US Treasury Market: Imminent Collapse?

Central Banks Are Buying GOLD Because War Is the Exit Plan!

Dear Investors,

I’m an optimist by nature, but that doesn’t mean I avoid reality.

Today, I want to draw your attention to something critical—something that history has shown us again and again: the devastating impact of debt crises on economies and societies.

"All models are wrong, but some are useful"

— George E. P. Box

While stock market crashes often grab the headlines, the real danger lies in debt crises, which have far more profound and lasting consequences.

Currently, there are concerning signs that we may be heading toward another such crisis, with signs suggesting this could occur around 2030.

To understand the gravity of what’s coming, let’s start with history.

Debt, Not Stocks, Drives Depressions

Many assume the 1929 stock market crash caused the Depression, but Herbert Hoover’s memoirs, freely available online, offer another perspective.

In the chapter on 1931, Hoover contends that the true catalyst of the Great Depression was a massive debt crisis.

In 1931, much of Europe, and even Canada, defaulted on their debts, sending shockwaves through the global financial system.

This wasn’t merely a stock market event; it was a collapse of the debt markets.

In the U.S., 9,000 banks failed, and firms like Goldman Sachs exacerbated the crisis by selling risky foreign bonds to everyday investors, wiping out savings.

Debt’s impact is profound because it’s roughly 10 times the size of equity markets.

A stock market crash of 20-40% affects only a subset of the population, but a debt crisis ripples through the entire economy.

Why Debt Crises Are More Severe?

The distinction between a stock market crash and a debt crisis is stark.

A stock market can fall 20%, 30%, or even 40% without dragging the entire economy down.

Not everyone owns stocks.

Debt, however, is pervasive.

When debt markets falter, the ripple effects hit businesses, governments, and individuals alike.

The 2007-09 Great Recession offers a modern parallel.

It wasn’t just a market downturn; it was a debt-driven crisis centered on real estate.

Real estate is key here.

While it involved a stock market decline, the real damage came from a debt crisis tied to real estate.

For most people, their home is their largest asset—their savings account.

When real estate values rise, people feel wealthier and spend more freely.

When they fall, even if income stays steady, people cut back, fearing they’ve lost their savings.

This psychological shift amplifies economic downturns.

In 2007-2009, banks played with fire by creating mortgage-backed securities—bets on the housing market.

When those bets failed, real estate values tanked, the debt market froze, and the economy suffered far more than a typical stock market crash would have caused.

As we look ahead, a similar dynamic looms, but this time with sovereign debt at the forefront.

Sovereign Debt on the Brink

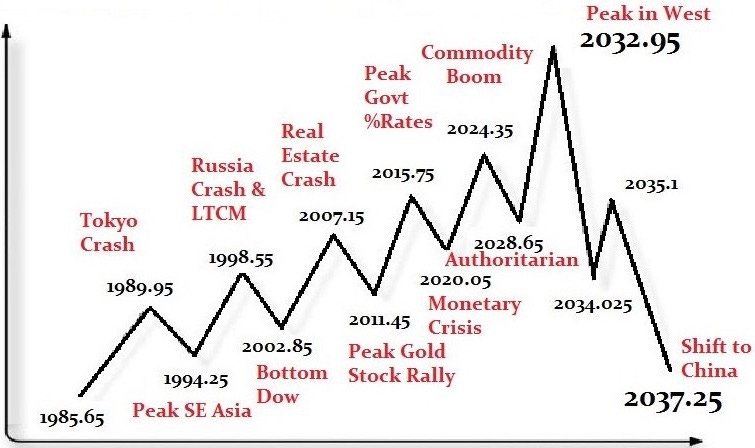

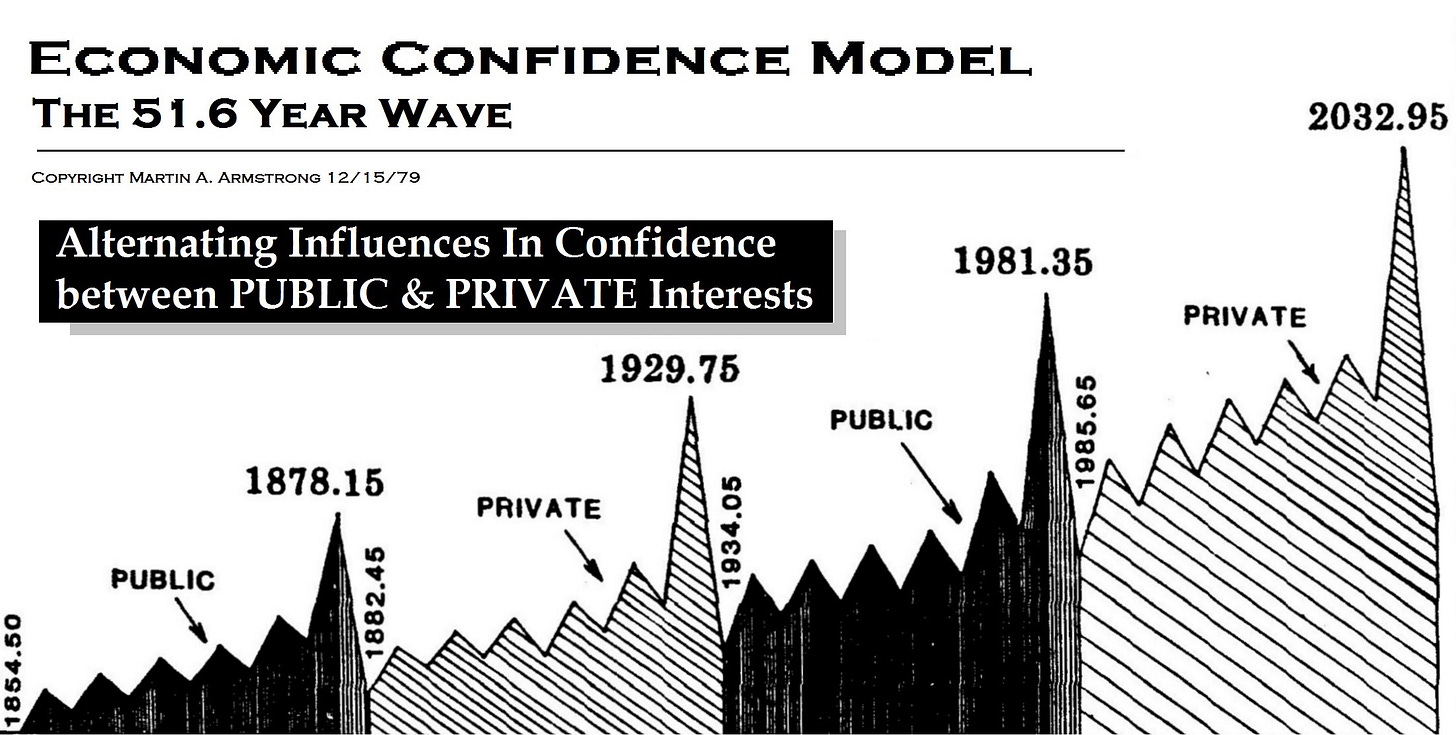

Martin Armstrong’s ECM, illustrated in the chart below, tracks cycles of confidence between public and private interests over centuries.

The ECM points to a recessionary period around 2030, and my concern stems from the involvement of sovereign debt.

Unlike corporate bankruptcies—where assets are sold, and creditors recover something—government defaults leave unsecured debt holders with nothing.

History is replete with examples:

During the Great Depression, cities like Detroit defaulted, and investors waited decades for repayment, often eroded by inflation.

In Europe, Italy has converted short-term debt into long-term obligations to avoid admitting default.

The U.S. Constitution promised to honor Continental Congress debts but never did—colonial currency is now a collector’s item on eBay.

Governments operate like Ponzi schemes, relying on new debt to pay off the old.

When that cycle breaks, collapse follows.

In Europe, the situation is dire.

The EU claims a Ukrainian collapse would topple Europe, but this rhetoric masks an unsustainable debt crisis.

War often becomes the escape hatch—new regimes emerge, default on prior debts, and start anew.

Investors holding government debt during such times are left with nothing.

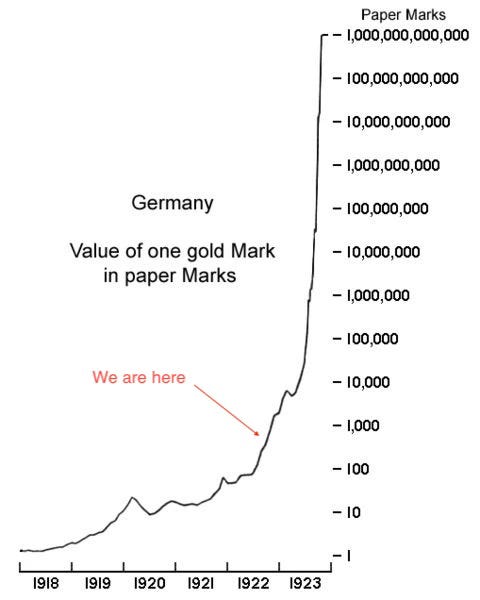

The devastating impact of debt crises can be vividly illustrated in a graph showing Germany’s hyperinflation from 1918 to 1923.

The value of one gold Mark in paper Marks soared to 1 trillion, demonstrating how excessive debt and money printing can lead to economic collapse.

This historical example underscores the dangers of unsustainable sovereign debt levels in the present day.

Moreover, the recent surge in gold prices bears a striking resemblance to Germany’s hyperinflation-when investors flocked to safe-haven assets amid economic uncertainty.

Currently, sovereign debt levels are alarming, especially in Europe.

Leaders are beating the war drums, warning of Russian invasions and rallying nationalistic fervor.

This isn’t just about security—it’s a distraction from an unsustainable debt crisis.

Governments in Ponzi-like debt schemes rely on selling new debt to pay off the old.

When that cycle breaks, collapse follows.

War has historically been a way for governments to default without accountability—new regimes emerge, and old debts vanish.

U.S. Treasury Bonds on the Edge of Collapse Too!

The U.S. Treasury bond market, a colossal $29 trillion financial asset roughly equivalent to the entire U.S. GDP, is facing an unprecedented threat.

The bedrock of global finance, this market could be teetering on the edge of collapse.

Treasury bond prices (TLT) have already plummeted by 50% since 2020, reshaping the economic landscape, but the real danger lies ahead.

A confluence of factors—could trigger another devastating drop, with catastrophic consequences for the economy:

Debt Through the Roof

The leverage risk in the U.S. economy has shifted—from consumers and corporations to the government itself.

Since the 2008 financial crisis, annual deficits have rarely dipped below $500 billion.

Post-pandemic, they’ve soared past $1 trillion, with the Congressional Budget Office projecting a $1.9 trillion shortfall in 2025.

This isn’t a one-off; it’s a structural problem fueled by entitlements, defense spending, and political gridlock.

To cover these deficits, the government borrows by issuing Treasury bonds.

More bonds mean more supply.

And in a market where supply outpaces demand, prices fall.

For bonds, that means yields rise—and higher yields spell higher borrowing costs across the board.

Buyers Are Vanishing

For decades, U.S. Treasury bonds were the world’s go-to safe investment.

Foreign governments like China and Japan, along with the Federal Reserve, were reliable buyers, snapping up massive quantities of U.S. debt.

Foreign ownership alone accounts for about 30% of outstanding Treasury debt.

But that dynamic is shifting. Geopolitical tensions and trade disputes have eroded trust in U.S. fiscal stability. China has been quietly trimming its Treasury holdings, and Japan is reevaluating its position. If these nations stop buying—or worse, start selling—it’s a double hit: reduced demand and increased supply.

The Fed Steps Back

After years of quantitative easing, where it bought Treasuries to prop up the economy, the Fed is now tightening, shrinking its balance sheet. It’s no longer the market’s safety net.This retreat comes at a terrible time. The U.S. government is issuing debt at a record pace to fund its spending spree, creating a dangerous supply-demand imbalance.

The $7 Trillion Maturity Wall

In 2025, a staggering $7 trillion in government debt matures—a “maturity wall” that could overwhelm the market.

The only way to pay it off? Refinance by issuing new bonds.

That’s another $7 trillion in supply hitting an already saturated market.

Without robust demand to soak it up, bond prices could collapse further.

A Treasury bond collapse wouldn’t just hit Wall Street—it would ripple through every corner of the economy:

Businesses

Higher Treasury yields push up corporate borrowing costs, stifling investment, hiring, and growth.Housing

Mortgage rates, already steep, would climb further, freezing the housing market and eroding consumer wealth.Recession

With credit drying up and costs rising, consumer spending and business activity could tank, tipping the U.S. into a recession.

Treasury yields are the benchmark for all borrowing.

If they spike, the pain spreads everywhere.

Can This Be Stopped?

The government’s options are grim.

Slashing spending is a political non-starter.

Raising taxes could choke growth.

The Fed, battling inflation, can’t easily pivot back to bond-buying.

Domestic investors—like pension funds or retail buyers—could step in, but with yields still low relative to risk, that’s a tough sell.

Sticky inflation might force rates even higher, worsening the spiral.

Capital War Between China and the U.S.

Geopolitical instability only exacerbates these risks.

Tensions with China and Russia add fuel to the fire—China, once a major holder of U.S. debt, is selling it off and buying gold, preparing for potential conflict and debt defaults.

Foreign Dumping?

The idea of “foreign dumping”—where nations like China or Japan offload their Treasury holdings—has long been a hypothetical risk.

But today’s fractured geopolitics make it more plausible.

Some speculate that this is some new form of a cold war that is being played on a financial level between China and the US at the moment.

It's not about trade wars.

It is about more important: capital wars.

If foreign holders lose faith in U.S. debt and start selling, it would flood the market with supply while slashing demand.

The Treasury market, already strained, might not withstand the pressure.

Trade Wars Are a Distraction

The real war, the real battle is the supremacy of capital.

American capital wants to dominate.

But then so does Chinese capital that they want to dominate and that war is being fought out in currency and financial markets and that's really what we're seeing in front of us.

Trump may well win the trade war.

Who knows?

It's anyone's guess at this point, but it certainly doesn't look like winning the capital war—at least not if you take the signals from the U.S. bond market seriously.

Yields are drifting higher, slipping out of control.

It's important to recognize those risks.

Rising yields and a loss of control over long-term funding—is not just noise.

It's a real financial risk that investors, policymakers, and the public should be paying attention to.

The U.S. government, like every government, needs funding.

If it can't secure long-term funding, the fallback will be the bill market.

Governments run deficits and need to borrow money to fund everything from defense to social programs. They do this by issuing bonds (debt).

If the government can’t find buyers for long-term bonds (like 10- or 30-year Treasuries) at acceptable interest rates, it will be forced to borrow short-term instead—by issuing Treasury bills (T-bills).

These are loans that mature in a few weeks or months, not years.

We’ve seen this before when Treasury Secretary Janet Yellen increased the issuance of short-term debt to manage the government’s cash needs.

This can be viewed as printing money to fund deficits, which can stoke inflation.

And history is pretty clear: that strategy doesn't end well.

That’s why I think that, in many ways, the outcome feels inevitable…

Sovereign Debts are on the verge of total collapse.

Investors need to be positioned accordingly—with clear allocations to assets that hedge against monetary inflation.

China’s Rise: An Unavoidable Shift

When Western Sovereign Debts will break, collapse will follow—and a new capital leader will emerge.

Martin Armstrong’s Economic Confidence Model forecasts a major geopolitical and economic shift toward China around 2034.

Billionaire investor Ray Dalio has reached similar conclusion.

In his work The Changing World Order, Dalio presents a simplified historical chart that tracks the rise and fall of dominant reserve empires over the past four centuries.

This visual shows the cyclical nature of global power transitions—from the Netherlands to Great Britain, then to the United States, and potentially now to China.

Each empire's decline is marked by periods of economic instability—what Dalio refers to as "transition zones."

Typically, these transitions are accompanied by capital flight into safe havens, followed by war, and the emergence of a new world order.

Historically, these transition periods coincide with debt crises.

For example, the shift from Dutch to British dominance was catalyzed by severe financial dislocation.

The chart serves as a stark reminder: debt crises have repeatedly marked the downfall of leading economic powers—and we may be entering such a phase again.

Hope Is Not A Strategy, Prepare Accordingly!

The U.S. Treasury bond market is heading into a perfect storm: dwindling demand, surging debt, a looming $7 trillion maturity wall, and widespread mispricing of risk.

A further 25–30% decline in bond prices isn’t just a possibility—it’s an imminent threat.

The consequences could be seismic, with the potential to reshape the global order.

This isn’t about fearmongering; it’s about awareness.

"By failing to prepare, you are preparing to fail."

— Benjamin Franklin

Whether you’re an investor diversifying your portfolio, a homeowner eyeing mortgage rates, or just someone paying attention, understanding this risk is the first step to preparing for it.

The Treasury market has been the backbone of global finance, but even the strongest backs break under too much weight—and the load is piling up fast.

The Only True Safe Haven

When tensions rise, capital flees to safety.