My Monster Growth Portfolio +22.5% YTD — March Update

Severe Changes in the Portfolio — Recession about to Start?!

Dear Investors,

I am happy to share my portfolio update, with above market performance once again!

Nevertheless, this month is a bit different…

In finance, there are times to make money and times to protect money!

I have drastically changed my portfolio holdings as I believe some severe head winds are about to start to rise against markets…

"Investing is all about identifying the best wave and riding it carefully for as long as possible, then getting out when it dies in order to find another."

—Mohamed Aly El-Erian

But let’s start with the fun part first:

Year to date, the Pareto 1 Portfolio is up 22.55% while S&P500 only delivered 9.62%.

Just a quick note for you:

"Since the beginning of January, a $1,000 investment in my portfolio would have outperformed the S&P 500 by an impressive 12%, translating to an additional $120 in your pocket.

That's enough to cover your annual subscription costs with ease! Just saying ;)

And that’s just considering a $1,000 stake.

I’m aware that many of you have entrusted me with over $100,000, which speaks volumes about the confidence you have in my approach."

—The Pareto Investor

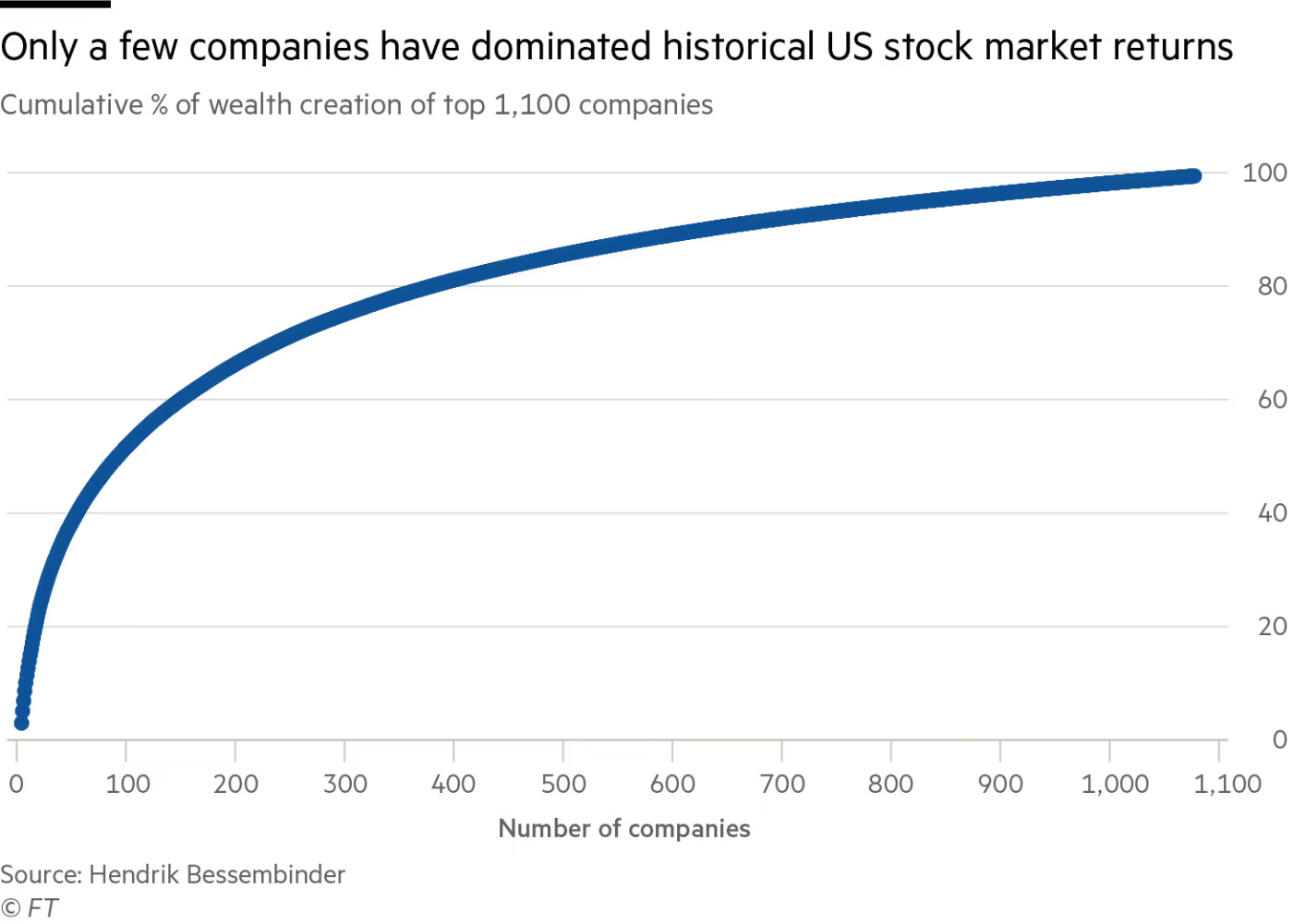

The Pareto Principle is a Fundamental Law of the Universe

Just like Pi, Phi, and Fibonacci, the Pareto’s Principle is a guiding principle that can transform the way you approach everything, including investing.

By understanding and applying it, investors simplify the investment process and focus on the most promising investments which increases their chances of outperforming the market.

This was first demonstrated by Bessembinder’s research years ago!

Pareto 1 Portfolio—Big Moves this Month!

18 Stocks (9 sold, 12 new)

3 ETFs (2 sold, 2 new)

Performance YTD: 22.5% (S&P500: 9.62%)

I'll keep saying it because it's true – leveraging the Pareto Principle in the investing game is next level. It's not simply good, it's gold-standard great!

This month, I've decided to secure some profits by selling off around 60% of my holdings and reallocating this portion into two assets.

It's a notable shift, but I believe it aligns with the need to sometimes prioritize protecting our investments over seeking aggressive growth.