Dear Investors,

The history of human civilization is intricately linked with the progression of economic systems.

Over the centuries, we have witnessed monumental shifts in the way we produce, distribute, and consume goods and services.

One of the most significant transitions in recent history has been the shift from an oil-based economy to one centered around information and, today, charged with the promise of Artificial Intelligence.

Understanding this evolution is crucial for gaining a competitive edge in investing.

Specialized indices tracking the AI sector saw jumps of 30% to 60% in 2023, fueled by expectations of hundreds of billions of dollars in annual revenues over the next five years.

This surging optimism has led many investors to aggressively pursue opportunities, even resorting to debt or concentrating their portfolios heavily in AI-related stocks.

But as valuations climb rapidly, a familiar question echoes through the market:

Is this growth sustainable, or are we witnessing the inflation of a speculative bubble?

Understanding Market Bubbles

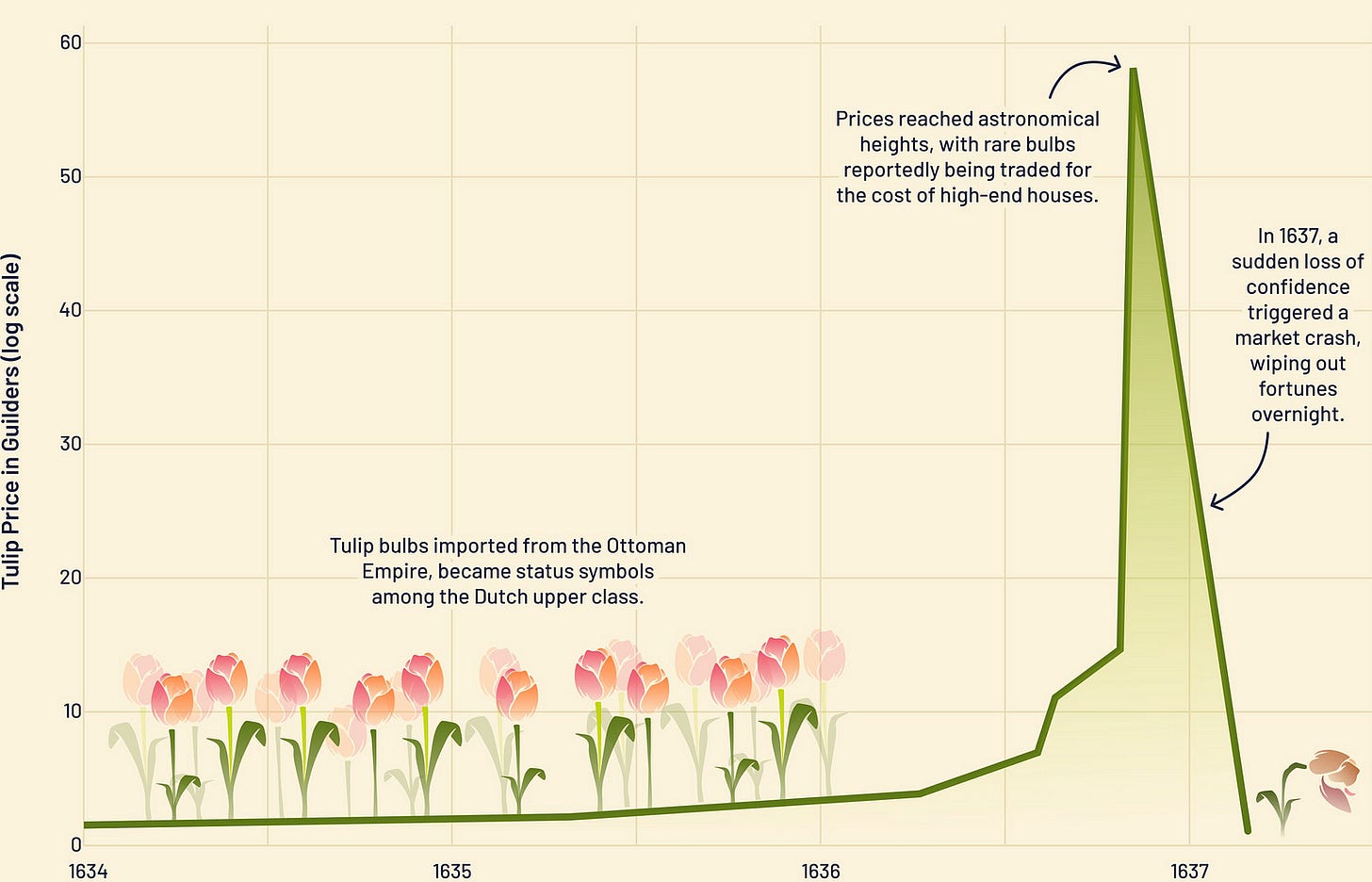

In finance, this phenomenon of rapidly escalating prices driven by optimistic — perhaps overly optimistic — expectations has a name: a bubble.

History offers stark lessons from past bubbles, demonstrating their mechanics and the often painful aftermath when they burst.

A speculative bubble typically begins with strong fundamentals: a new technology, promising growth prospects, or impressive earnings reports justify an initial increase in value.

However, a tipping point is reached when hype and the "Fear of Missing Out" (FOMO) attract a wave of investors who pour money into the asset, driving prices far beyond its intrinsic economic performance.

The most vivid historical example is the Tulip Mania in the Netherlands around 1635, where tulip bulbs, seen as exotic status symbols, reached astronomical prices equivalent to houses before the market collapsed.

More recently, the Dotcom bubble of the late 1990s and early 2000s serves as a textbook case.

Fueled by the rise of the internet, tech stocks soared, with the Nasdaq index multiplying fivefold between 1996 and 2001.

The bubble burst in March 2002, sending the Nasdaq plummeting by 78% as the lack of profitability in many internet companies became apparent, resulting in significant losses and bankruptcies.

When the collective optimism wanes and reality sets in, the bubble bursts, leading to a swift and often violent collapse in prices, wiping out billions and potentially triggering broader economic distress.

It took 15 years for the tech sector to recover its previous highs.

Concentration and Industry Revolutions

To gain perspective on the current AI-driven market, it's helpful to look at broader historical patterns of wealth creation and economic transformation.

The U.S. stock market, a powerful engine of wealth over the past century, reveals a striking reality: wealth creation is highly concentrated.

According to a study by Hendrik Bessembinder covering 1926-2019, a mere 4% of all publicly traded stocks accounted for all of the net wealth earned by investors in the stock market during that period.

This "winner-takes-all" dynamic has become even more pronounced in recent years, with a handful of technology giants contributing a disproportionate share of wealth creation.

This concentration isn't limited to specific companies; it also manifests at the industry level.

While technology currently dominates, accounting for a significant portion of wealth creation ($9.00 trillion or 19% between 1926-2019), other sectors have also been significant contributors.

Finance ($7.21 trillion, 15%) and Healthcare/Pharmaceuticals ($4.64 trillion, 10%) have generated substantial wealth.

Looking back over centuries, the dominant sectors in the stock market have consistently mirrored the prevailing economic revolution.

From Finance and Real Estate in the 19th century to Transport, then Energy in the 20th century, and most recently Information Technology, the structure of the market has shifted with technological and economic paradigm changes.

The rise of the Information Technology sector, while currently significant, is not unprecedented in its dominance compared to past leading sectors like Energy.

Current AI Landscape

Today, the intense focus is on Artificial Intelligence.

The rapid advancements in deep learning, natural language processing, and robotics are opening up unprecedented applications across virtually every industry.

The market is betting heavily on this transformative potential, driving up the valuations of companies at the forefront of AI development and implementation.

The Nasdaq AI and Robotics Index, launched in 2018, has risen significantly, including a notable 33% gain last year.

Similarly, the MSCI Imi Robotics and AI index jumped 28% in the past year, outpacing the broader S&P 500's gain in the same period.

The AI sector in 2024 is broadly comprised of software and IT services (led by Microsoft), electronic devices (like Apple), semiconductors (dominated by NVIDIA and AMD, showing the strongest growth), and communications and networks (such as Cisco Systems).

NVIDIA, in particular, has become a poster child for the AI surge, with its cutting-edge chips essential for AI computation, leading to astronomical valuation increases.

However, the question remains: is the current market enthusiasm for AI justified by fundamentals, or is it veering into bubble territory?

Skeptics like Michael Burry, known for his bet against the housing market before the 2008 financial crisis, have voiced concerns, suggesting the AI fervor is irrational and predicting a potential downturn that could impact the entire tech industry.

Geopolitical tensions, such as those concerning Taiwan's role in semiconductor manufacturing, and the possibility of a US economic downturn add layers of risk to the optimistic outlook.

While a "soft landing" is hoped for, the potential for a sudden economic contraction and a significant market correction cannot be dismissed.

The rapid ascent of semiconductor and AI companies, while reflecting their innovation and profitability, also raises concerns about whether valuations have become detached from current economic realities.

Analyzing metrics like Price-to-Earnings (P/E) ratios and capitalization-to-revenue can offer insights, but the sheer speed and scale of the recent price increases in some AI leaders do spark questions about market over-exuberance.

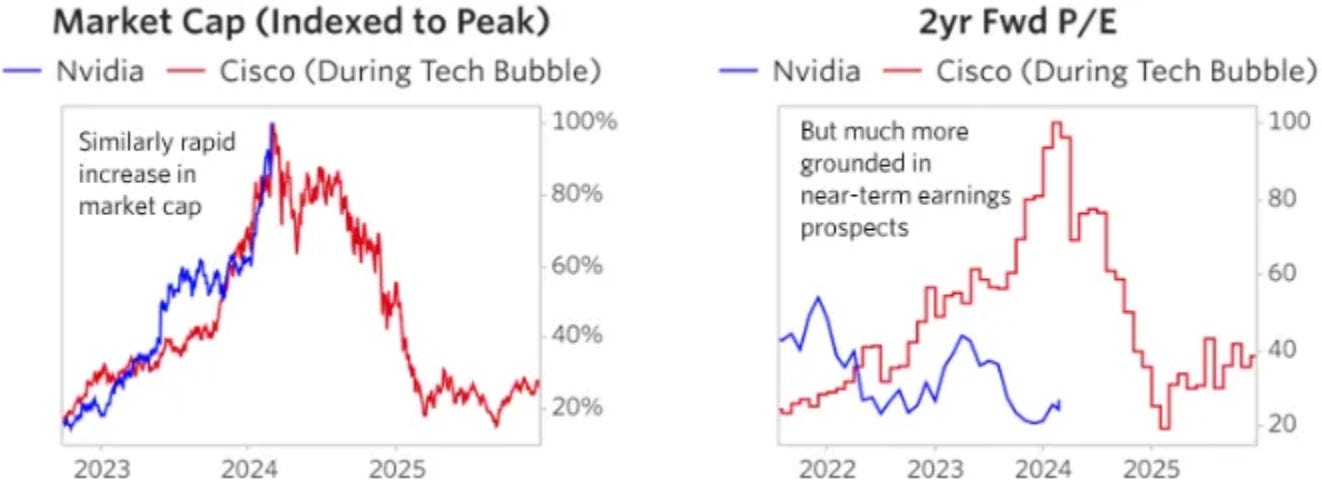

Contextualizing the Tech Bubble Comparison

During the dot-com bubble (1995–2000), Cisco Systems was the poster child of the internet revolution, producing routers and switches critical to the web’s infrastructure.

Its stock surged 4,000% from 1995 to its peak in March 2000, reaching a market cap of over $500 billion, briefly making it the world’s most valuable company.

However, when the bubble burst, Cisco’s stock plummeted 88% by 2002, and it has never regained its 2000 peak, trading at around $53 today despite revenue growing to $52 billion by 2022.

The bubble was fueled by speculative fervor, with companies like Pets.com commanding sky-high valuations despite negligible fundamentals.

Cisco’s price-to-earnings (P/E) ratio hit 158x, and its price-to-sales ratio soared to 27x, reflecting unsustainable hype.

Nvidia today, driven by the AI boom, invites comparisons.

Its stock has risen 3,000% over five years, with a market cap reaching $3.3 trillion in 2024, briefly making it the world’s most valuable company.

Demand for its GPUs, essential for AI, has driven revenue from $27 billion in 2022 to $18.1 billion in Q3 2023 alone, tripling year-over-year.

Yet, some argue Nvidia’s trajectory isn’t a bubble, unlike Cisco’s. Here’s why this perspective holds, while keeping Munger’s caution in mind.

Why I Don’t See a Bubble Today:

Fundamentals and Profitability

Cisco’s rise in the 1990s was marked by declining margins due to competitive pricing pressures, signaling a weakening moat.

Its P/E ratio of 158x and price-to-sales ratio of 27x were detached from its business performance. Nvidia, conversely, boasts record-high margins (55–56% adjusted net income through 2026) and a forward P/E of 34.9x, significantly lower than Cisco’s bubble-era valuations.

Nvidia’s earnings growth—driven by a near-monopoly in AI chips (90% of the data center AI GPU market)—justifies its premium, unlike Cisco’s speculative run. The dot-com era saw unprofitable startups like CMGI and Yahoo dominate; today’s AI leaders (Nvidia, Microsoft, Alphabet) are established, debt-free giants with proven models.Market Dynamics and Speculation

The dot-com bubble was characterized by rampant speculation, with the Nasdaq 100 trading at 200x earnings and small-cap valuations mirroring large-cap exuberance.

Today’s market lacks this broad euphoria.

Tech stocks’ P/E ratio is 28x, high but far below the 50x of 1999, and small-caps are trading at historically low valuations.

Only 1% of Nvidia’s shares are shorted, indicating limited profit-taking, unlike the late stages of a bubble. JPMorgan’s Mislav Matejka notes that the “Magnificent Seven” tech giants’ valuations are lower relative to the S&P 500 than their five-year average, suggesting a disciplined market.Technological Moat and Demand

Cisco’s hardware was infrastructure-heavy, with long replacement cycles, leading to demand slowdowns post-bubble.

Nvidia’s GPUs and CUDA software ecosystem create a stronger moat, with constant innovation driving recurring demand from tech giants like Microsoft and Meta. AI’s applications—spanning cybersecurity, pharmaceuticals, and data centers—are seen as transformative, unlike the internet’s early, hype-driven promises.

Jamie Dimon has argued AI’s utility is real, not speculative, unlike the dot-com era’s unfulfilled visions. Nvidia’s supply constraints fuel pricing power, contrasting with Cisco’s competitive pressures.Market Concentration and Stability

At its peak, Cisco was 5.5% of U.S. GDP; Nvidia is 11.7%, raising concentration concerns. Yet, the S&P 500’s reliance on Nvidia is less about bubble dynamics and more about its dominance in a high-demand sector.

Unlike the dot-com era, where easy credit fueled speculation, today’s high interest rates and tight monetary policy limit “fuel” for a classic bubble.

The 2022 bear market also tempered valuations, providing a healthier backdrop.

No Bubble, But Vigilance Required

The Cisco-Nvidia comparison highlights why many don’t see a bubble today. Nvidia’s robust fundamentals, lower valuations relative to the dot-com peak, and AI’s tangible demand contrast with Cisco’s speculative overreach.

The market’s discipline—reflected in lower P/E ratios and limited speculative frenzy—further supports this view.

Investing isn’t easy, and Nvidia’s concentration risk, potential competition, or macroeconomic shifts could disrupt its run.

The absence of a bubble doesn’t mean invincibility.

Future Wealth Creators

If history is a guide, the current AI revolution suggests that Artificial Intelligence and related fields, particularly semiconductors, could be the next era of significant wealth creation, potentially dominating the market landscape in the coming decades, much like Information Technology did recently or Energy did in the mid-20th century.

For investors seeking to capitalize on this, understanding the patterns of wealth concentration and historical industry shifts is crucial.

The data suggests that focusing on the few companies that are likely to become the dominant players in the new economic era can lead to outsized returns.

This isn't about blindly chasing hype, but about identifying companies with robust fundamentals, significant investment in research and development (R&D intensity has been shown to be a predictor of stock returns), and the potential to be long-term leaders in the AI-driven economy.

R&D Intensity and Abnormal Stock Returns in U.S Stock Market

An Analysis of the R&D Effect on Stock Returns for European Listed Firms

The explanatory power of R&D for the stock returns in the Chinese equity market

While the current excitement around AI carries the echoes of past speculative periods, the underlying technological advancements are real and transformative.

The challenge for investors is to navigate the potential for a bubble while positioning themselves to benefit from the genuine, long-term growth that AI is poised to unlock.

Investors must balance the risk of an AI bubble with its long-term growth potential.

Here's how:

Understand Fundamentals

Don't get swept up in the euphoria. Deeply analyze the financial health, growth prospects, and competitive advantages of AI companies.

Look beyond soaring stock prices to assess if the underlying business can justify the valuation in the long run. Ben Graham's principles of value investing, focusing on intrinsic value, remain highly relevant.Be Selective

Not all companies in the AI space will be winners. The principle of wealth concentration suggests that a small number will likely drive the majority of returns. Focus your research on identifying those with the strongest potential for sustained growth and profitability.Maintain a Long-Term Perspective

The history of market bubbles shows that corrections are an inevitable part of the cycle. A long-term mindset helps you weather potential downturns and stay focused on the growth trajectory of the underlying businesses.Manage Risk

Avoid over-concentrating your portfolio in a single sector, even one as exciting as AI. Diversification across different industries can help mitigate the impact of a potential AI-specific downturn.

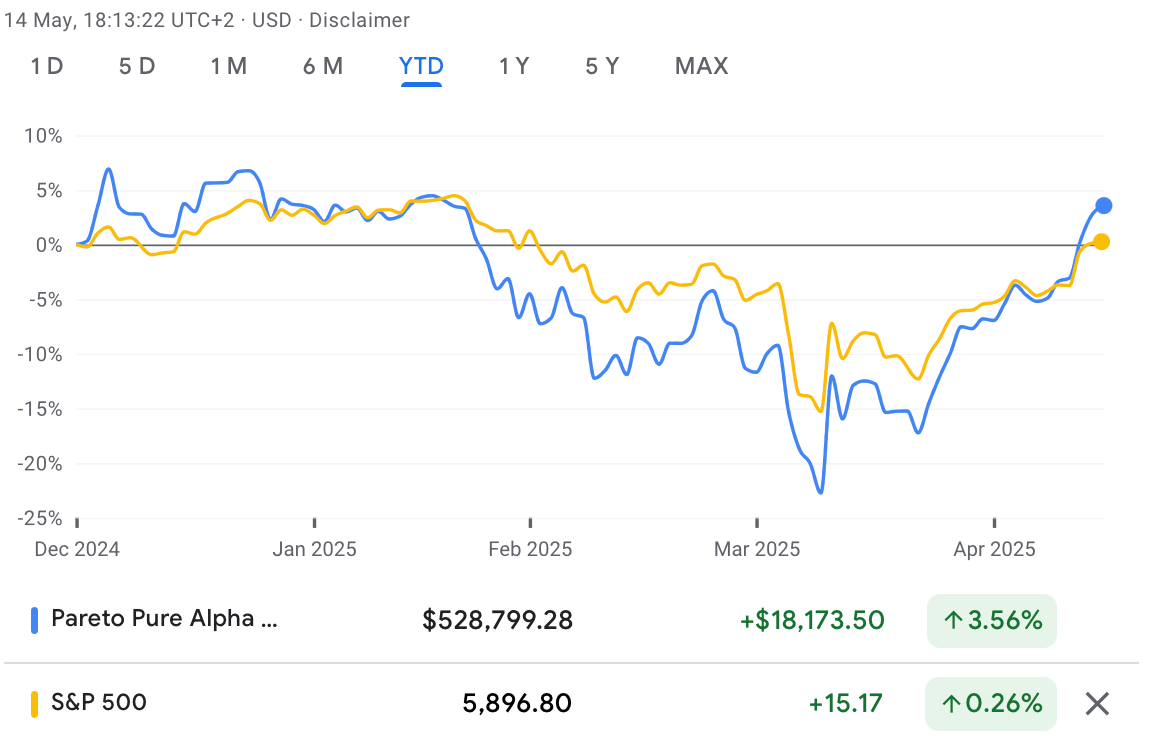

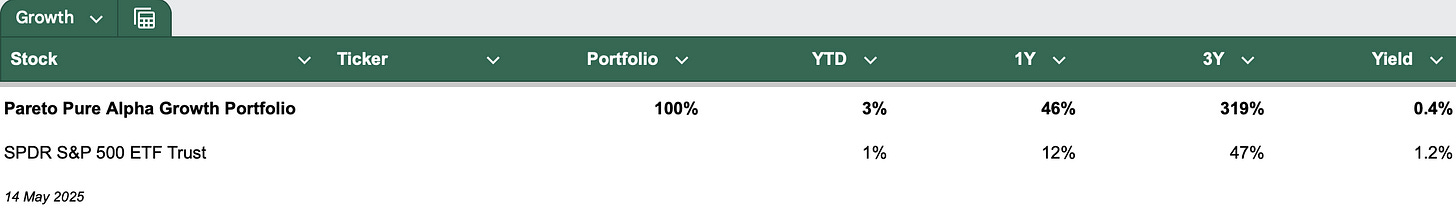

My Pareto Pure Alpha Growth Portfolio

The stock market dipped in April 2025 amid macro pressures and U.S.-China tension, I saw this as a buying opportunity.

However, in this dynamic and volatile environment, a balanced portfolio is essential.

The Pareto Pure Alpha Growth Portfolio is designed to capture long-term growth opportunities, particularly in high-potential sectors like artificial intelligence (AI), while mitigating risks from market volatility or sector-specific bubbles with resilient structure to weather economic cycles.

Seize this opportunity now to position yourself for future growth.

To celebrate reaching 10,000 subscribers, I'm offering a limited-time 50% discount, granting you access to detailed insights into my strategy and more.