Dear Investors,

Over the past two decades, software stocks have been the darlings of Wall Street, delivering staggering returns for early investors.

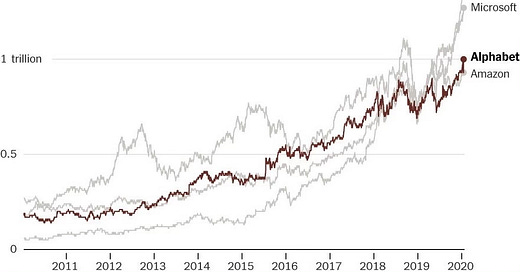

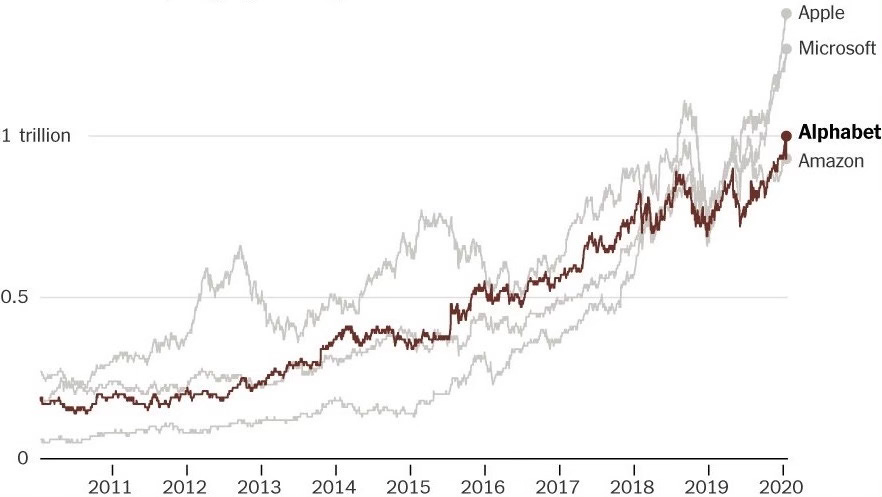

A $10,000 investment in Microsoft 20 years ago would now be worth $140,000.

The same amount in Google would be $250,000, and in Amazon, a jaw-dropping $1 million.

These giants, alongside others like Adobe, Oracle, and Salesforce, rode the wave of the internet boom, transforming the S&P 500 where software now accounts for 27% of its market cap, up from just 5% in 2002.

But as I’ve been analyzing, the winds of change are blowing.

The software era may have peaked, and a new industry is poised to dominate the next decade: semiconductors.

The Software Boom

The meteoric rise of software was no accident.

In the early 2000s, the internet triggered an insatiable demand for digital tools.

Businesses scrambled to build websites, adopt e-commerce, manage data, and streamline operations—all requiring sophisticated software.

Yet, the supply was scarce.

Coding was a niche skill, and launching a software company was prohibitively expensive.

Physical servers cost a fortune, and developing a single product could run into hundreds of thousands of dollars.

This high barrier to entry meant companies like Microsoft and Oracle faced little competition, allowing them to dominate and deliver exponential returns.

Between 2002 and 2020, the software sector outperformed the S&P 500 by 239%, claiming a massive share of the market.

But since 2021, cracks have appeared.

Software stocks have underperformed the broader market by 15% over the past four years.

Why?

The landscape has shifted dramatically.

Competition and Saturation

Today, the software industry is no longer the exclusive club it once was.

The barriers to entry have crumbled.

The number of software developers has quadrupled over the past 20 years, armed with efficient tools and no-code platforms that allow anyone to build applications without touching a line of code.

Artificial intelligence is the final nail in the coffin, generating code autonomously and reducing costs to near zero.

Meanwhile, growth has slowed.

Most businesses have already adopted the digital tools they need, leaving less room for the explosive expansion of the early 2000s.

Don’t get me wrong—software will continue to grow.

But the days of it outpacing the market by triple-digit margins are likely over.

So, where should investors turn for the next big opportunity?

The Next 10x Opportunity?

I’ve identified an industry with the same potent combination of rapid growth and high barriers to entry that defined software in its heyday: semiconductors.

The demand for chips is skyrocketing, driven by the global race to adopt artificial intelligence.

Just as businesses needed software to digitize in the 2000s, today they need AI to stay competitive—and semiconductors are the backbone of AI.

The semiconductor industry is uniquely positioned.

Demand has surged exponentially over the past two years and shows no signs of slowing.

Yet, supply is constrained by towering barriers to entry.

Building a semiconductor fabrication plant costs $10 to $20 billion, and the talent pool for nanochip manufacturing is minuscule.

This limits competition to a handful of players, allowing companies to raise prices and boost profit margins.

In fact, semiconductor profit margins have climbed from 25% in early 2023 to nearly 40% today.

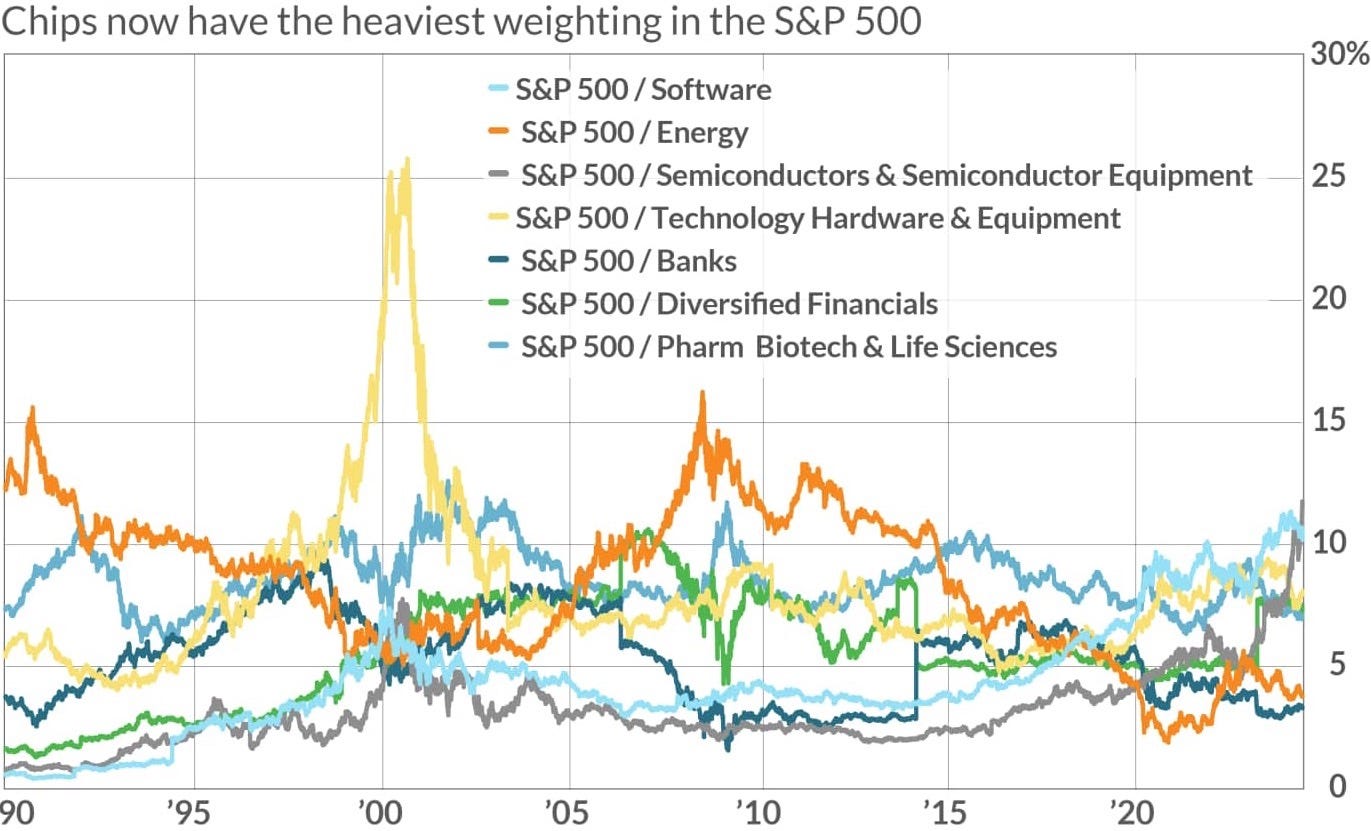

Chips Overtake Software

Semiconductors have already doubled their share of the S&P 500, rising from 6% in 2022 to 12% today.

But there’s room to grow.

Software’s 27% market cap dominance shows what’s possible, and historical precedents—like the 40% market share held by industrial giants like US Steel and Ford in the early 1900s—suggest semiconductors could claim an even larger slice of the pie as AI reshapes the economy.

Skeptics might argue that semiconductor stocks have already run too far, too fast.

And it’s true—volatility is high, and the sector is currently trending lower.

I see this as a golden opportunity.

The current market panic is setting the stage for the next leg up, potentially as explosive as the rally we saw in 2023 and 2024.

Positioning for the Future

The stock market is a forward-looking beast, always searching for the next big thing.

Software had its moment, but the future belongs to industries that can combine explosive growth with limited competition.

Semiconductors fit that mold perfectly, poised to power the AI revolution and redefine market leadership.

I’m not just watching from the sidelines.

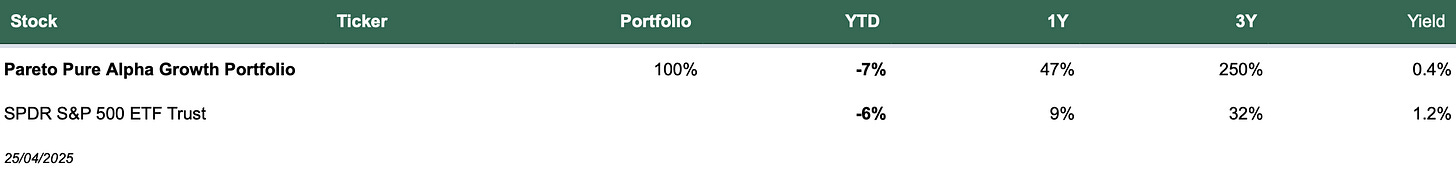

My track record speaks for itself—My Pareto Pure Alpha Growth Portfolio, with a 1-year return of 47% compared to the S&P 500’s 9%, is strategically positioned to ride this wave.

The software giants of yesterday delivered life-changing returns, but the titans of tomorrow are emerging.

Semiconductors well might be the key to unlocking the next wave of wealth creation.

I’m now eyeing semiconductors as the next big trade, and I invite you to join me.

For two decades, software stocks like Microsoft, Google, and Amazon redefined wealth creation.

Their dominance, fueled by the internet boom and high barriers to entry, reshaped the S&P 500, where software now commands 27% of the market cap.

But the tide is turning.

Since 2021, software stocks have lagged the broader market by 15%, signaling a peak in their explosive growth.

As barriers to entry crumble and growth slows, the software era is giving way to a new leader: semiconductors.

The semiconductor industry is at an inflection point, mirroring the early days of software’s rise.

The global race for artificial intelligence is driving unprecedented demand for chips, with semiconductor profit margins climbing from 25% in 2023 to nearly 40% today.

Yet, supply remains constrained by $10–$20 billion fabrication plants and a scarce talent pool, creating a moat that limits competition and boosts pricing power.

Semiconductors have already doubled their S&P 500 market share from 6% in 2022 to 12%, with room to grow toward software’s 27% or even the 40% held by industrial giants like US Steel in the early 1900s.

Despite recent volatility—semiconductor stocks dipped in April 2025 amid macro pressures and U.S.-China tensions—I see this as a buying opportunity, much like the setup before the sector’s 2023–2024 rally.

Now is the time to act on this potential!

Gain access to the Pareto Pure Alpha Growth Portfolio below to seize the best semiconductor opportunities.

My limited-time 50% discount, celebrating 10,000 subscribers, unlocks detailed insights into my semiconductor strategy and beyond.