The Little Principle That Beats the Market

Leveraging the Pareto Principle to Outperform the Market with Minimal Effort

Dear Investors,

Today marks the culmination of 10 years of hard work and I’m incredibly proud to announce the release of my book, “The Little Principle That Beats the Market.”

This groundbreaking book unveils the untapped potential of the Pareto Principle for stock market success.

This book explores the fascinating world of investing through the lens of Pareto’s Principle, revealing how a handpicked selection of stocks can significantly influence your portfolio’s returns.

If you’ve ever wondered how to invest smarter, not harder, this book is your ultimate guide to achieving financial greatness by:

Unlocking the power of the Pareto Principle for your investments.

Discovering my time-tested strategy for turbocharging your portfolio’s performance, outpacing passive investing by a wide margin.

Gaining insights into why a selected small fraction, in terms of numbers of elements, always accounts for a large fraction in terms of effect.

If you want to make your money work as hard as you work, this book will definitively help you to transform the way you approach wealth creation with stocks!

It is an essential read for anyone seeking a smarter, more effective way to invest.

This book explores the fascinating world of investing through the lens of Pareto’s Principle, revealing how a select group of stocks drives most market returns.

From the size of seashells to the weight of planets or the distribution of population wealth, the Pareto’s Principle is an undeniable force in the Universe, and it works with stocks too.

By simplifying your investment strategy, embracing selectivity, and trusting in the market’s consensus, you can embark on a journey towards financial success.

This book will transform the way you approach wealth creation with stocks!

Why Pareto’s Principle Matters in Investing

In the world of investing, there are countless strategies, techniques, and approaches. Yet, amid this sea of options, one principle stands out as a potential game-changer: Pareto’s Principle.

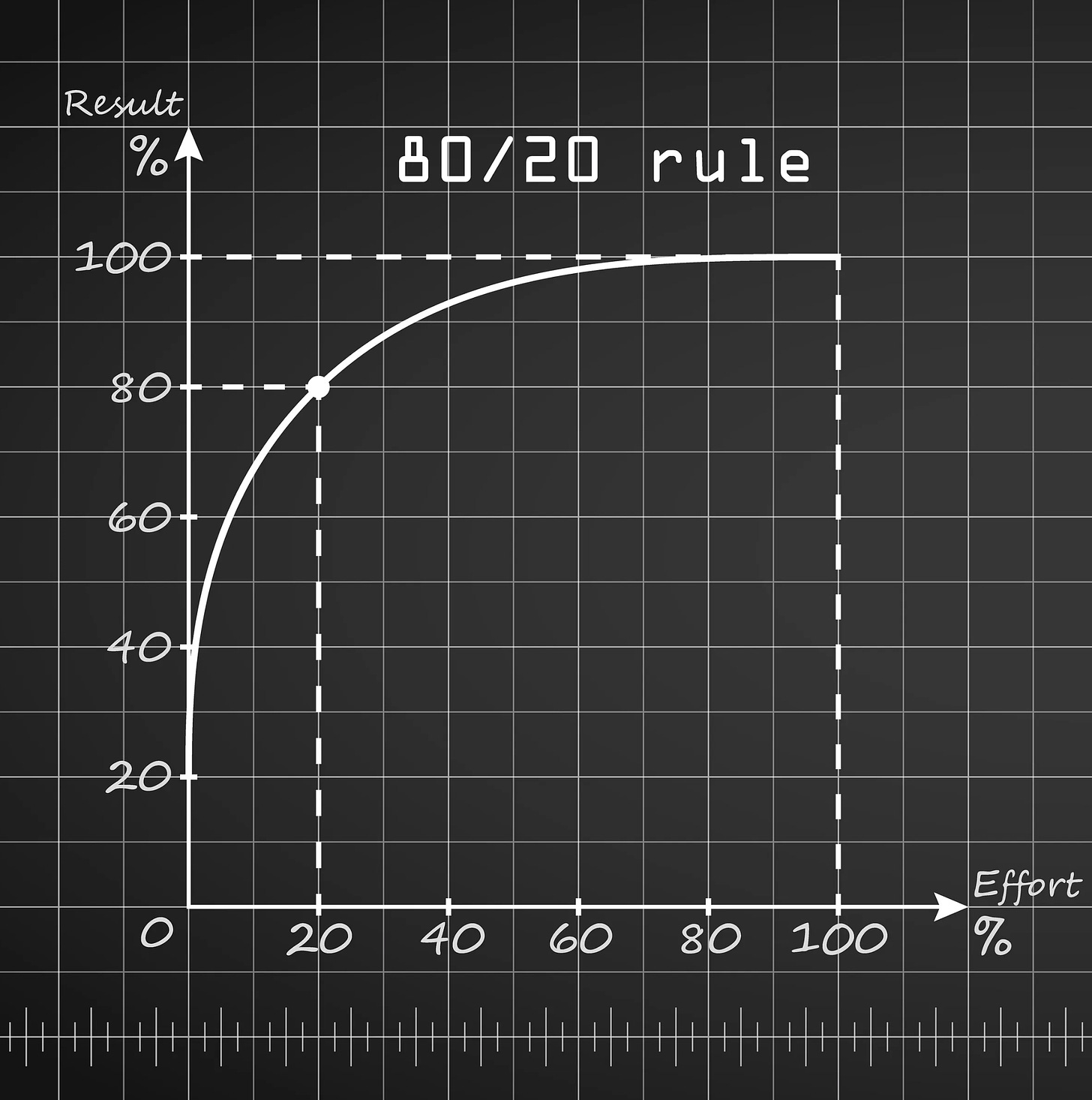

This book explores how Pareto’s Principle, also known as the 80/20 rule, can revolutionize your approach to stock market investing.

By focusing your efforts on a select few, high-potential stocks, you can achieve greater financial success.

Table of Contents

Before you embark on this journey to uncover the power of Pareto’s Principle in the stock market, let’s map out the chapters that will guide you along the reading:

Chapter 1: Epiphany Through Socrates

Chapter 2: The Stock Picking Reality

Chapter 3: Historical Insights

Chapter 4: Shocking Stats

Chapter 5: Why Avoid Indexes

Chapter 6: Average? Not an Option

Chapter 7: The Big Reveal

Chapter 8: Outperforming Traditional Methods

Chapter 9: Focusing on Market Leaders

Chapter 10: The Secret Sauce of Successful Investors

Chapter 11: The Pinnacle Year for Apple

Chapter 12: Pareto’s Distribution Principle Meets Smith’s Invisible Hand

Chapter 13: Discovering Pareto’s Top Stocks

Chapter 14: The Power of Selectivity and Simplicity

Chapter 15: The Pareto1 Portfolio

Chapter 16: The Beauty of Simplicity

Chapter 17: To Sum Up

Chapter 18: Final Thoughts

Chapter 1: Epiphany Through Socrates

“I cannot teach anybody anything. I can only make them think."

—Socrates

Legendary investors such as Warren Buffett, Benjamin Graham, and Peter Lynch have all emphasized the importance of selective investing.

Buffett, for example, is known for his focus on a small number of high-quality stocks that he holds for the long term.

Graham, known as the “father of value investing,” developed a rigorous investment framework that focuses on identifying undervalued stocks.

Lynch, a successful mutual fund manager, was known for his focus on investing in companies with strong growth potential.

Legendary investors gave me tactics.

But Socrates? He reshaped my entire view of the world!

Socrates and the Art of Humble Investing

The ancient Greek philosopher Socrates is known for his philosophy of humility and self-awareness.

This philosophy has relevance to investing because it encourages investors to be mindful of their own limitations and to avoid the pitfalls of overconfidence.

My investment journey took a serendipitous turn when I stumbled upon the wisdom of Socrates.

His philosophy of humility and self-awareness resonated deeply with me, and I began to see the stock market in a new light.

“All I know is that I know nothing.”

— Socrates

Prior to my encounter with Socrates, I had been guilty of overconfidence.

I thought I knew more than I did, and I made some costly mistakes as a result.

By embracing humility, I was able to approach investing with a more open mind and a willingness to learn.

I became more mindful of my own limitations, and I started to focus on developing a deeper understanding of the market.

When investors are overconfident, they may be more likely to make impulsive decisions or to take on too much risk.

This can lead to losses and missed opportunities.

By embracing the idea that we know little about the market, we can approach investing with a more open mind and a willingness to learn and adapt.

The Role of Knowledge in Wealth Creation

Knowledge is a powerful tool in the world of investing.

The wisdom of legendary investors and the principles of Socrates can teach us a lot about successful investing.

By embracing humility, continuously learning, and expanding your knowledge base, you can improve your chances of achieving your financial goals.

I would like to add that it is important to have a clear investment plan and to stick to it.

This will help you to avoid making impulsive decisions and to stay disciplined in your approach to investing.

It is also important to be patient and to remember that investing is a long-term game.

There will be ups and downs along the way, but by focusing on the long term and staying disciplined, you can increase your chances of achieving your financial goals.

Chapter 2: Stock Picking Reality

“It’s not whether you’re right or wrong that’s important, but how much money you make when you’re right and how much you lose when you’re wrong.”

— George Soros

The stock market is a vast and ever-changing landscape, with countless investment opportunities and potential pitfalls.

The Elusive Quest for the Next Amazon or Apple

For many investors, the ultimate goal is to discover the next Amazon or Apple: a company that can deliver extraordinary returns.

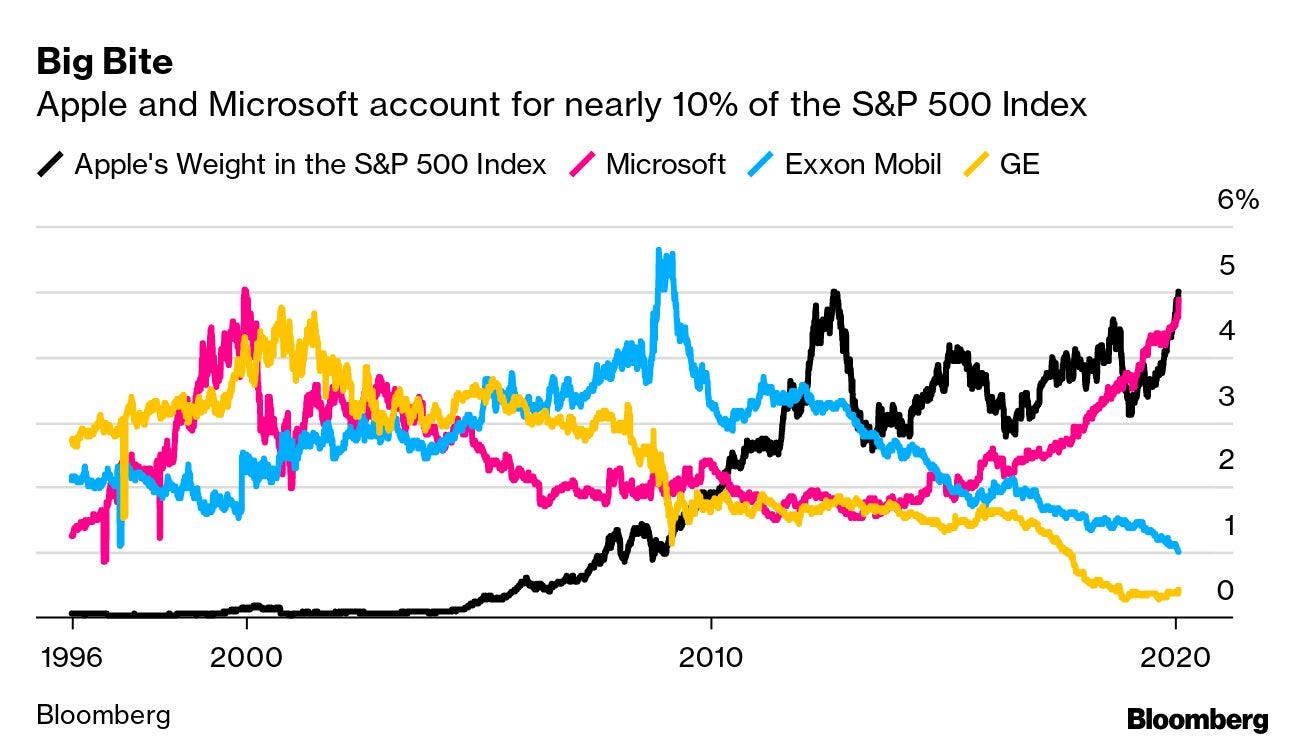

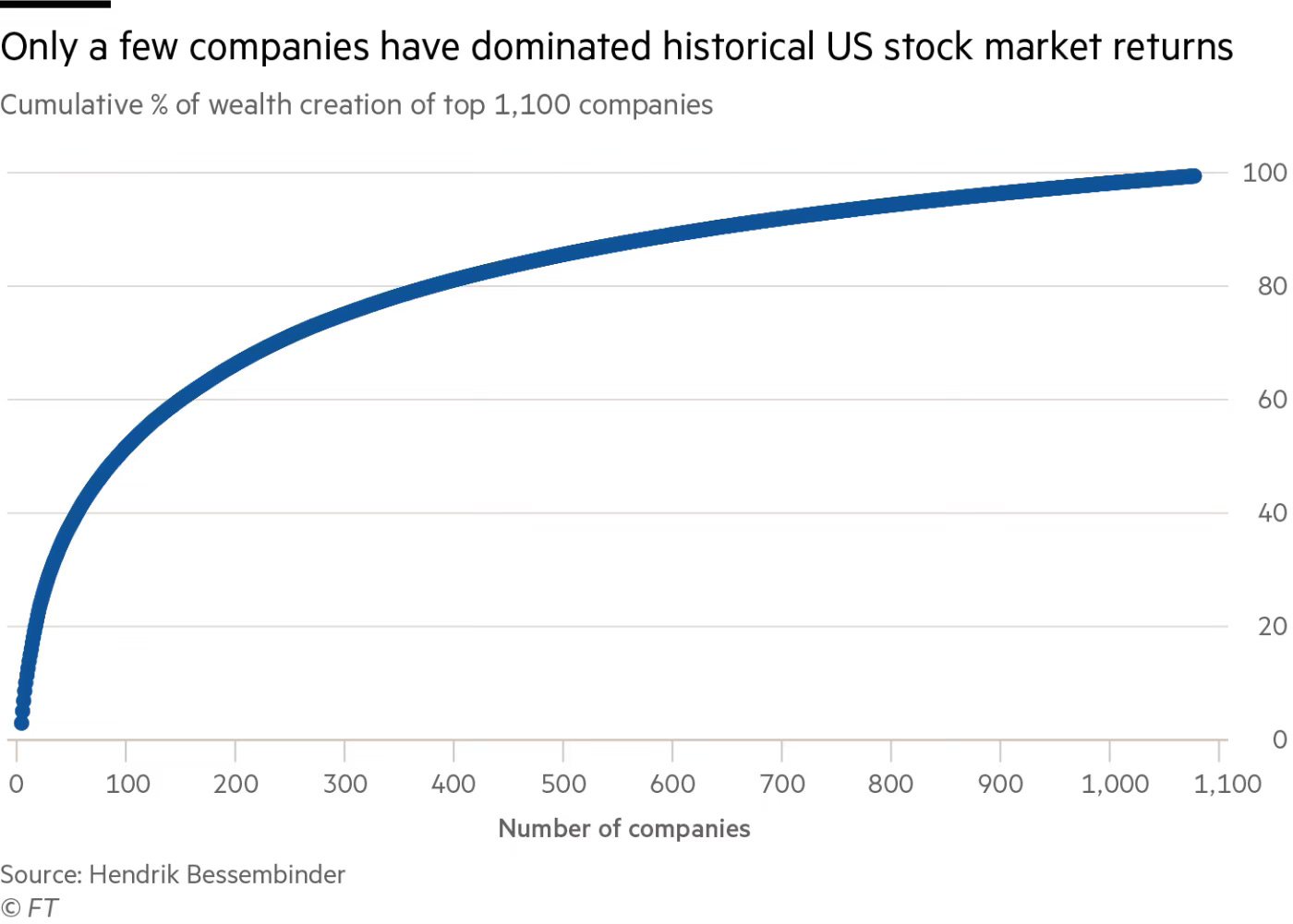

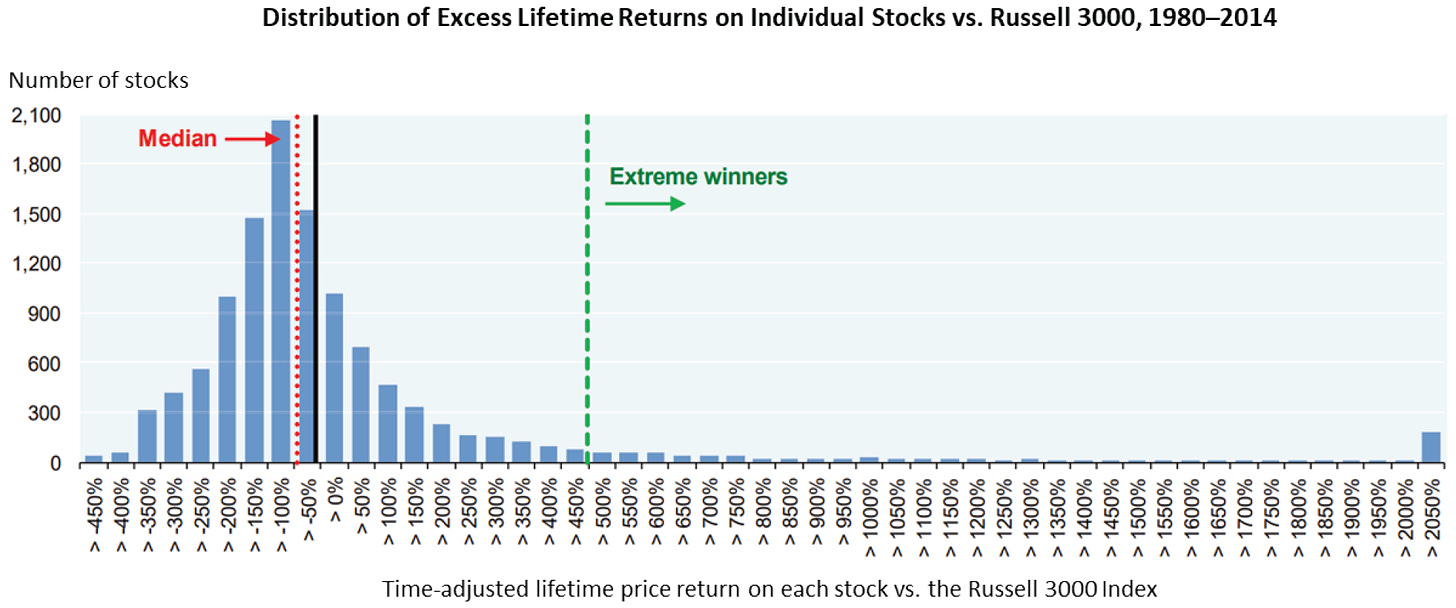

However, stock picking is an elusive quest fraught with challenges, as you can see with above chart, only a few stocks are extreme winners.

Navigating the Stock Market Landscape

The allure of finding the next Amazon or Apple is understandable.

These companies have achieved unprecedented success, generating massive wealth for their shareholders.

However, it’s important to remember that these are rare outliers.

The vast majority of companies on the stock market will never achieve such dizzying heights.

There are many challenges involved in stock picking. Even the most experienced investors make mistakes. Some of the key challenges include:

Information overload

There is a vast amount of information available about publicly traded companies. It can be difficult to sift through all of this data and identify the most important factors to consider.Unpredictability

The stock market is unpredictable. Even the best companies can experience setbacks. It’s impossible to predict with certainty how any individual stock will perform.Emotions

Investing can be an emotional roller coaster. It’s important to stay disciplined and avoid making decisions based on fear or greed.

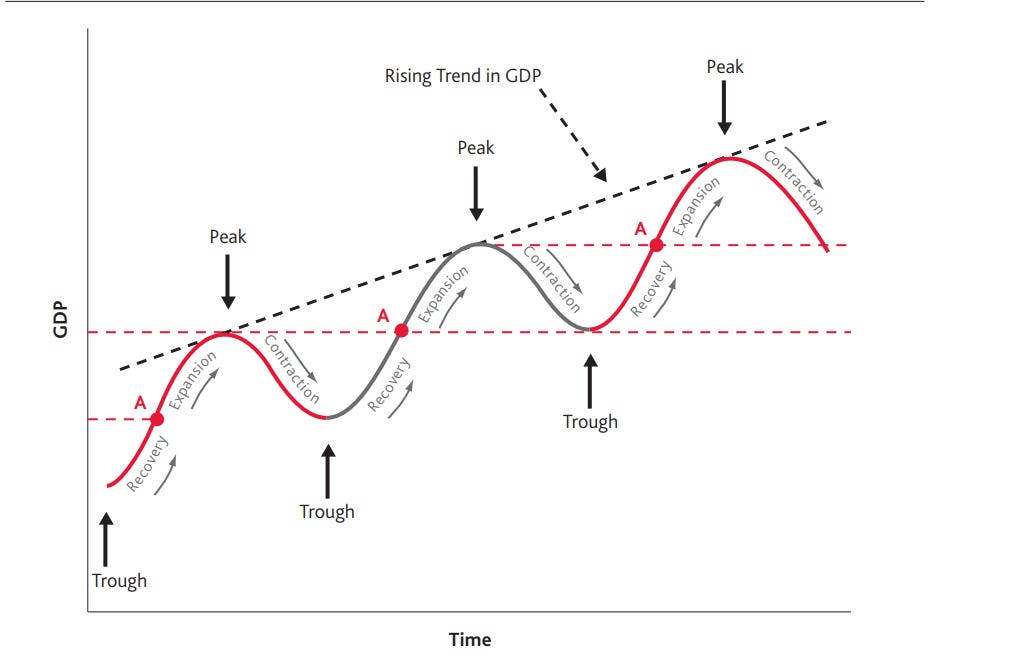

To succeed in stock market investing, it’s crucial to navigate the complex terrain effectively.

This includes understanding different asset classes, market indices, and the role of diversification.

It’s also important to be aware of market cycles and how they can influence investment decisions.

Selective investing is at the heart of the Pareto-based approach. In other words, it’s more important to choose the right stocks than to try to pick the next big thing.

A selective approach involves focusing on companies with strong fundamentals and growth potential. It also involves diversifying your portfolio to reduce risk.

Chapter 3: Historical Insights

“Rule №1: Never lose money. Rule №2: Never forget rule №1.”

— Warren Buffett

Lessons from Past Market Leaders

The stock market is a graveyard for failed companies.

Once-dominant companies like General Electric, Exxon, and Nokia have all fallen on hard times.

What can we learn from their rise and fall?

One key lesson is that no company is immune to disruption.

Even the most successful companies can be overthrown by new technologies, changing consumer preferences, or mismanagement. It is important for investors to be aware of the risks and to invest in companies with a strong track record of adapting to change.Another lesson is that even the best companies can make mistakes.

No company is perfect, and even the most well-managed companies can make poor decisions. It is important for investors to diversify their portfolios so that they are not overexposed to any stock.

Avoiding the Graveyard of Failed Companies

The harsh reality is that many companies fail or disappear over time.

In fact, studies have shown that the average lifespan of a company listed on the S&P 500 index is just 30 years.

There are a number of reasons why companies fail.

Some of the most common reasons include:

Disruption

New technologies and changing consumer preferences can disrupt existing industries and lead to the downfall of once-dominant companies (Ex: Exxon).Mismanagement

Poor decision-making and mismanagement can lead to companies making strategic mistakes that cost them dearly (Ex: Nokia).Debt

Excessive debt can make it difficult for companies to weather economic downturns or other challenges (Ex: Credit Swiss).

Pareto’s Principle and Stock Picking

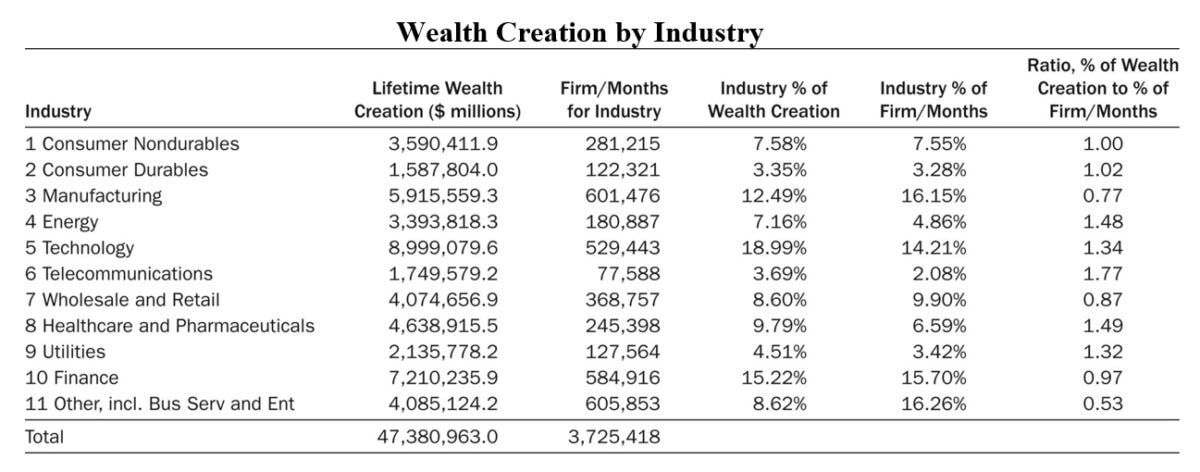

In the context of stock picking, Pareto’s Principle suggests that the majority of market returns are generated by a select few companies.

By focusing on these companies, investors can increase their chances of building wealth over time.

Here are some tips for avoiding the graveyard of failed companies with Pareto:

Identify the top 20% of companies (or less)

This can be done by looking at factors such stocks that are leaders in their respective industries.Rebalance your portfolio regularly (at least once a year)

Because the economy changes, as well as market participants, you may need to rebalance your portfolio to ensure that you are still invested in the top 20% of companies.

Chapter 4: Shocking Stats

"Only 4 percent of all publicly traded stocks account for all of the net wealth earned by investors in the stock market since 1926"

—Hendrik Bessembinder

Unveiling the Truth

Hendrik Bessembinder’s research on the distribution of stock returns has been groundbreaking.

His work has shown that a vast majority of stocks underperform the market, while a small number of top-performing stocks drive the majority of market returns.

This research has important implications for investors.

It suggests that it is more important to focus on identifying a small number of top-performing stocks than to try to pick the winners and losers from the entire market.

The Power of a Handful of Top-Performing Stocks

Bessembinder’s research has shown that a very small percentage of stocks account for the majority of market wealth creation.

Bessembinder’s research validates Pareto’s Principle in the stock market, and investors should focus on identifying a small number of top-performing stocks with a strong track record of performance and financial fundamentals.

This approach is more likely to lead to long-term success than trying to pick the winners and losers from the entire market.

Consistent winners are companies that consistently outperform their peers and deliver sustainable returns.

These companies are highly sought-after by investors, as they offer the potential for significant wealth creation.

Pareto’s Principle can be a helpful guide for investors seeking to identify consistent winners.

By focusing on large capitalization companies with a strong track record of performance and financial fundamentals (companies which are leaders in their respective industries), investors can increase their chances of beating the market consistently.

Chapter 5: Why Avoid Indexes

“My biggest prediction for the future is that people are going to start looking after individual investors.”

—John C. Bogle

Challenging the Status Quo on Index Funds

Index funds are a type of mutual fund or exchange-traded fund (ETF) that tracks a specific market index, such as the S&P 500.

Index funds are popular because they are relatively low-cost and diversified.

However, there are a number of pitfalls associated with settling for average returns through index funds.

One of the biggest drawbacks of index funds is that they are designed to track the market, not beat it.

This means that index fund investors will earn average returns in the long run. For investors who are seeking to maximize their returns, this may not be acceptable.

As mentioned above, index funds are designed to track the market, not beat it. This means that index fund investors will earn average returns in the long run. For investors who are seeking to maximize their returns, this may not be acceptable.Another drawback of index funds is that they are not immune to market downturns.

When the market declines, index funds will also decline. This can be a problem for investors who are nearing retirement or who have other short-term financial goals.

Index funds may be a good fit for some investors, but they are not for everyone. Investors with specific financial goals or risk tolerances may need to consider alternative investment strategies.Finally, index funds do not allow investors to take advantage of individual stock opportunities.

When investors invest in an index fund, they are essentially buying a basket of stocks. This means that they are unable to select individual stocks that they believe have the potential to outperform the market.

Some investors want to take a more active role in their investments and select individual stocks that they believe have the potential to outperform the market. Index funds do not allow investors to do this.

Index funds are widely considered to be a safe and convenient investment option.

Index funds seem like the go-to for those seeking diversification and reduced fees.

They’ve become a staple in many portfolios.

In the vast realm of investing, few concepts have been as universally lauded as index funds.

Lauded for their ease and diversification promise, they’ve become the go-to choice for novice and seasoned investors alike.

But are they truly the best option? Best investors avoid indexes.

Why? Because they don’t want to be average.

They go for stocks with strong fundamentals and growth potential.

And so should you!

While index funds are a safe bet for many, real money lies in active investing!

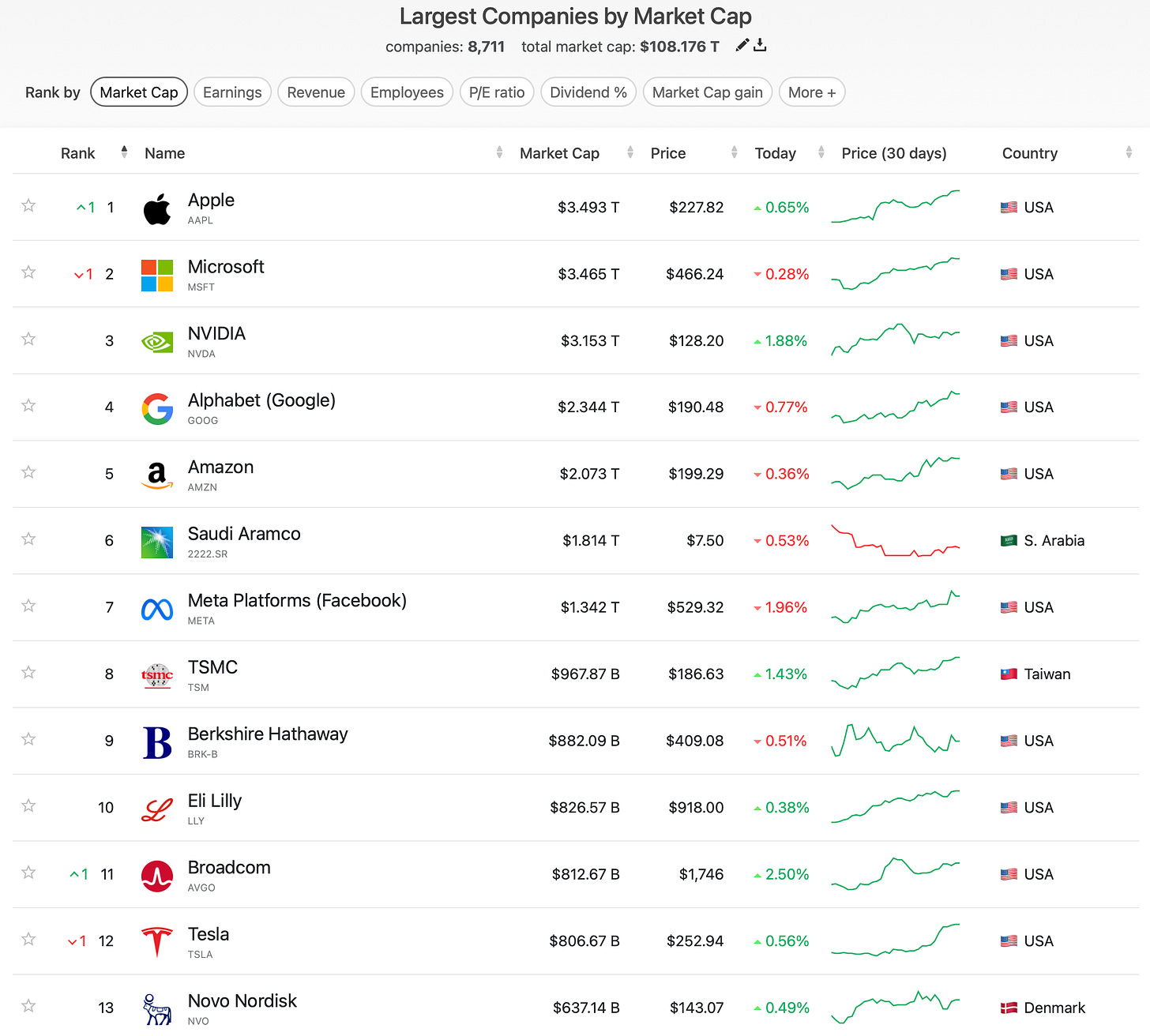

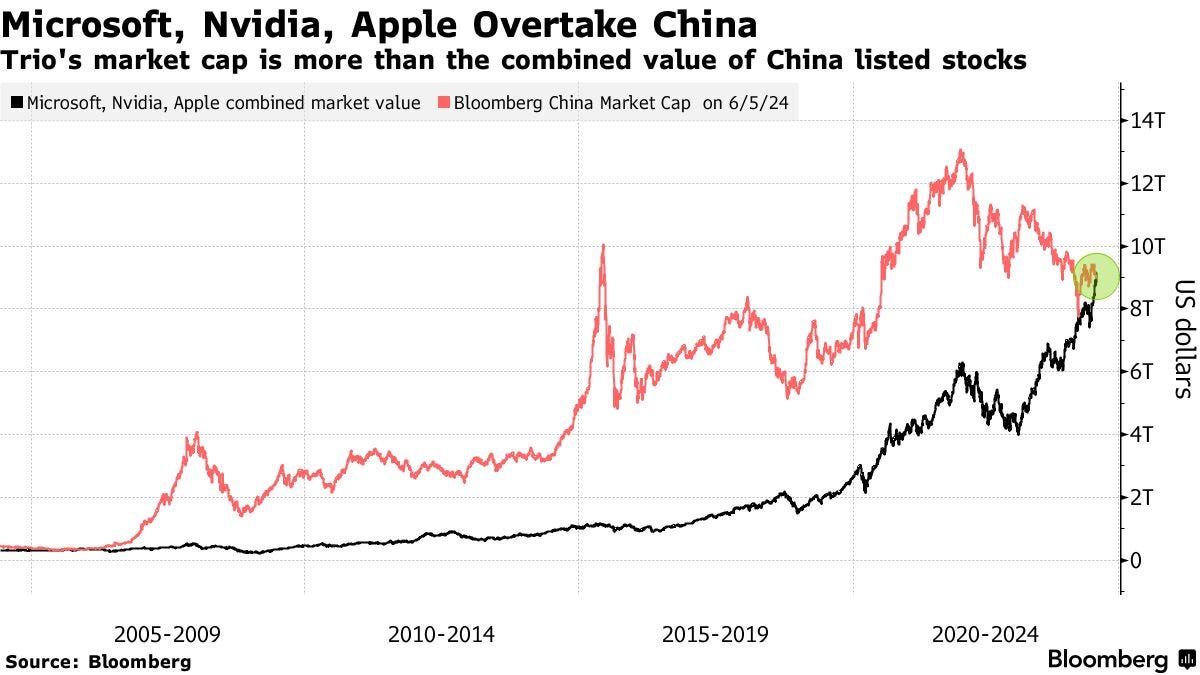

The increasing concentration suggests a growing “winner-take-all” dynamic, especially in the technology sector.

This trend implies that future wealth creation may continue to be dominated by a small number of firms.

Pursuing Strong Fundamentals and Growth Potential

Investors who prioritize strong fundamentals and growth potential often outperform those who passively invest in indexes.

Stocks with strong fundamentals typically have a strong track record of profitability, growth, and financial stability.

Stocks with growth potential are those that are expected to grow faster than the overall market.

But who are these stocks?

You know the answers now: Market Leaders!

By focusing on these stocks, investors can increase their chances of outperforming the market and achieving their financial goals.

Index funds are a popular investment option, but they are not the best choice for everyone.

Investors who are seeking to maximize their returns or who want to take a more active role in their investments may want to consider alternative strategies, such as Pareto investing.

Chapter 6: Average? Not an Option

“In investing, what is comfortable is rarely profitable.”

— Robert Arnott

Index funds are designed to track the market, not beat it.

This means that index fund investors will earn average returns in the long run.

For investors who are seeking to maximize their returns, this may not be acceptable. Index funds do not allow investors to select individual stocks.

This means that investors are unable to take advantage of individual stock opportunities.

The Allure of Achieving 25% Annual Returns

Achieving annual returns of 25% or more may seem ambitious, but it’s a goal that some investors actively pursue.

Achieving 25% annual returns can help investors achieve financial freedom sooner.

Compound interest is the process of earning interest on interest.

Over time, compound interest can have a significant impact on investment returns.

For example:

an investor who invests $100,000 and achieves 10% annual returns will have $1 million in 30 years.

an investor who invests $100,000 and achieves 25% annual returns will have over $30 million in 30 years.

By investing in stocks with strong fundamentals and growth potential, investors can increase their chances of outperforming the market.

Over the long term, the stock market has historically returned around 10% per year.

However, I say 25%, because I did it, you can achieve spectacular returns by “actively” managing our portfolios with the Pareto Principle.

Real-Life Examples of Exceptional Stock Performance

There are many real-life examples of stocks that have delivered exceptional performance in recent years.

Over recent years, the performance of these several prominent stocks has been nothing short of remarkable.

The consistent growth in these stocks reflects the dynamic nature of the global markets and the evolving preferences of consumers and industries alike.

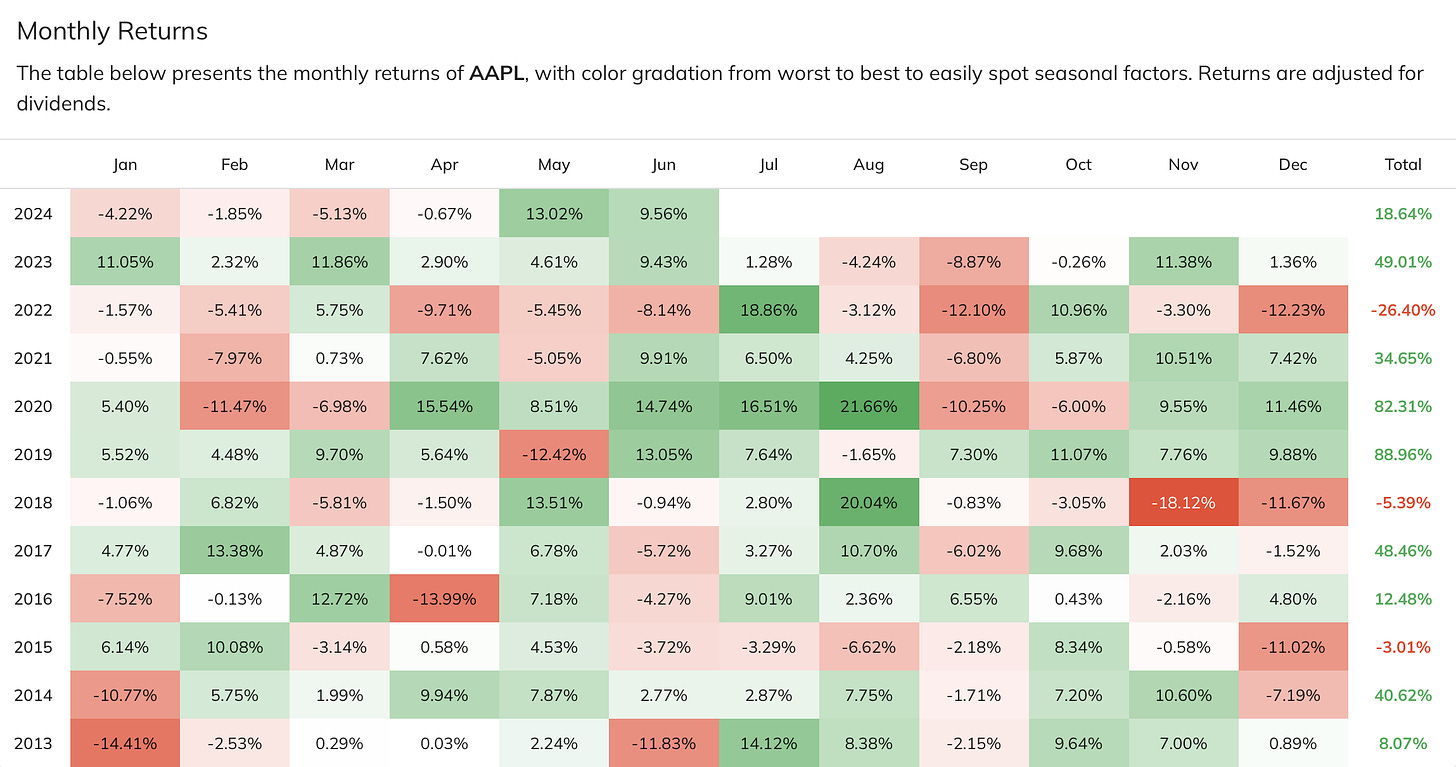

Apple is the best real-life example of a stock that has delivered exceptional performance in recent years.

Since 2011, Apple’s stock price has increased by over 1694%.

This is a significantly higher return than the S&P 500 (320%) over the same period.

Apple’s stock performance has been driven by a number of factors, including:

Strong brand

Apple has a strong brand and a loyal customer base. This gives the company a competitive advantage and allows it to charge premium prices for its products.Innovative products

Apple is known for its innovative products, such as the iPhone, iPad, and Mac computer. These products have been popular with consumers and have helped Apple to grow its revenue and profits.Strong financial performance

Apple has a strong track record of financial performance. The company has consistently generated high revenue and profits. This gives investors confidence in Apple’s future prospects.

These examples show that it is possible to achieve above-average returns in the stock market.

However, it is important to remember that past performance is not indicative of future results.

Chapter 7: The Big Reveal

“An investment in knowledge pays the best interest.”

— Benjamin Franklin

Pareto’s Principle, also known as the 80/20 rule, is a statistical principle that states that for many outcomes, roughly 80% of consequences come from 20% of causes.

This principle has been observed in a wide range of phenomena, including the stock market.

In the context of stock market investing, Pareto’s Principle suggests that a small number of stocks (roughly 20%) are responsible for generating most returns (roughly 80%).

This means that by focusing on a select group of stocks, investors can potentially achieve significant returns without having to invest in a large number of stocks.

Applying Pareto’s Principle in Stock Investing

There are a number of ways to apply Pareto’s Principle in stock market investing.

One common approach is to focus on stocks with strong fundamentals, such as high earnings growth, strong cash flow, and low debt.

Another approach is to focus on stocks that are leaders in their respective industries.

Investors can also use technical analysis to identify stocks that are breaking out from bullish patterns or that are trading above key resistance levels.

Once a list of potential stocks has been identified, investors can use Pareto’s Principle to filter out the least promising stocks and focus on the most promising ones.

The Promise of Wealth Maximization

Pareto-based investing has the potential to help investors maximize their wealth creation.

By focusing on a small number of high-quality stocks, investors can achieve significant returns over the long term.

Pareto’s Principle is a powerful principle that can be used to improve investment outcomes.

By understanding and applying Pareto’s Principle, investors can potentially identify the vital few stocks that have the potential to deliver exceptional returns.

Chapter 8: Outperforming Traditional Methods

“An investment strategy is vital, but sticking to it is even more important. Success often comes from the ability to stay the course, especially when the seas of the market get rough.”

— Peter Lynch

Pareto’s Principle states that for many outcomes, roughly 80% of consequences come from 20% of causes.

In the context of stock market investing, this means that a small number of stocks (roughly 20%) are responsible for generating the majority of returns (roughly 80%).

Pareto-based investing challenges the conventional wisdom of diversification and suggests that investors achieve superior returns by focusing on a small number of high-quality stocks without necessarily increasing risks.

The Pitfalls of Conventional Investing

Diversification has its merits, but it is not without flaws.

One of the main pitfalls is over-diversification.

Over-diversification occurs when investors invest in too many different assets with too many investment vehicles such as mutual funds and exchange-traded funds (ETFs). This led to mediocre returns.Another pitfall is the emotional toll of market fluctuations.

Many conventional investors focus too much on short-term performance. This can lead them to make impulsive decisions, such as selling stocks after a short-term decline.The last pitfall is the herding mentality of investors.

Many conventional investors follow the herd and invest in whatever is popular at the time. This can lead them to buy high and sell low.

The Simplicity of Pareto-Based Investing

Pareto-based investing is a simpler approach to investing than diversification.

It involves identifying a small number of stocks that are leaders in their respective industries and investing in those stocks.

Pareto-based investing offers a paradigm shift in investment strategies.

It challenges the conventional wisdom of diversification and suggests that investors can potentially achieve superior returns by focusing on a small number of high-quality stocks.

Pareto-based investing is a simpler approach to investing than diversification.

It is also less emotionally taxing, as investors do not have to track a large portfolio or worry about the performance of many different assets.

Chapter 9: Focusing on Market Leaders

“History doesn’t repeat itself, but it often rhymes.”

— Mark Twain

Market leaders are companies that have a dominant position in their industry.

They have a strong brand, loyal customers, and a proven track record of success.

Market leaders are also often the most innovative companies in their industry, and they are well-positioned to capitalize on new trends and opportunities.

Pareto’s Principle: The Ultimate Filter

Here are why investors should focus on market leaders:

Market leaders are more stable and profitable than smaller companies.

This is because market leaders have a larger customer base and a more diversified product or service offering.Market leaders are better equipped to withstand economic downturns.

This is because market leaders have more financial resources and a stronger track record of profitability.Market leaders are often well-known and respected brands.

This gives them a competitive advantage.

Zeroing In on Stocks with Market Leaders

One of the best ways to filter out market noise is to focus on market leaders, in this way investors reduce their risk and increase their chances of success.

Once you have identified a list of stocks, you can buy it and hold it for the long term.

But it’s important to rebalance your portfolio at least once a year.

As the market changes, you may need to rebalance your portfolio to ensure that you are still invested in the top 20% (or less) of companies.

This means selling your losers and buying more of your winners.

Focusing on top market caps or industry leaders with Pareto’s Principle is a wonderful way to increase your chances of success in the stock market.

Chapter 10: The Secret Sauce of Successful Investors

"Compound interest is the eighth wonder of the world. He who understands it, earns it he who doesn't pays it. "

—Albert Einstein

The Art of Doing Nothing

This might be a counterintuitive concept, but successful investors often achieve more by taking a hands-off approach.

Learn how patience and strategic inaction can lead to wealth growth.

The notion of doing nothing as an investment strategy may seem paradoxical, but it’s a principle embraced by many successful investors.

When you take a hands-off approach, you’re essentially letting your investments compound and grow over time.

This can be a very effective way to build wealth, especially if you start investing early.

The Compounding Effect: Letting Wealth Grow

The compounding effect can work in your favor when you adopt a selective investment approach.

With consistent growth it can lead to substantial wealth over time.

The compounding effect is a powerful force that can help you grow your wealth over time.

It’s the process of earning interest on your interest, which can lead to exponential growth over the long term.

For example, let’s say you invest $10,000 at a 10% annual return.

After one year, your investment will be worth $11,000.

In the second year, you’ll earn interest on both your initial investment and the interest you earned in the first year.

This means that your investment will grow to $12,100.

Now, imagine with 25% return on average per year… the compounding effect can lead to enormous wealth accumulation!

How Top Investors Achieve More with Less

Quality, not quantity, leads to exceptional performance.

Successful investors often do less but earn more.

They focus on finding a few high-quality investments and holding them for the long term.

This approach is in line with the Pareto Principle, which states that 80% of the effects come from 20% of the causes.

When it comes to investing, this means that 80% of your returns are likely to come from 20% of your investments.

This is why it’s so important to focus on finding high-quality stocks that have the potential to outperform the market over the long term.

Warren Buffett, one of the most successful investors of all time, is known for his long-term investment horizon and his focus on finding high-quality companies at a reasonable price.

In 2016, Buffett began investing in Apple.

He saw the company as a high-quality business with a strong brand, innovative products, and a loyal customer base.

Buffett has since become Apple’s largest shareholder, with a stake worth over $100 billion.

He has held his Apple shares for over five years and has never sold a single share.

Buffett’s investment in Apple is a good example of how top investors achieve more with less.

He identified Apple as a high-quality company with a strong future, and he has held his shares for the long term.

As a result, he has generated significant returns on his investment.

The art of doing nothing is a counterintuitive but effective investment strategy.

By taking a hands-off approach and letting your investments compound, you can achieve significant wealth growth over time.

Top investors understand the power of the compounding effect and focus on finding a few high-quality investments to hold for the long term.

By following their example, you can increase your chances of achieving financial success.

Chapter 11: The Pinnacle Year for Investing in Apple

“Risk comes from not knowing what you’re doing.”

— Warren Buffett

Apple’s transformation from near bankruptcy to market dominance is a testament to its resilience and innovation.

In the late 1990s, Apple was on the brink of collapse.

The company was facing stiff competition from Microsoft and other PC makers, and its products were falling out of favor with consumers.

However, Apple was able to turn things around thanks to a new focus on innovation and design.

In 1998, Steve Jobs returned to Apple as CEO, and he immediately began to implement a new strategy.

Jobs focused on developing high-quality products that were both innovative and user-friendly.

He also streamlined Apple’s product line and focused on a few key products, such as the Mac computer and the iPod.

Apple’s new strategy was a success.

The company began to regain market share, and its products became popular with consumers and businesses alike.

2011 was a golden opportunity to invest in Apple.

The company had released a number of innovative and successful products, including the iPhone, iPad, and Mac computer.

Apple was also generating significant profits and had a strong balance sheet.

For investors, 2011 was a golden opportunity to invest in Apple.

The company was clearly a leader in the technology industry, and its products were in high demand.

Apple’s stock price reflected its performance, and the company’s market capitalization exceeded $300 billion.

If Pareto’s Principle Guided Your Investments Back Then

If you had applied Pareto’s Principle to your investment decisions in 2011, you would have focused on investing in the top 20% of stocks (or less), which would have included Apple.

This would have given you the opportunity to generate exceptional returns, as Apple’s stock price increased by over 29% per year since 2011.

Apple’s success since 2011 is a reminder of the importance of innovation and market leadership.

Investors who were able to identify Apple’s growth potential and invest accordingly were able to generate significant returns.

Pareto’s Principle can be a valuable tool for investors who are looking to focus on the top-performing stocks.

By focusing on stocks leaders that are most likely to outperform the market, investors increase their chances of generating superior returns over the long term!

Chapter 12: Pareto’s Distribution Principle Meets Smith’s Invisible Hand

“Individual Ambition Serves the Common Good.”

—Adam Smith

Adam Smith’s “Invisible Hand” Theory Suggests that Self-interest Leads to Overall Economic Benefit

Imagine the scenario with three butchers, Butchers A, B, and C. Butcher A specializes in beef, Butcher B excels in poultry, and Butcher C is less skilled in both areas.

The “invisible hand” represents the self-regulating nature of the market.

In this context:

Specialization

Butcher A and Butcher B are specialized in what they do best, beef and poultry, respectively. They are driven by their self-interest to maximize their profits by producing high-quality products efficiently.Competition

The competition between Butchers A and B is intense. They strive to outperform each other, offering better quality and lower prices to attract customers.Consumer Choice

Consumers in the town have the freedom to choose between the specialized offerings of Butchers A and B. They make purchasing decisions based on their preferences for beef or poultry, price, and quality.Market Dynamics

Butcher C, who is less skilled in beef and poultry, faces challenges in competing directly with A and B in their specialized areas. As a result, the “invisible hand” guides him to adapt or explore niches where he can add value.

For example, Butcher C may choose to focus on unique, gourmet sausages, which neither A nor B produce. He recognizes a demand for specialty sausages, and the “invisible hand” guides him toward this niche.Market Balance

The “invisible hand” ensures that resources are efficiently allocated. Butchers A and B thrive in their specialties, consumers benefit from a variety of meat products, and Butcher C finds his own niche within the market.

The “invisible hand” represents the idea that self-interest, competition, and consumer choices collectively guide market participants to allocate resources efficiently.

It promotes specialization and the pursuit of what one does best, leading to economic growth and prosperity.

In the global economy, this concept extends to companies, where each entity specializes in producing goods and services for which it has a comparative advantage.

Through international trade, the “invisible hand” of the market guides companies to allocate resources efficiently, ultimately benefiting the global economy as a whole.

Apply this Concept to the Stock Market

In the context of the stock market, this means that companies who are acting in their own self-interest (i.e., seeking to maximize their profits by creating the best products/value to consumers) will ultimately capture more customers/capital than the average (ex: Butcher A and B, who excel in their specialized areas, have successfully attracted more customers/capital, while Butcher C, who possesses fewer skills, faces challenges when competing directly with them).

Just as the butchers benefit from specializing in what they do best, companies can also reap the rewards of specialization and the free flow of capital.

When companies focus on producing goods and services, they are most efficient at and engage in international trade, they can enjoy growth, diversity of products, and prosperity for their investors.

In other words:

“Capital flows always to where it is treated best.”

— The Pareto Investor, based on Adam Smith, The Wealth of Nations

Investors who understand this can benefit from it in all markets!

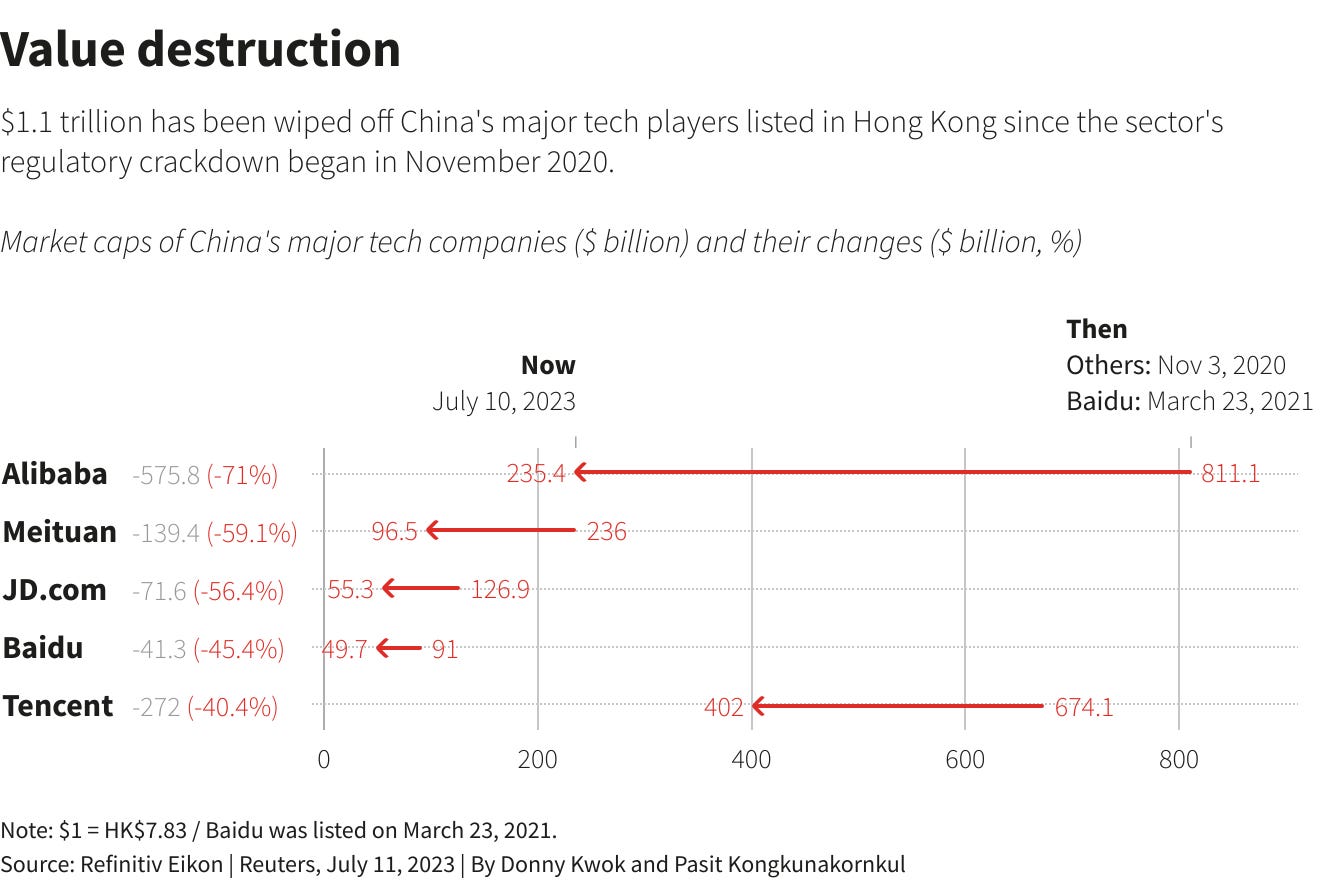

Beijing's regulatory crackdown wipes $1.1 trillion off Chinese Big Tech

In 2022, Beijing’s regulatory crackdown has had a profound impact on the Chinese tech industry, wiping out $1.1 trillion in market value from its leading companies.

The stringent measures, aimed at curbing monopolistic practices and tightening data security, have created significant uncertainty among investors.

Do you wonder where investors’ money went?

Capital flows to where it is treated best, and in times of economic uncertainty or regulatory upheaval, investors seek stability and favorable conditions.

The recent regulatory crackdown in China has prompted a significant shift of capital towards the United States, where the investment environment is perceived as more predictable and secure.

America’s robust financial markets, strong legal protections, and business-friendly policies attract global investors looking for safer and more lucrative opportunities.

Synergy of Economic Theories: Pareto’s Principle Refines Adam Smith’s Ideas

Pareto’s Distribution Principle and Adam Smith’s concept of the “Invisible Hand” are two powerful economic theories that intersect in the stock market context.

Pareto’s Principle states that 80% of the effects come from 20% of the causes.

In the context of the stock market, this means that 80% of the market’s returns are likely to come from 20% of the stocks.

Pareto’s Principle refines and enhances Adam Smith’s theory by highlighting the role of a select group of market influencers.

In other words, Pareto’s Principle shows that it is not simply the aggregate of individual (or companies) self-interest that drives market movements, but rather the actions of a small number of participants in the market.

This is important to understand because it means that investors can focus on identifying and investing in the stocks that are most likely to drive the market.

This can give investors a significant advantage in the market, as they can invest in stocks that are more likely to outperform the rest.

Chapter 13: Discovering Pareto’s Top Stocks

“Less is more.”

—William Shakespeare

The concept of letting the market guide your investment choices is based on the philosophy of Socrates, as I stated at the beginning of the book:

“All I know is that I know nothing.”

— Socrates

This philosophy recognizes the vastness of the market and the impossibility of predicting its movements with certainty.

Instead of trying to time the market or pick individual winning stocks, investors who embrace this philosophy focus on identifying the elite group of top-performing stocks that have the potential to deliver exceptional returns over the long term.

By trusting the market’s wisdom (Adam Smith Invisible Hand) and investing in a small section of top-performing stocks (Pareto Distribution Principle), investors increase their chances of success without having to engage in complex analysis or market timing.

By letting the market guide your investment choices and focusing on the elite group of top-market stocks, investors can increase their chances of success without having to engage in complex analysis or market timing.

Example with Magnificent 7

If you had invested in Magnificent stocks, in 2019, you would have earned an average annual return of 43%.

Why?

Because Microsoft, Apple, Nvidia, Alphabet, Amazon, Meta and Tesla have sought to maximize profits by creating the best products in the economy.

Ultimately, this is why theses companies have captured more capital than any other companies in the world! #AdamSmith

This is a clear example of how investing in first market capitalization stock can lead to exceptional returns over the long term.

Chapter 14: The Power of Selectivity and Simplicity

“It is not the strongest of the species that survives, nor the most intelligent that survives. It is the one that is the most adaptable to change.”

— Charles Darwin

The stock market offers a vast array of investment options, with over 10,000 stocks listed on major exchanges worldwide.

This can be overwhelming for investors, especially those who are new to the market.

One of the biggest challenges investors faces is how to navigate this sea of stocks and identify the ones that are most likely to outperform the market.

This is where selectivity becomes key!

By focusing on a select group of top-quality stocks, investors can simplify their decision-making process and increase their chances of success.

Leveraging the Strength of Distribution Law

The Pareto Principle, also known as the 80/20 rule, is a fundamental principle of statistics that states that 80% of the effects come from 20% of the causes.

This principle can be applied to many different areas of life, including investing.

In the context of investing, the Pareto Principle suggests that 80% of the market’s returns are likely to come from 20% of the stocks.

This means that by focusing on the top 20% of stocks, investors can capture a significant portion of the market’s returns.

The Pareto Truth: Quality Over Quantity

Rather than trying to trade frequently or pick individual winning stocks, Pareto investors focus on identifying and investing in a small number of high-quality stocks that they believe have the potential to outperform the market over the long term.

One of the key insights of Pareto investing is that success often involves strategic inaction.

This approach is supported by the Pareto Principle, which suggests that a few pivotal decisions can lead to most of your returns.

In the context of investing, this means that by making a few strategic investments in high-quality stocks, investors can achieve significant returns without having to engage in complex analysis or market timing.

Pareto investing is a powerful investment strategy that leverages the power of selectivity and simplicity.

By focusing on a select group of high-quality stocks, investors can simplify their decision-making process and increase their chances of success.

Chapter 15: The Pareto1 Portfolio

“The investor’s chief problem — and even his worst enemy — is likely to be himself.”

— Benjamin Graham

The Pareto1 portfolio is the culmination of selective investing guided by Pareto’s Principle.

“All I truly understand is that my knowledge is limited; hence, I rely on the prevailing consensus of the market and steer my investments into the Top 1%, the minority that achieves the majority of returns”

— The Pareto Investor

It is a portfolio consisting of only one stock, the stock that rank number one in market capitalization worldwide.

The portfolio has performed at an average annual rate of 23%, beating the S&P500/Nasdaq by a wide margin.

The ‘Pareto 1’ portfolio is a powerful example of the wealth-building potential of Pareto’s Principle.

By selectively investing in a small number of high-quality stocks, investors can achieve their financial goals more efficiently and effectively.

Two Decades of Selective Investing

My Pareto 1 portfolio has shown impressive performance over years.

It has consistently outperformed the S&P 500, which is the benchmark for the overall stock market.

Consistent Outperformance

In every year from 1998 to 2023, Pareto 1 has delivered more positive returns than the benchmark.

This is a remarkable achievement, especially considering the various market conditions during this period, including the financial crisis of 2008.Total Return

The grand total return for Pareto 1 over the entire period is 23%, which is significantly higher than the S&P 500’s return of 9%.

This indicates that your portfolio has not only outperformed but has done so by a substantial margin.Volatility Management

It’s important to note that while Pareto 1 has achieved higher returns, it may also have experienced varying degrees of volatility and risk along the way.

The portfolio’s performance is attributed to a less diversified range of investments.

Long-Term Perspective

Investing with a long-term perspective is often associated with higher returns, and your portfolio’s performance seems to support this principle.

Over the years, it has consistently beaten the S&P 500, suggesting a successful investment strategy that should align with your financial goals.

Overall, my Pareto 1 portfolio has demonstrated strong performance, and it’s a testament to effective investment decisions and strategies.

Pareto’s Principle has the potential to pave the way for a financially prosperous future.

By focusing on top stocks, investors increase their chances of generating exceptional returns over the long term.

Chapter 16: The Beauty of Simplicity

“Simplicity is the ultimate sophistication.

More often then not we have the tendency to complicate rather then simplify.

We assume that sophistication equals results, brilliance, performance, and intelligence but it doesn't. More information, more choices, and more products is not better.”—Leonardo da Vinci (1452–1519)

The Astoundingly Simple Yet Effective Strategy

Pareto’s investment strategy is astoundingly simple yet effective.

It is based on the Pareto Principle, which states that 80% of the effects come from 20% of the causes.

All my Pareto portfolios have demonstrated impressive performance, and it’s a testament to simplicity yet extremely effective investment decisions and strategies.

Evidence from Seven Decades of Financial Data

My research with seven decades of financial data and analysis proves the effectiveness of Pareto’s investment strategy.

My studies have shown that Pareto portfolios consistently outperform indexes over the long term.

This was initially demonstrated by Bessembinder’s research several years ago.

Additionally, researchers from the University of Chicago found that the top 1% of stocks outperformed the S&P 500 by an average of 2.5% per year over a 50-year period.

Trusting the Pareto Principle in Your Investment Journey

The Pareto Principle is a powerful tool for investors because it simplifies decision-making and leads to lasting wealth.

By focusing on a small number of high-quality stocks, investors can avoid the noise and distractions of the market and focus on what matters most: generating above average long-term returns.

The Pareto Principle is based on the fundamental principle of selectivity.

By investing in the top stocks, investors can capture a significant portion of the market’s returns without having to invest in every stock.

Pareto’s investment strategy is a simple yet effective way to achieve financial success.

By focusing on a small number of high-quality stocks, investors can outperform traditional indexes and generate wealth faster.

If you are looking for an investment strategy that is simple, effective, and backed by evidence, then Pareto investing is more than worth considering.

Chapter 17: To Sum Up

“In any series of elements to be controlled, a selected small fraction, in terms of numbers of elements, always accounts for a large fraction in terms of effect.”

—Vilfredo Pareto

Vilfredo Pareto’s work, in my opinion, is undervalued!

His distribution principle, also known as the 80/20 rule, is more than just a mathematical concept, it’s a universal key to unlocking success.

It’s a fundamental law of the universe.

Just like Pi, Phi, and Fibonacci, the Pareto’s Principle is a guiding principle that can transform the way you approach everything, including investing.

By understanding and applying it, investors simplify the investment process and focus on the most promising investments which increases their chances of outperforming the market in the long term.

The Pareto Principle is a powerful principle for investors.

The key benefits of using the Pareto investment strategy are:

Superior returns

The Pareto investment strategy has been shown to outperform the S&P 500 index over the long term.Simplicity

The Pareto investment strategy is simple to implement and maintain.

Investors only need to focus on a small number of stocks.Discipline

The Pareto investment strategy encourages disciplined investing.

Investors are less likely to make impulsive decisions or to chase the latest trends.Reduced risk

The Pareto investment strategy reduces risk by investing in best high-quality stocks.Time savings

The Pareto investment strategy saves time, as investors do not need to constantly monitor the market or trade frequently.

To implement the Pareto investment strategy:

Identify a small number of high-quality stocks

This can be done by focusing on top market cap stocks with strong earnings growth, strong cash flow, and low debt.Invest equally in each of the selected stocks

Invest equally in each of the selected stocks to create a well-diversified portfolio.Review the portfolio annually

This helps to ensure that it is still aligned with the market/economy.

That is all, it is that simple!

The Pareto investment strategy is a simple and effective way to outperform the market over the long term.

It is a strategy that is used by successful investors around the world.

Combining Ancient Wisdom with Modern Economics for Investment Success

In the ever-evolving realm of investment, where algorithms and financial jargon dominate conversations, there’s a remarkable wisdom in seeking guidance from the ancients:

1. Embrace Socrates’s Philosophy — The Pursuit of Wisdom:

Importance of Humility

The investment world, often a theater of highs and lows, can quickly transform overconfidence into an investor’s Achilles’ heel.

The first lesson we draw from Socrates is the significance of humility.

Acknowledging the bounds of your knowledge is as critical as recognizing what you do know. It keeps your mind open, making you more receptive to the ever-changing tides of the market.Continuous Learning

Socratic ignorance should serve as a catalyst for perpetual learning.

This philosophy drives you to continuously seek more profound insights into the intricacies of the market, various sectors, and specific investment opportunities.

By embracing Socrates’s wisdoms, you’re on a perpetual journey of growth and adaptation.

2. Follow Smith’s Invisible Hand — The Market’s Natural Order:

Understanding Market Mechanisms

Adam Smith’s “invisible hand” principle is the cornerstone of modern economics. It posits that individual self-interest, when left unchecked, indirectly promotes the greater good of society.

Translating this into investment terms, it signifies that markets possess innate mechanisms that guide capital toward its most productive use.

No single entity orchestrates this; it’s the collective actions of participants.Trust Market Efficiency

While markets might appear chaotic and unpredictable in the short term, Smith’s theory assures us of a deeper order.

Over time, markets demonstrate efficiency in allocating resources.

This insight is a comforting anchor for long-term investors who recognize that beneath the market’s turbulence lies a steady undercurrent directing capital toward growth and value.

3. Harnessing the Power of Pareto’s Principle

The Vital Few

Pareto’s Principle teaches us that a minority of investments often yields most returns.

This underscores the importance of focus. It means putting all your capital into a few assets; it’s about identifying and keeping eyes on high performers.Risk Management

Pareto do not emphasizes the need for diversification.

But diversification will still allow you to capture potential gains while mitigating risks.

As you venture forth investing, let Socrates’s humility, Adam Smith’s invisible hand, and Pareto’s Principle be your guiding stars, leading you toward the radiant horizon of investment success.

Chapter 18: Final Thoughts

This book explored the fascinating world of investing through the lens of Pareto’s Principle, revealing how a select group of stocks drives most market returns.

As you close the final chapter, remember that index funds are a safe bet for many, however they are not the best path to financial success.

By simplifying your investment strategy, embracing selectivity, and trusting in the market’s consensus, you can embark on a greater financial success journey.

The power of Pareto’s Principle in stock market investing is undeniable and will revolutionize your approach to wealth creation with stocks.

Sincerely,

The Pareto Investor