultimate vehicle for capitalizing on this moment.

The confluence of ETF approvals, macroeconomic tailwinds, and growing institutional adoption makes this an exciting time to be involved.

For investors willing to take calculated risks, MSTR offers an unparalleled opportunity to ride the Bitcoin wave with enhanced upside potential.

Half of the world’s $450 trillion in wealth is allocated to preserving capital.

Bitcoin’s use case is simple: it lets you keep your money, immune to inflation and entropy.

Over the next 21 years, Bitcoin could reach $13 million per coin, fundamentally reshaping wealth distribution.

MicroStrategy is publishing its playbook for everyone to see.

Leverage Bitcoin intelligently, and you can transform your balance sheet, outperform the market, and build lasting wealth.

Bitcoin is not just an investment; it’s the foundation of a new era in capital markets.

The time to act is now.

With Bitcoin ETFs gaining traction, institutional adoption accelerating, and companies like MicroStrategy leading the charge, the crypto Renaissance is here—and it’s unstoppable!

Keep stacking!

Sincerely,

The Pareto Investor

You get Bitcoin at the price you deserve mine was 40000$. Glad to see more and more people/investors finally getting the real game that is playing before our eyes

Let me start by saying that I like Bitcoin. However, it not no longer seems like a contrarian play. I think it is getting close to a cycle high. This doesn't mean that it will crash. I think it will likely keep rising. However, the risk-reward is poor after a large rally looking at past rallies.

I'd love to see a pullback and either sell MSTR puts spreads if implied volatility is high, or buy call diagonal spreads if volatility is low.

When something is at a record high, it means that there must be value somewhere else. What Is relatively cheap but has undeniable intrinsic value? Silver, uranium, oil, natural gas, coal, copper., and platinum group metals. Demand for these commodities isn't going away anytime soon. Most of the world's population is increasing their demand exponentially, while supply appears to be peaking or slowing.

I am buying uranium and silver using URA and SLV options and waiting for the others to reverse their downtrend.

I can't wait for Bitcoin to make a new cycle low and use MSTR options for passive income.

This isn't financial advice. If you're interested, I share how to use options to maximize returns on the right assets at the right times.