The 80/20 Rule: A Proven Strategy to Outperform the S&P 500

How My Pareto Investing Strategy Maximizes Returns with Selective Focus

Dear Investors,

Outperforming the S&P 500 is a goal for many investors.

However, many adhere to the wisdom of broad diversification.

This approach unfortunately anchors performance to the average.

This is why, for years, I have been on the quest for superior investment returns.

The solution has been found by using Vilfredo Pareto’s work!

Vilfredo Pareto's observation that roughly 80% of consequences stem from 20% of causes has proven relevant across numerous fields.

“In any series of elements to be controlled, a selected small fraction, in terms of numbers of elements, always accounts for a large fraction in terms of effect.”

—Vilfredo Pareto

In investing, it suggests that a disproportionately large share of market gains often comes from a relatively small number of top-performing stocks.

By identifying and concentrating investments in these "vital few," this approach would clear a path towards greater portfolio efficiency and outsized success.

This isn't just theory.

Historical market data indicates that a select group of stocks drives the bulk of wealth creation over time.

Foundations of the Pareto Investment Strategy

Empirical evidence suggests that while diversification smooths returns, it also dilutes the impact of these exceptional performers.

Research, notably by Professor Hendrik Bessembinder, reveals a striking pattern:

over decades (e.g., 1926-2019), a very small percentage of publicly listed companies generated the vast majority of net wealth creation in the market.

Bessembinder's findings indicate that a mere fraction of stocks significantly outperformed risk-free assets like Treasury bills, while the majority did not.

Reference: Bessembinder, H. (2018). "Do Stocks Outperform Treasury Bills?"

Reference: Bessembinder, H., et al. (2020). "Long-Term Shareholder Returns: Evidence from 64,000 Global Stocks"

Index funds and broadly diversified portfolios are designed to mirror the market, effectively guaranteeing average market returns (minus fees).

While valuable for passive investors, this approach inherently limits the potential for significant outperformance.

Now, imagine a strategy focused on identifying and holding only the highest-impact stocks, which according to 100 years of stock market data, therefore capturing the largest share of the market's gains.

This is the strategy I have developed, based on Pareto's Principle and Bessembinder's research.

My Pareto Investment Strategy advocates for a selective concentration in stocks identified as having the highest probability of driving substantial future returns.

This represents a shift from passive investing with average performance to a more active approach, capitalizing on the extraordinary growth driven by market leaders.

Execution of the Pareto Investment Strategy

The practical application involves identifying the small percentage of stocks likely to generate the majority of returns.

“Simplicity is the ultimate sophistication.

More often then not we have the tendency to complicate rather then simplify.

We assume that sophistication equals results, brilliance, performance, and intelligence but it doesn't. More information, more choices, and more products is not better.”—Leonardo da Vinci (1452–1519)

While sophisticated analysis can be employed, a straightforward interpretation that focuses on market leaders, often those with the largest market capitalizations, as highlighted in Bessembinder's research, is I believe, the optimal approach for identifying the small percentage of stocks with the strongest potential impact on market gains.

A simple starting point involves screening for top companies globally or within specific regions/sectors based on market capitalization.

Example tool: Publicly available market cap screeners like CompaniesMarketCap.com

Key characteristics often sought in these potential "Pareto Stocks" include:

Market Leadership: Dominant position in their industry.

Strong Fundamentals: Robust financials, profitability, and growth potential.

Resilience: Demonstrated ability to navigate economic cycles.

To demonstrate the principle in its most distilled form, consider the "Pareto 1" Portfolio concept.

This involves concentrating capital solely in the single largest stock by market capitalization worldwide.

Historically, this position has shifted between General Electric, ExxonMobil prior to 2012, and Apple more recently.

Disclaimer: This is a highly simplified and concentrated illustration, not necessarily a universally recommended portfolio.

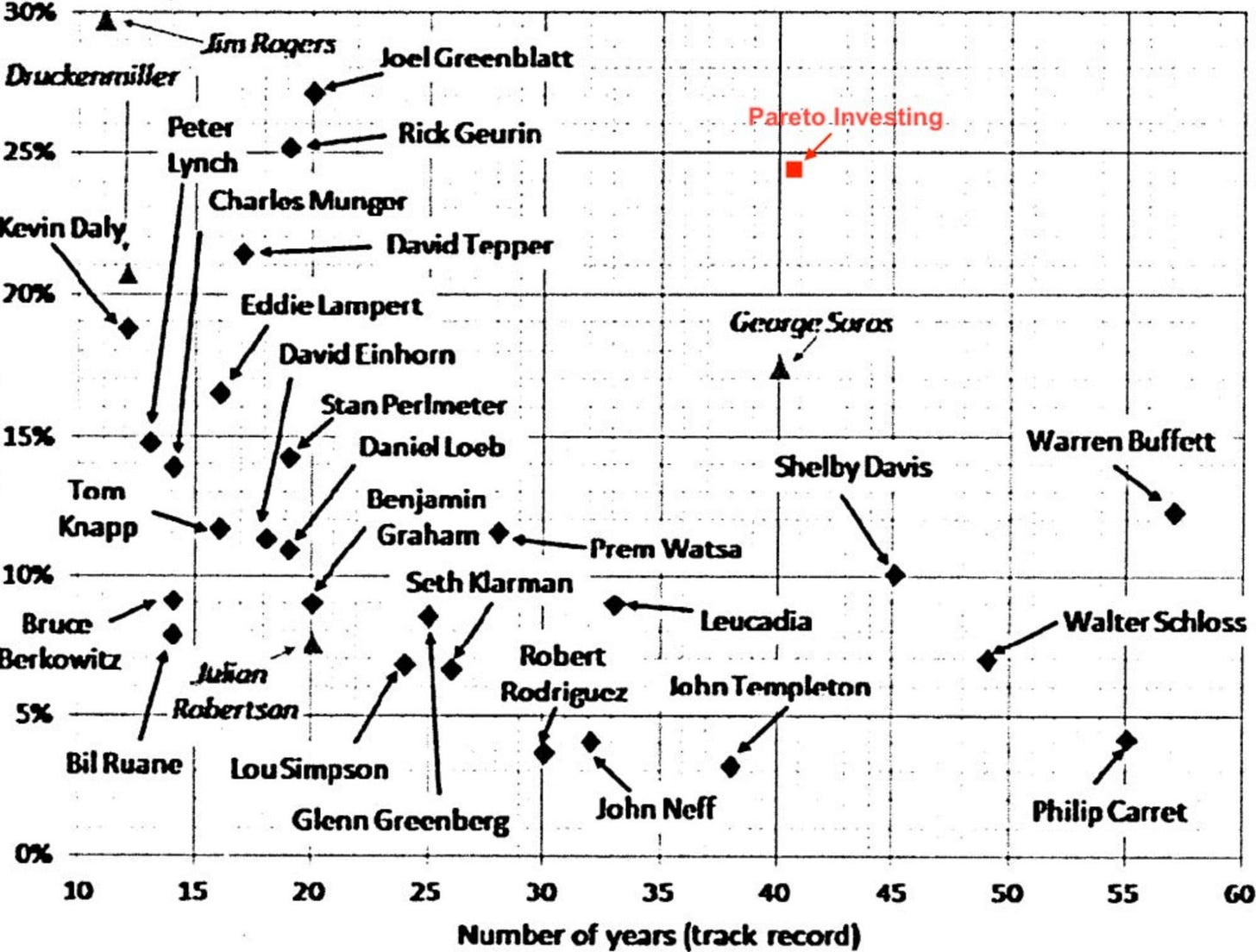

Analysis based on historical data suggests that a focused strategy, investing solely in the worldwide market leader, has significantly outperformed broader market indices over the past 30 years, delivering twice the returns of the S&P 500 (SPY 11% vs. Pareto 21%).

This hypothetical performance underscores the potential power of concentrating on the perceived 'best' single asset, leveraging the market's collective assessment.

It illustrates an extreme yet potent application of the 80/20 rule in practice.

A key benefit of concentrating on high-performing stocks is the potential to harness the power of compounding more aggressively.

By focusing capital on assets with potentially higher growth rates, even modest investments can grow significantly over time, outpacing the compounding effect within broadly diversified, average-return portfolios.

Long-Term Success and Adaptation

My Pareto Investment Strategy is not static.

Market leadership evolves, and economic landscapes shift.

Therefore, periodic review and rebalancing are crucial.

An annual assessment, at minimum, is recommended to ensure the portfolio continues to reflect the intended concentration – whether that's the top 1%, the single top stock, or another defined metric based on the Pareto Principle.

This ensures the portfolio adapts to changing market dynamics and captures emerging leaders every year!

As market sentiment shifts, capital naturally flows towards perceived optimal opportunities – the portfolio should adapt accordingly.

While the core principle remains focused concentration, the methodology allows for adaptation based on evolving market conditions and economic cycles.

Recognizing that different asset classes perform differently during various economic phases (expansion, peak, contraction, recovery) is vital.

“Investing is all about identifying the best wave and riding it carefully for as long as possible, then getting out when it dies in order to find another.”

—Mohamed Aly El-Erian

During periods of economic uncertainty or specific cycle phases, strategic inclusion of other asset classes (e.g., commodities like Gold, or alternative assets like Bitcoin) might be considered for wealth preservation or capturing opportunities outside traditional equities.

This adaptability ensures the strategy remains relevant and aims to optimize returns across different market environments, aligning with the idea of identifying the dominant "wave" and riding it effectively.

A Path to Higher Returns

My Pareto Investment Strategy offers a compelling alternative to traditional passive, too broadly diversified investment strategies.

By embracing the principle that a select few investments drive the majority of market gains, and moving away from the comfort of broad diversification to accept the risks associated with concentration, my Pareto Investing Strategy provides a structured, evidence-based framework for pursuing potentially exceptional returns.

For investors seeking a focused, potentially high-impact strategy to outperform market averages, applying the Pareto Principle offers a clear and potent pathway.

Sincerely,

The Pareto Investor

Thanks for sharing. Gave me another perspective to think about.

One issue I can't get around: this analysis assumes that you will know, at the beginning of the year, which stock will have highest market cap by year's end, and invest in it at the start of the year. You still need a crystal ball. For example, 2018. Microsoft had a cap of 780B. In 2019, Apple was 1.287T. 73% gain - awesome, but at the start of 2019 would you have known to move into Apple? Would anyone sell Microsoft on the dip of December 2018? Nah, we'd hold on, double down! Microsoft was still larger, by market cap, at the end of 2018.