Dear Investors,

Regarding diversification, I have two different answers.

If you are not a professional investor—if your goal is not to manage money in such a way as to get a significantly better return than the world—then I believe in extreme diversification.

Ninety-eight or ninety-nine, maybe more than ninety-nine percent of people who invest, should extensively diversify and not trade.

That leads them to an index fund type of a decision, with very low cost, because all they're going to do is own a part of America.

They've made a decision that owning a part of America is worthwhile.

I don't quarrel with that at all; that is the way they should approach it unless they want to bring an intensity to the game to make a decision and start evaluating businesses.

But once you're in the business of evaluating businesses, and you decide that you're going to bring the effort, intensity, and time involved to get that job done, then I think that diversification is a terrible mistake to any degree.

If you really know businesses, you probably shouldn't own more than fifteen of them.

If you can identify fifteen wonderful businesses, that is all the diversification you need, and you're going to make a lot of money.

I guarantee you that going into a sixteenth one, rather than putting more money in your first one, is going to be a terrible mistake.

Very few people have gotten rich on their sixteenth-best idea, but a lot of people got rich on their best idea.

So, I would say that for anybody working with normal capital who really knows the businesses they've gone into, fifteen is plenty.

I don't diversify personally.

All the people I know that have done well don't diversify.

Diversification, as practiced, generally makes very little sense for anyone that knows what they're doing.

Diversification is a protection against ignorance.

If you want to make sure that nothing bad happens to you relative to the market, you own everything.

There's nothing wrong with that; that's a perfectly sound approach for somebody who does not feel they know how to analyze businesses.

If you know how to analyze businesses and value businesses, it's crazy to own 50 stocks, or 40 stocks, or 30 stocks, probably because there aren't that many wonderful businesses that are understandable to a single human being in all likelihood.

And to have some super wonderful business and then put money in number 30 or 35 on your list of attractiveness, and forgo putting more money into number one, is just madness.

It's conventional practice, and it may—if all you want to achieve is average—preserve your wealth.

On a personal basis, in my growth portfolio I own 13 stocks.

It's businesses I know, and it leaves me very comfortable.

So, do I need to own 34 stocks in order to have proper diversification?

That'd be nonsense.

I could pick out three of my businesses, and I would be very happy if they were the only businesses I owned and I had all my money in.

Now, I love the fact that I can find more than that and that we keep adding to it, but three wonderful businesses are more than you need in this life to do very well.

If you look at how fortunes were built, they weren't built out of a portfolio of 50 companies

They were built by someone who identified with a wonderful business.

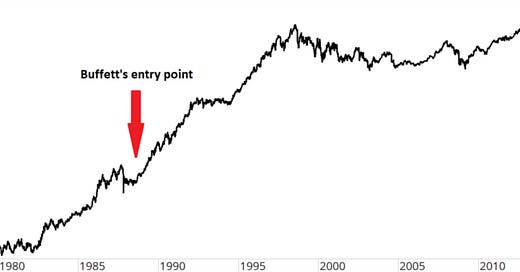

Coca-Cola is a great example; a lot of fortunes have been built on that.

And there aren't 50 Coca-Colas; there aren't 20.

If there were, that would be fine.

We could all go out and diversify like crazy among that group and get results that would be equal to owning the really wonderful one, but you're not going to find it.

And the truth is, you don't need it.

If you have a really wonderful business, it's very well protected against the vicissitudes of the economy over time and competition.

I'm talking about businesses that are resistant to effective competition, and three of those will be better than a hundred average businesses.

They'll be safer, incidentally.

There is less risk in owning three easy-to-identify wonderful businesses than there is in owning 50 well-known big businesses.

It's amazing what has been taught over the years in finance classes about that.

But I can assure you that I would rather pick three businesses from those I own than own a diversified group of 50.

Much of what is taught in modern corporate finance courses is total non-sense.

Modern portfolio theory has no utility.