Dear Investors,

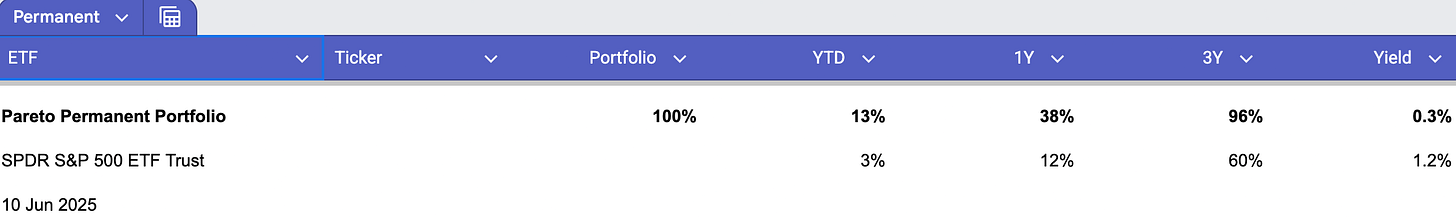

Six months ago, I launched the Pareto Permanent Portfolio, which has achieved a year-to-date return of +13.1%.

After years in the financial markets, I’ve come to realize that success lies in simplicity, this why the Pareto Permanent Portfolio is a straightforward investment strategy utilizing three ETFs, designed to outperform traditional market indices.

“That's been one of my mantras – focus and simplicity.

Simple can be harder than complex…”— Steve Jobs

ETFs are the cornerstone of our investments, offering targeted exposure to different asset classes while maintaining simplicity and efficiency.

Designed for simplicity, this portfolio features only three ETFs to achieve superior long-term performance, making it an ideal choice for investors seeking both ease and excellence in their investment strategy.

The Pareto Permanent Portfolio draws inspiration from Harry Browne’s Permanent Portfolio, which emphasizes diversification across asset classes (stocks, bonds, gold, and cash) to achieve stability and growth in various market conditions.

There’s no need to reinvent the wheel.

Harry Browne, was an influential financial advisor and author, he introduced the Permanent Portfolio, in 1982, as a resilient strategy designed to thrive under any economic condition.

His belief was simple yet profound: the future is unpredictable, so a portfolio must be prepared to perform regardless of market trends.

This timeless approach offers a reliable path to sustainable wealth creation.

Over the 42-year period ending in December 2024, the Harry Browne Permanent Portfolio posted positive returns in 36 years (85%) and realized a compound annual growth rate of 6.88%. Its maximum drawdown was -15.92%.

To achieve this, Browne allocated equal portions of an investor’s funds to four distinct asset classes:

Stocks (25%): Representing growth-oriented assets, stocks capitalize on economic prosperity and provide significant returns during periods of market expansion.

Bonds (25%): Long-term government bonds add stability and perform well during deflation or declining interest rates.

Gold (25%): A hedge against inflation and currency debasement, gold protects wealth during economic turmoil.

Cash (25%): Treasury bills or cash equivalents provide liquidity and act as a buffer during market volatility or economic contraction.

The Permanent Portfolio’s genius lies in its diversification across uncorrelated assets.

Each component is designed to thrive in specific economic scenarios—stocks during growth, gold during inflation, bonds during deflation, and cash during uncertainty.

This balance reduces risk while ensuring consistent performance over the long term.

By incorporating the principles of the Permanent Portfolio, the Pareto Permanent Portfolio seeks to achieve stability and growth through a simplified, yet powerful, investment structure for maximum efficiency and growth potential.

The Pareto Permanent Portfolio

By concentrating my investments on only three ETFs, I can leverage the power of the Pareto Principle to maximize returns.

Each ETF plays a specific role in my portfolio, offering exposure to different asset classes and market segments.

This focused approach allows me to streamline my investment strategy and capitalize on all markets.

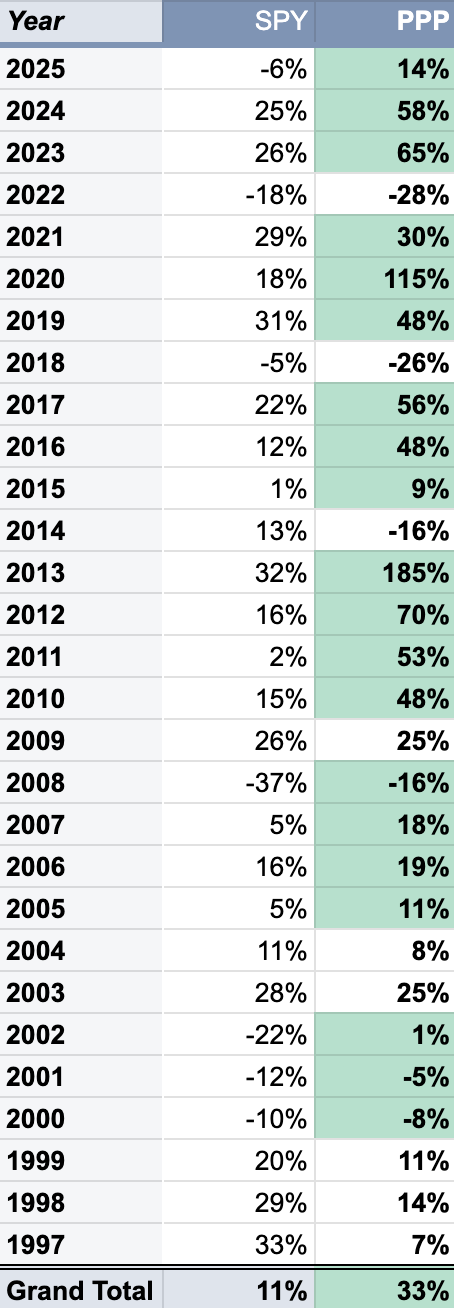

Over 25 years of backtesting, the Pareto Permanent Portfolio has shown exceptional growth.

From its inception in 1997, my Pareto Permanent Portfolio has yielded an average of 34% per year.

The Pareto Permanent Portfolio has outperformed the market 26 times on 28 years (64% of the time), with only six negative years.

By combining these three ETFs, I achieve a balanced and high-performing portfolio.

I encourage you to explore these ETFs and consider how they can fit into your investment strategy for 2025 and beyond.